No time to read? Listen to an audio version of this blog below.

When I was in college, I tapped into a level of frugality some might not even consider possible. I cut expenses at every corner, made spreadsheets, and neglected basic human comfort—all just to save a few dollars here and there. I was significantly more budget-conscious than my peers and more obsessed with my finances than anybody I knew.

To this day I can still recite the cheapest places to get wings on any given day in my college town. So, if you’re reading this on a Tuesday in Oxford, Mississippi, you’re in luck—the Wingstop on Jackson Avenue has 60-cent boneless wings all day today.

However, I couldn’t have cared less about the interest rate on my checking account—that I can say with certainty. I wasn’t interested in a credit card, didn’t hold an auto loan, and wasn’t anywhere close to owning a home. As for my friends, well, I was just surprised when they remembered the passwords to their online banking accounts.

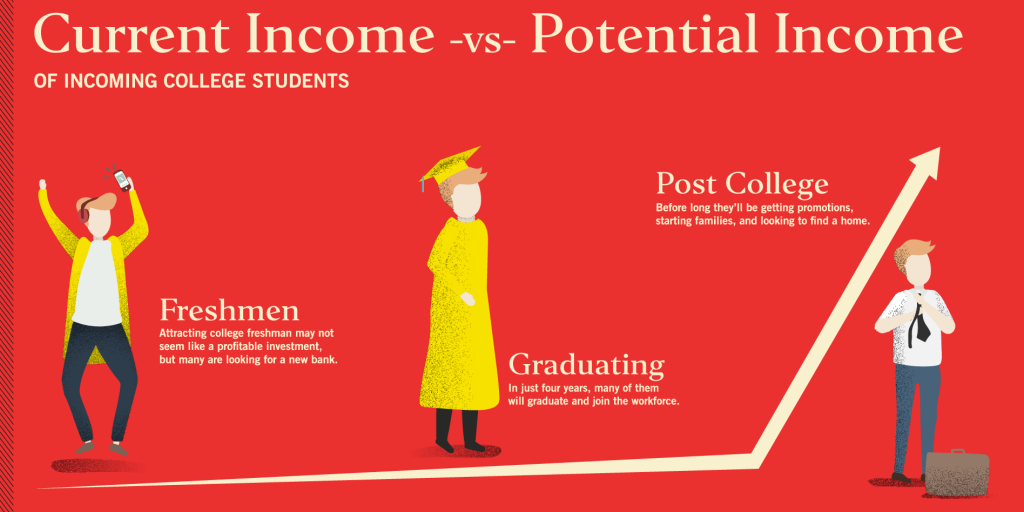

Your college-aged customers—and millions of university students just like them—are going to bring big business your way as they transition into the workforce.

College students may be some of the worst bank clients you could ever ask for. They seem to generate few deposits, hold only the minimum necessary amount of products, and for all intents and purposes, don’t care one bit about what their bank is or why they are using it.

But a closer look reveals some surprising information. According to a 2016 FICO survey, the average U.S. adult has 5.79 financial products, but bank customers in the 25-34 age range hold 8.3 percent more (an average of 6.27 financial products).

Here’s what that means: Your college-aged customers—and millions of university students just like them—are going to bring big business your way as they transition into the workforce.

Perhaps I’ve already slipped in to the white-noise-filled void of conference speakers that scream about the importance of marketing to millennials. Let me be clear: Marketing to millennials isn’t all that great. They’ve already established their banking relationships.

However, there are millions of 18- to 24-year-olds (classified as Gen Z by most) across the country who haven’t done so yet. More importantly, they’ve yet to face all the major life decisions (like graduate school, first direct-deposit jobs, and first car loans) that could impact their choice of banks.

If you haven’t been working to capture business from these potential clients, the good news is that it’s not too late.

1. Start With Student Checking

Let’s start with a no-brainer: if your bank offers a student checking account, now’s the time to ever-so-gently promote the hell out of it. Why? According to The New York Times, the number of out-of-state freshmen at public universities nearly doubled from 1986 to 2016. That’s thousands of potential clients coming to your turf, looking for a bank with ATMs and branches to serve them during their four years (or more) of college. Even if they’re not out-of-state students, many incoming freshmen want to get off their parents’ account and establish their own financial independence (or maybe just hide those bar tabs).

This is one of the few times in a person’s life when they are actively looking to establish or switch accounts. If you can get these students onboarded, there’s a pretty good chance you’ll hold on to them after graduation.

A banking behavior report published by Digital Scientists showed that more than half of 18- to 24-year-olds spent at least three years or more with their personal financial institutions. This means you can expect most of the students you attract to hold accounts with you far beyond their college years, sometimes even five to 10 years—or more—into the future.

