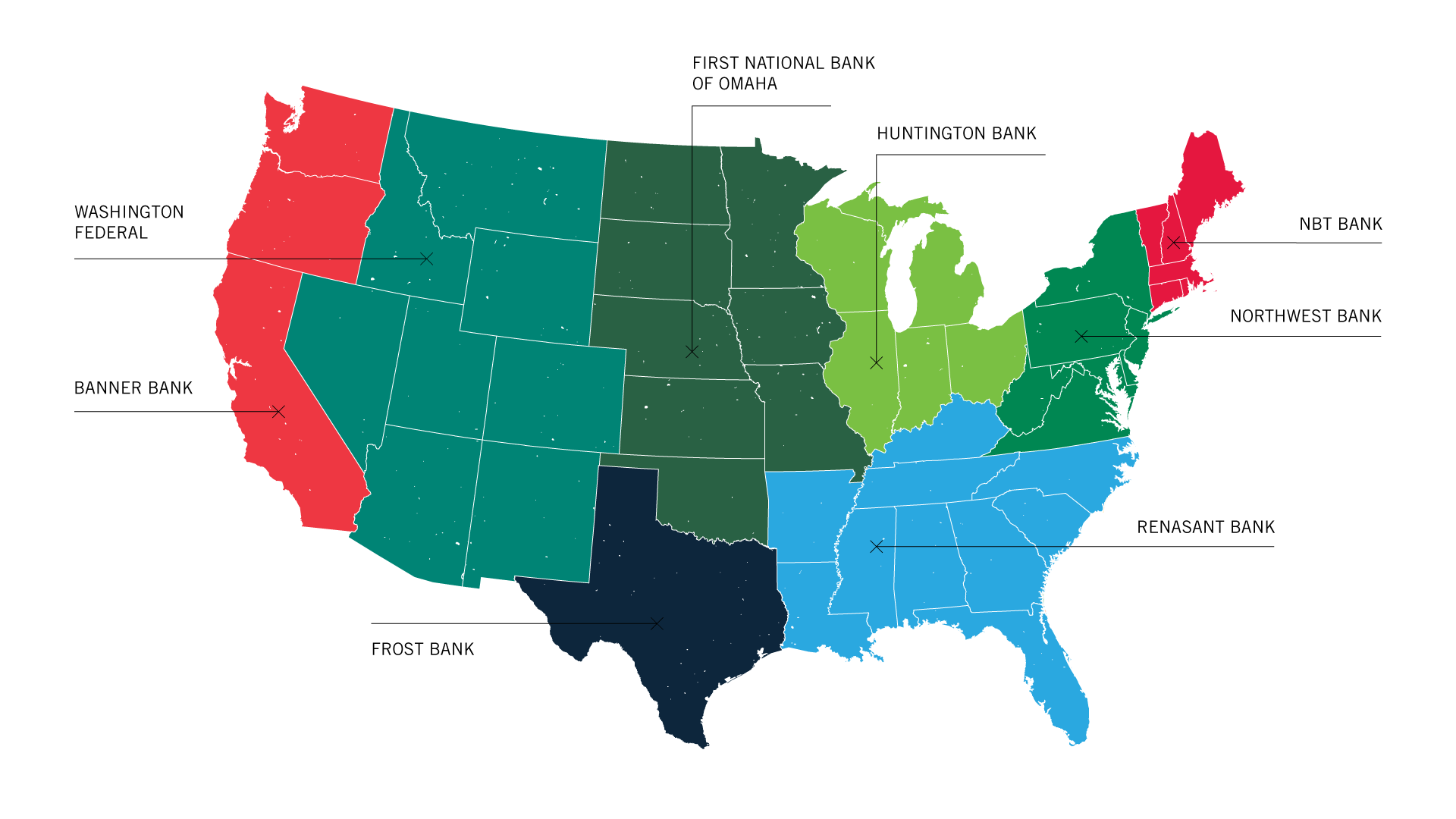

What makes a bank the best? Time magazine’s Money.com published a list of the best banks in each region, and the list is pretty short—eight to be exact.

Renasant Bank—named the best bank in the South—was one, and we were especially excited because it’s our longest-tenured client.

