Since it’s the most wonderful time of the year, why not bring joy to your customers this season?

As Black Friday approaches, there’s plenty of green flying around.

Banks are just as busy as retailers during the holiday season, processing sleighfuls of debits, charges, and money transfers to make sure customers can access their money wherever and whenever they need it. Sure, that’ll keep you on Santa’s “Nice” list, but what if you did even more?

Finding unique ways to help your clients save and budget for the upcoming onslaught of sales, specials, and shopping adventures won’t just increase their financial literacy, it’ll boost their impression of you as a financial partner.

A NEW ERA OF SHOPPING…

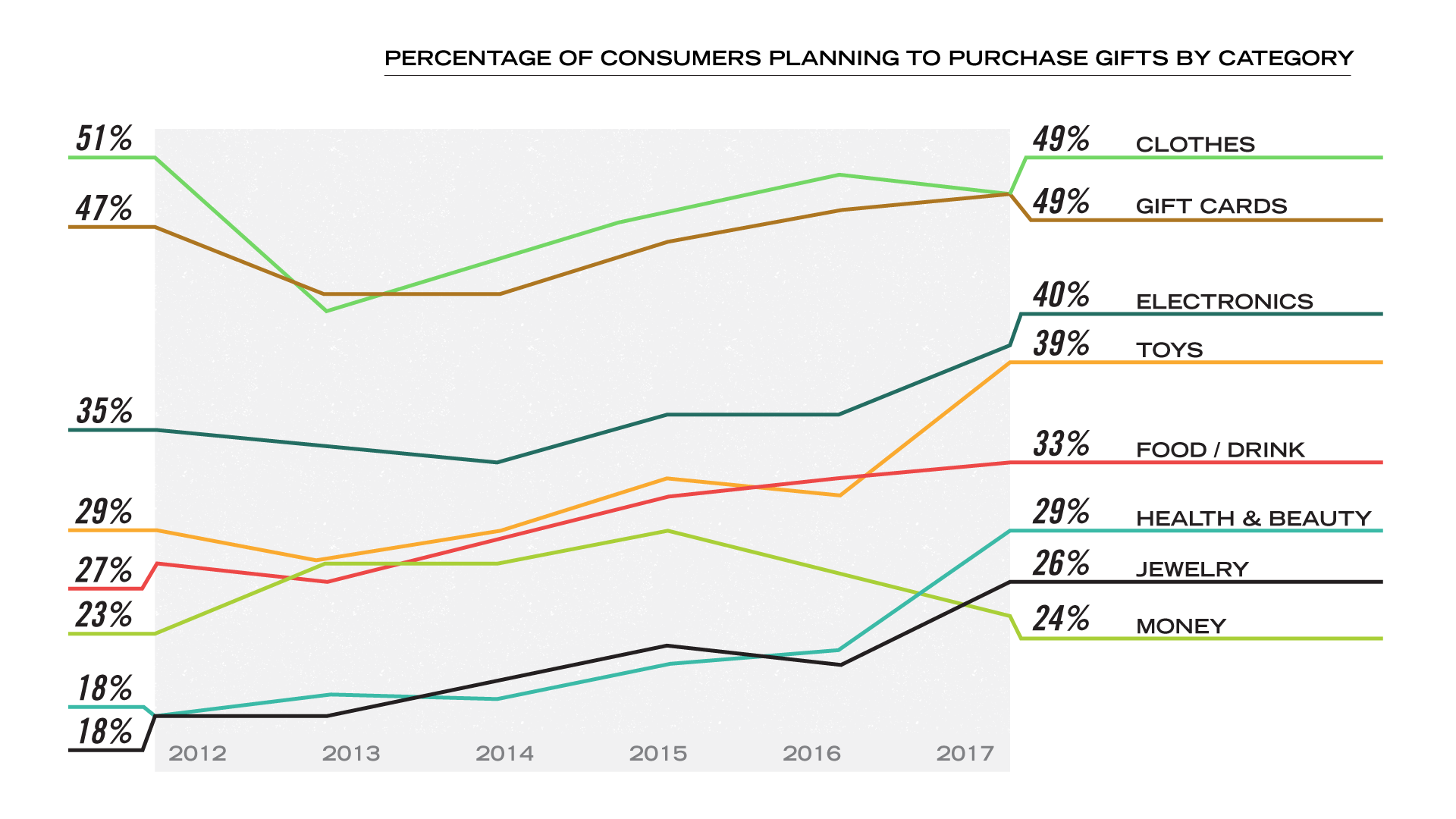

In 2017, a significant change in behavior took place—for the first time ever, holiday spending preferences shifted to the digital space, according to Deloitte’s annual analysis of the upcoming holiday shopping season. Respondents said they planned to spend 51% of their total holiday budgets using computers, smartphones, or tablets rather than in brick-and-mortar stores (42%—a drop of 5% off 2016 results).