Getting Started

Talk with your retail team about creating and marketing a student checking account. If you already offer one, that’s great. In either case, student checking can be similar to just about any other checking account you offer, but make sure it’s tailored to the needs of financially inexperienced college students. Income generated from fees and restrictions is important, but when it comes to students, think about lower minimum balance requirements or advanced overdraft forgiveness features as a way to convert prospects.

When it comes to promotion, it’s important to start digitally. Thousands of families are researching their students’ new homes months in advance of move-in day. It’s a perfect opportunity for you to work up some content around the benefits of establishing banking relationships in your town, and offer your student checking account as a solution. Through targeted social and web promotion of this content, you could find yourself onboarding plenty of new clients long before orientation even starts.

Another viable means of promotion is to contact your local university and see if they may be interested in a partnership. If they’re up for it, your bank will be presented directly to students as the local banking solution of choice—during orientation and at events held throughout the school year.

2. Content, Content, Content

When I was signing the lease on my first big-boy apartment and it came time to hand over the security deposit, I was shocked to find out that neither of my roommates knew how to write a check. I’m not saying this is the norm, but you’d be surprised to know how little basic financial knowledge most students have.

According to Forbes.com, 44 percent of Americans don’t have enough cash to cover a $400 emergency. Additionally, about 43 percent of student borrowers aren’t currently making payments on their student loans. Pretty scary, right? As many experts have asserted, financial illiteracy in this country is approaching epidemic levels.

As the financial experts in your community, you have an opportunity—and, dare I say, a responsibility—to fill a great need, educating the students you encounter online and in person. By offering your expertise, you’ll help them become more knowledgeable about finances and how they affect their present and future.

Sharpen Your Pencils. Class Is in Session.

The main idea here is that promoting financial literacy to college students through your own content publishing platform is a great way to reach members of this tech-savvy demographic.

To the 21-year-old majoring in art history, you might as well be Warren Buffett. Articles as simple as “Ten Basic Financial Skills You Need to Survive” or “How Credit Card Use Can Benefit Your Financial Future” will be HUGE with university students. And, by creating engaging content that meets their specific needs and interests, you’ll have potential clients coming to your site on their own terms. That’s powerful stuff.

Content works. It’s inexpensive to produce and effective, and best of all, the majority of your content has a lengthy shelf life.

3. Move to Mobile

Mobile is the present and future of banking—and bank marketing. Your success as a bank depends on your online and mobile capabilities among all audiences. Josh wrote a few words about how a 2018 Bank of America earnings call has only confirmed this reality, and I’d suggest you give it a read. In the meanwhile, let’s take a closer look at how college students are interacting with banks as part of the ongoing mobile revolution.

According to a 2017 consumer payment study from global payment solutions provider TSYS, 48 percent of 18- to 24-year-old respondents said they’d used their financial institution’s banking app at least weekly—which made them the most active mobile users of all segments profiled in the study. These same respondents were also were among the most active users of peer-to-peer payment services such as PayPal and Venmo. All of this data points to one thing—mobile banking is the key to the college student’s heart.

If your bank doesn’t already have a good mobile banking app, now’s the time to make it happen, because you’re already falling behind. However, just having an app isn’t good enough. Let’s take a deep dive into the second part of the equation.

More About Mobile Marketing

There are two keys to fully utilizing the power of your bank’s mobile capabilities: attraction and onboarding. In order for your clients to use your mobile banking tools to their fullest potential, they need a reason to download them in the first place. So, be sure to give them one. Then, continually use the platform to promote additional products and services that your mobile-savvy clients may need.

It doesn’t take much to sell a college student on mobile banking. Since some students’ current banks don’t have mobile apps, simply having one gives you the upper hand. To really get your money’s worth, I’d suggest running a targeted campaign that focuses exclusively on your mobile capabilities, so that you’ll know where to highlight advantages you may have over your near-campus competitors.

Don’t reduce your app to a mere bullet point on a list of benefits that come with a checking account. Mobile banking isn’t something to take lightly, so make it the main event. Plaster it on billboards, put it on posters in your branches, and run digital ads featuring screenshots and animations from your app—your goal is to make sure every student knows about you and your mobile app.

As I mentioned earlier, 18- to 24-year-olds will soon use a higher number of financial products and services than the average American adult. Since you know they’ll be logging into your app frequently, it would be foolish to not utilize this platform to its fullest potential. Just think about all the products you offer that can directly benefit a local student’s life—from checking and savings accounts to debit and credit cards (not to mention auto, mortgage, and student loans).

Mobile offers the ideal space in which you can advertise to an audience that’s hungry for financial products and education.