Since Mabus Agency works with Renasant Bank every day, we know what makes it successful, but we were curious. Were Renasant’s habits unique? It turns out these banks all have a few things in common, and we believe these similarities contributed to their place at the top, and could help your bank, too.

Here are the banks that took the prize in each region. Congratulations to each!

- Pacific – Banner Bank

- Mountain West – Washington Federal Bank

- Midwest – First National Bank of Omaha

- Great Lakes – Huntington Bank

- Mid-Atlantic – Northwest Bank

- New England – NBT

- South – Renasant Bank

- Texas – Frost Bank

If you’re looking to improve your offerings, make sure you can check the box next to these industry-leading factors. We can’t guarantee you’ll be the best bank in your region, but we can guarantee you’ll be a better bank. And your clients will appreciate that.

1. Benefit-Forward Products

Whether it’s Banner Bank’s time-saving bill-pay dashboard, First National Bank of Omaha’s free checking, or Renasant Bank’s ATM fee refunds, most of the banks on this list make their benefits clear. When advertising products, these banks let clients know what’s in it for them up front instead of relying on vague descriptions. Here are a few product descriptions for the best banks:

- “Free means free. And that means no hidden monthly fees…”

- “Get the checking account that gives you cell phone insurance, roadside assistance, ATM fee refunds…”

- “Simplify how your business manages its cash flow with our secure online portal.”

In many cases, banks exhibit FOMO (fear of missing out) and list everything that might bring interest. The banks on this list had the bravery to bring the key benefits to the front.

2. Client-Focused Products

Great benefits come from great accounts. It’s difficult to truly differentiate product offerings from those of other institutions. These banks found nuanced ways to improve products with a focus on client needs.

Most of the banks on this list offer simple, up-front accounts with some combination of no account minimums, service fees, or ATM fees.

But it doesn’t stop with these entry-level products. These banks offer comprehensive upgrade paths that provide impactful interest rates, exceptional technology, and convenient features.

If you want to join the list of best banks, find ways to move from the commoditized field of other banks.

3. Easy-to-Access Digital Banking

Most bank clients live a large portion of their lives online, whether they simply dabble in social media or order all their groceries from Amazon. Banks have taken far too long to adapt to the public’s move toward digital. It’s 2018 and too many banks still have hard-to-find and impossible-to-navigate online banking portals.

Your clients have the entire world at their fingertips. They can order almost anything at almost any time. And they’re comparing their other experiences on the World Wide Web to their experience with your website and online banking.

Each bank on Money.com’s best-in-the-region list provides easy access to its client portals, online account opening tools, and mobile banking services through its website home page.

4. Actual Customer Service

It’s no surprise that many of the award-winning banks have been recognized for superior customer service in recent years. Banner Bank, First National Bank of Omaha, Huntington Bank, Northwest Bank, and Frost Bank were all ranked at or near the top of their region for customer service according to J.D. Power.

Those banks not explicitly rated by J.D. Power make it clear that their associates are ready and willing to address any concerns with easy-to-find contact pages, eager call center staff, and even feedback forms on some sites.

Most banks tout their customer service, but it’s easier said than done. To truly differentiate, you have to live up to those promises of great service.

5. A Brand That’s Different

Banks suffer from a naming problem. Nearly 66 percent of banks use the word state, first, national, trust, or savings in their name. While some have better brands than others, the majority of these banks have a clear identity. Of all the banks on Money.com’s best-in-the-region list, only one uses any of those words. Still, that bank has a clear visual and tonal brand.

Browsing the banks’ marketing materials, it’s clear each bank’s leadership and marketing teams are willing to make a decision one way or the other as opposed to riding the fence and trying to be all things to all people.

A bank that sticks to its identity will attract the clients it’s best suited to serve, and in the end all parties are happier.

Does Your Bank Have What It Takes?

No one’s saying your bank has to be the best in your region, but if you want to grow, you’ve got to be better. There are some clear commonalities between the banks that are doing things right, and pursuing a like-minded approach will pay dividends for your bank and improve the customer experience.

It’s up to you to determine which areas can impact your bank’s culture in a positive way. And you don’t have to do it alone. Find a partner that can help you shore up your weaknesses and keep you moving in the right direction.