NOTE: This blog post began as a presentation given during the 2019 American Bankers Association’s annual Bank Marketing Conference in Austin, Texas. Since the post was the highest-rated session at the conference, we decided to share the contents of his presentation with the bank marketers who weren’t able to attend.

Your bank has more opportunity than ever, but you’ll have to make some changes to ride the wave away from the sea of sameness. Now is your chance to shift from status quo bank marketing and take advantage of new techniques that can lead to differentiation in the marketplace and smarter communication with the clients you attract.

So, where do we start? First, let’s look at the five macro issues that helped create the sea of sameness in modern bank marketing.

How We Got Here

1. Reaction rather than strategy

Banks tend to have jerky-knees. Small moves by competition, the market, or small data points can cause knee-jerk reactions within financial institutions. This isn’t just a marketing issue, but it does affect a bank’s ability to bring innovative products to the marketplace consistently. Without consistency, it’s hard to gain an edge.

2. Bank brand dilution

Too many banks are fine with commoditized names. Perhaps this is because a rebrand seems intimidating. Josh, our President and Chief Creative Officer, helped us demystify the rebrand in this blog. Yet many banks still don’t value the differentiation good branding provides, while ironically yearning for the sleek brand appeal of upstart fintechs. And if you fall into the group of 67% of banks that share one of five common words in your name, the digital age has only amplified your branding challenge.

3. Demographic delusion

The Millennial has grown up. Gen Z is now a gainfully employed adult cohort. And our surveys have failed us. Most banks still don’t know what these groups want. The truth is, generational and demographic data doesn’t give you the picture you need to effectively market today. Our clients’ actions speak volumes, and, as marketers, we have the ability to capture valuable behavioral insights and reciprocate by giving some value back. “Blasting” a list of people based on tired demographic data isn’t the way to win clients.

4. Manual and muddled processes

Have you tried to kick off a data-centric project within your bank? Whew. For an industry sitting on a treasure trove of information, it can take an act of divine power to get a report on something as simple as how many checking clients you have. If your process is tedious, it an weigh down agile marketing and limits your potential. So, why not start with these four data points?

5. Too many damn hats…

Marketing can be the great catchall role. You’re creative, right? You’ve used Photoshop before? You can write? Sounds like you should run digital banking, training, HR, sales enablement, and events and—oh, right—champion our brand and run our marketing department.

It’s hard to wear all those hats, but it’s a reality for many bank marketers. With limited resources and more than one top priority, your bank’s communication efforts suffer.

What’s the result?

What’s the result of these five significant issues? We scramble to release reactive marketing campaigns (often with too little runway to effectively launch) that winds up not connecting with the intended audience.

As an industry, we prefer to “blast” and see what happens.

Branding Over Blasting

I cringe when I hear the term “blast.” Any request to militaristically drop messaging payloads on a random population of people with a product description they don’t care to receive (but continue to receive without rhyme or reason) makes no sense to me. It’s blast-phemy. Isn’t that advertising, though? Technically, yes. But, it’s not good marketing strategy.

John Wanamaker, a late-19th-century American merchant, famously said, “Half the money I spend on advertising is wasted; the trouble is I don’t know which half” (and you may have seen this quote incorrectly attributed to David Ogilvy on the internet). The quote holds up. We have the tools to optimize our digital campaigns, but we often fail to quantify that coveted ROI. And in our quest to analyze, it’s easy to look in all the wrong places, discovering “insights” that distract us from where our focus should be.

Not debilitated by data, Mr. Wanamaker knew in the earliest American advertising age that brand was more than just advertising and the “retail experience” was intimately tied to how people perceived his business. He marketed innovations like in-store telephones and pneumatic tubes that transported customer cash to help sell gloves and golf balls. He created brand associations that linked his company with a progressive, thoughtful customer experience. Today, as banks try to find new ways to promote innovation, their last-century brands aren’t holding up. Maybe it’s time for a change?