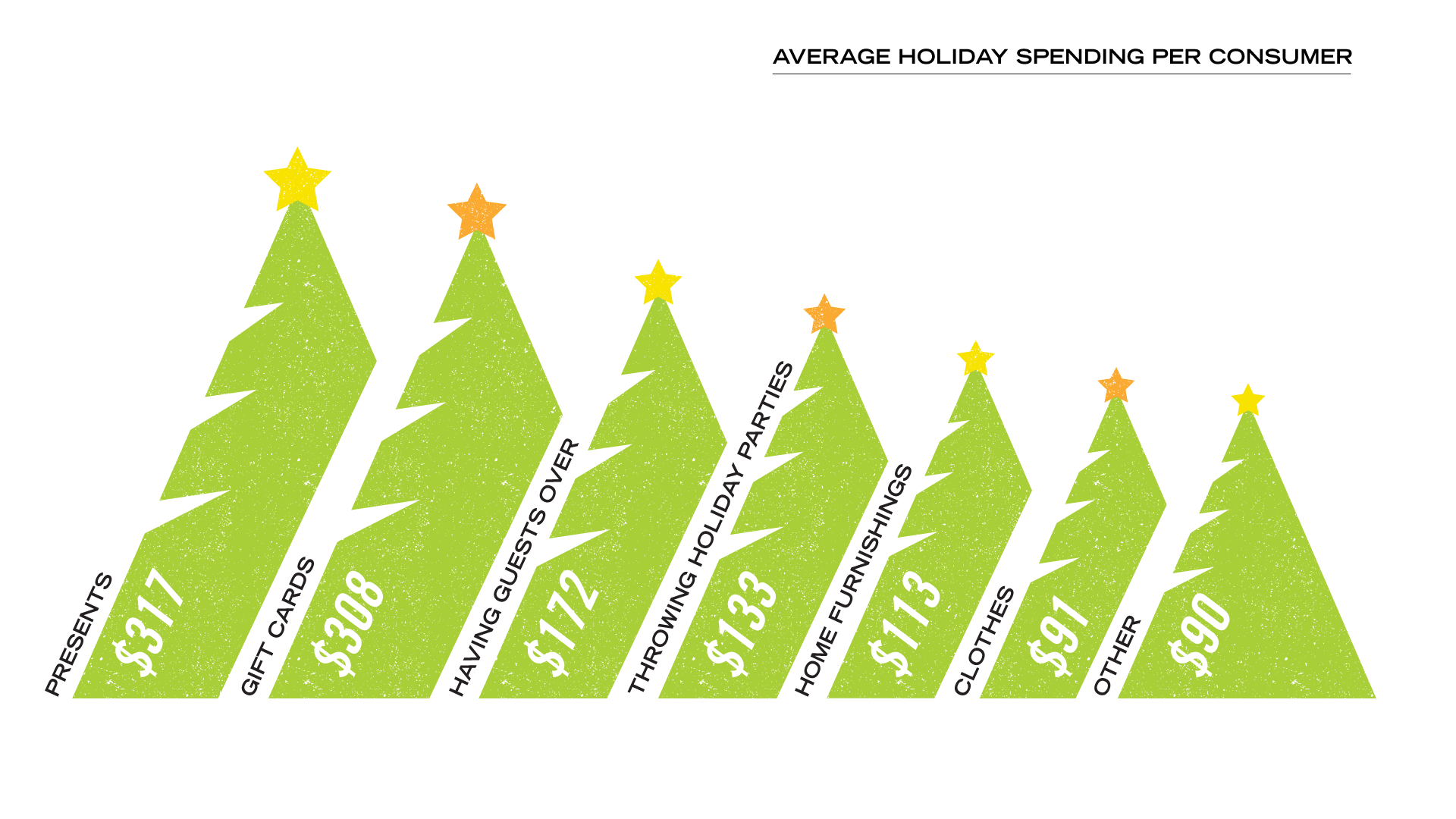

But whether they’re lining up for Black Friday sales or shopping online, one thing’s certain: your customers are spending some serious money. Survey results showed the average consumer was expected to spend $1,226 during the holiday shopping season—with your high-income client households (those earning more than $100,000) planning to put an additional $1,000 worth of gifts under the tree.

…BEGETS A NEW ERA OF BANKING

And just like the digital storefronts offered by internet-only or dual-presence retailers, we see the same trends in the banking world. Mobile and online banking usage continue to rise, simply because they’re convenient. These 24-hour branches-on-the-go let customers and prospects multitask (i.e., bank while doing laundry, watching TV, or enjoying a grande-mocha-hazelnut-espresso-bean smoothie at their local coffee shop), or actually compare products, rates, and services offered by you and your competitors.

So, as the holidays approach, find a way to make your bank stand out from the competition. Those skip-pay programs of years past have become ubiquitous in the financial marketplace, so there’s really nothing special about them anymore.

On top of that, financially savvy consumers (as well as the rash of bloggers and journalists writing for budget/credit/smart-spending websites) have realized the true cost of skipping payments—service fees, additional interest accrual, and another month tacked onto the end of current loans.