Even 100 years ago, customers needed time to build trust with brands. There were impulse buys, of course, but brand loyalty was still achieved through consistently good experiences and relationships. There were not as many financial options for bank clients in those days, but there were plenty of choices for various consumer goods. And many of the consumer packaged goods companies of that day emphasized brand building. One hundred years later, it’s the bank industry’s turn to emphasize brand. Today, the number of financial product choices is overwhelming, and clients are increasingly puzzled about where to place and manage their money. Great bank brands can rise to meet this need, but it will take some courage.

Break Through the Buzz

As if the brand challenge weren’t hard enough, you also need to consistently communicate to clients in a crowded digital space. Most people (myself excluded) don’t have an Instagram feed filled with bank and fintech brands. They’re looking at a friend’s new baby or one of ten “little dog in a big city” accounts.

Bottom line: it’s noisy and really hard to attract new interest to your bank.

When you produce great content, your window of opportunity can close as quickly as it opened. The same goes for your biggest opportunity: marketing to your current client base.

So how can bank marketers take all this data we’ve talked about and use it to connect helpful content with well-thought-out, always-on, client-specific campaigns?

The answer is marketing automation.

It’s simpler than it sounds. Marketing automation refers to the strategy, data process, and tools designed for organizations to more effectively market on multiple channels (such as email, text, direct mail, social media, websites, etc.), personalize communication, and automate repetitive communication.

Another definition could be marketing to someone’s behaviors and not their persona.

Yet another definition could be the programmatic glue between many different marketing touch points.

The Seven Keys to Marketing Automation

In the past five years, marketing automation tools have matured to the point that many industries are reaching mass adoption. The banking industry is behind (surprise), although you may already have some forms of automated marketing in your organization today and not realize it (e.g., a core-generated email about eStatements).

As marketers implement marketing automation in greater numbers each year, a new responsibility has emerged: knowing what data matters and what data doesn’t. While marketing automation provides an opportunity to send progressively more valuable information to clients based on what they do, it can also isolate clients from messages they need to see.

It’s why there are seven keys to effectively implement marketing automation. I’ve summarized them here.

1. Strategy

Just like your brand and campaigns are closely tied to good strategy, your automation programs must be strategic. You’ll start by defining the program.

- Is your goal an advertising automation to nurture people who have shown interest in a product or service?

- Are you developing an automated onboarding program that educates your new client on how to deepen their relationship with your bank?

- Maybe you need to reinvigorate relationships with disengaged clients.

Each of these approaches affects the choices you make in the setup, implementation, and analysis of your automation programs.

2. Contact or list management

List and contact management is critical. Automation tools help you develop static and dynamic lists that serve different purposes depending on your goal.

- Static lists tend to work like basic lists you may have used in email tools before. You have a group of people with a certain characteristic and you send them a specific email.

- Dynamic lists are incredibly powerful segmentation tools that allow prospects or clients to move on and off a contact list based on actions they take. These actions could include visiting a certain web page, clicking a social media post, or engaging with a certain part of an email.

Lists require detailed quality assurance, but when developed correctly, this type of segmentation gives you the ability to send more meaningful messaging and at more appropriate times.

3. Mapping

“Journey mapping” has become a popular marketing buzz phrase of the past decade. And while some banks have prioritized client experience by analyzing these “journeys,” bank marketers haven’t always applied the same planning in multichannel marketing campaigns.

It’s hard enough to get a campaign to market, so marketers too often want to “just get it out there” and don’t apply the time, energy, or resources to effectively map how their advertising, content, and conversion channels work in concert. Thus, mapping is a critical pre-launch component of marketing automation.

You can use an outside mapping tool like Visio or Miro or you may choose to develop your maps directly inside your automation tools. But the process of building maps, debating the most meaningful actions, planning the sequence of emails, and defining the information that is most relevant at each stage will transform your “just get it out there” campaign into a powerful lead-generating, ROI-producing automation program.

4. Channel Connectivity

Marketing automation gives you the ability to glue together channels that are traditionally disparate.

With custom redirects (a cookie-enabled link that registers someone’s behavior after a click), you can record when a prospect clicks on a promoted home renovations post on Instagram that links to your HELOC campaign landing page. Weeks later, when that same user visits your website, they can be presented with dynamic content that shows them a HELOC promotion on your website.

Simply put, your marketing automation tool replaced a less meaningful CD rate slider image with a HELOC renovation promo, creating more relevance and more value for your prospective client.

And your campaign doesn’t have to end after 90 days. You can automate everything from CD advertising to mortgage marketing (even in the winter, when people say people don’t buy homes—hint: they do)! Set it and watch it run in the background until it’s no longer relevant.

5. Content Development

You’ll need plenty of content to build a thoughtful automation program. And your content should have a distinct purpose at each stage. Some content is meant to attract new prospects to your bank. Some content is intended to convert interested prospects into clients.

Defining the topic and intent for the various pieces of content you develop ensures you only invest in content that will move you toward your goal. As your marketing automation programs advance, you’ll be able to see what content topics and types best help you onboard, nurture, and re-engage prospects and clients alike.

6. Software Selection

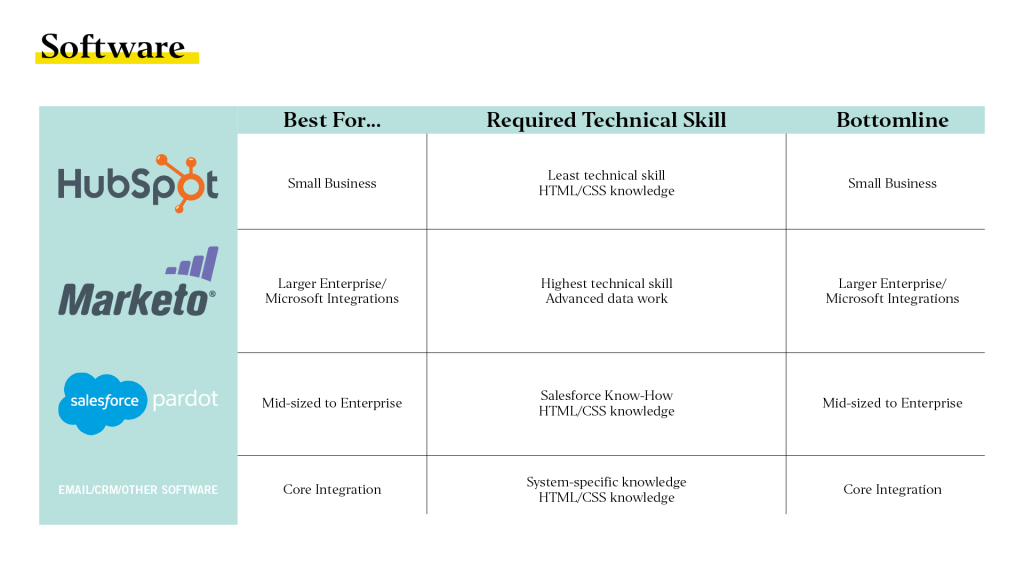

The marketing automation tool you choose should be lower on your priority list. Don’t let the technology drive your decision—let your goals do that. There are four or five mass-market automation tools and a long tail of smaller, niche softwares. Some of the tools you have installed in your bank today offer some form of marketing automation as well; however, it may not be the right tool on which to build your corporate and brand marketing programs. Here’s a quick chart on the pros and cons of top marketing automation tools.

7. Testing

Unlike marketing campaign tests you’ve employed in the past (e.g., advertising in a select market before opening up the investment), marketing automation requires a more integrated—and sometimes technical—testing approach. You’ll test everything from email deliverability to dynamic content population in landing pages.

As with any new tool, the key is to start small. Send six onboarding emails that have three offshoot emails based on which link a new client clicked in the first email. If fully integrated with your CRM, use a small sales group to test their follow-up times for a niche small business lending campaign. These tests will help you prepare for more advanced automations as your experience with marketing automation matures.

It can feel overwhelming to take on marketing automation, so start simply. This blog just scratches the surface on what’s possible when marketing automation is backed by sound strategy, good data, and great creative. But go in with the understanding that any good marketing automation practice takes three years to mature. You’ll have some wins along the way, but a robust marketing automation program takes time and patience. If done correctly, one of your many hats may be a little less burdensome.

Or, if you need someone to wear the hat for you, let us know.