DON’T BE A SCROOGE THIS HOLIDAY SEASON

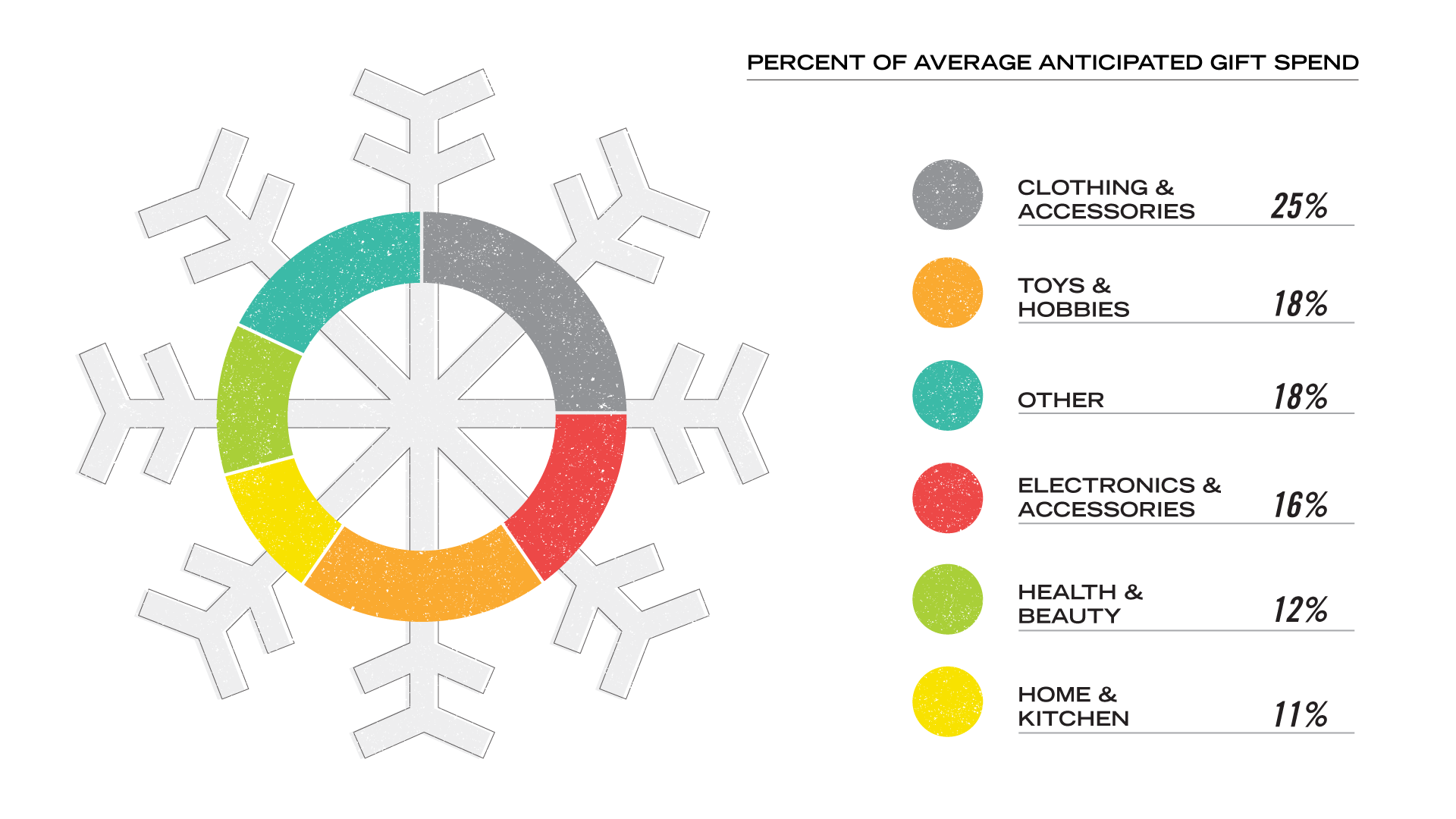

A whopping 50 percent of Deloitte survey respondents said they also buy gifts for themselves while shopping for others. With that in mind, how about turning your focus to budgeting assistance, and helping your customers plan more wisely for holiday purchases, so they don’t overspend?

MAKE A LIST, CHECK IT TWICE

- Give out budgeting worksheets (or provide links to their online counterparts)—it’s simple, and can be an easy way to help your clients see where their holiday dollars are going.

- Offer partnership programs with the top online retailers—savings plans that will save your customers a few bucks while giving you a little extra edge.

- Plan for spring, when you can begin promoting new, short-term, high-yield holiday CDs or savings accounts that let customers sock away a bit of money for six to eight months until it’s time to shop.

The possibilities are endless, but you have to get started today. After all, Santa’s not going to bring the answer down the chimney with him—his sleigh’s already overflowing with boxes from Amazon, eBay, Target.com, and other online retailers.