5 Lessons Learned in Bank Geotargeting

These takeaways will make or break your bank’s geotargeting investment.

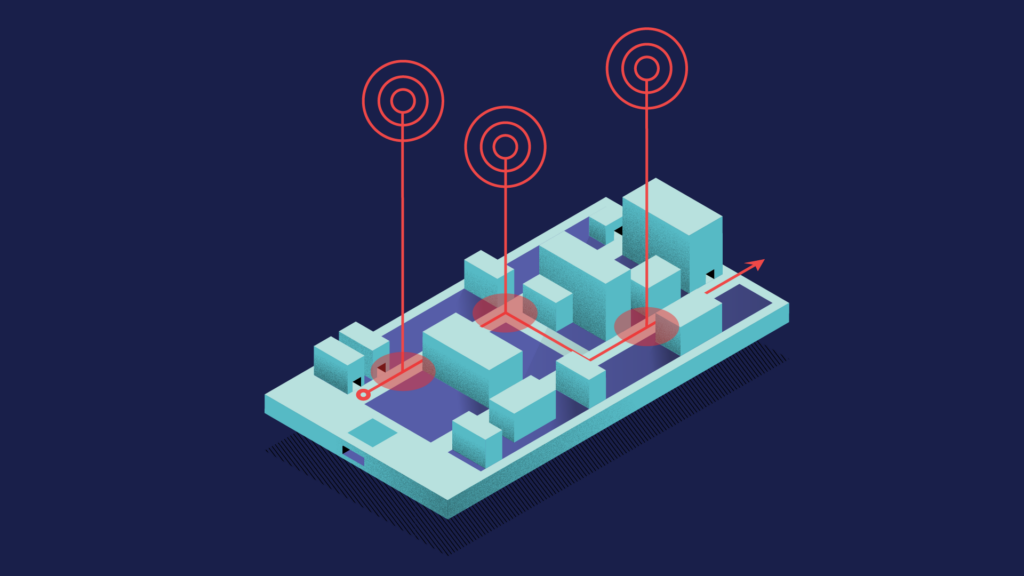

Geotargeting and geofencing are two of the trendiest advertising activities enabled by the mobile revolution. More than that, they’re proving to be the next big thing on the advertising frontier. Understandably so—marketers move their dollars to where people spend most of their time. And today’s U.S. consumers spend at least five hours of their day on their mobile devices.

But both these activities come with inherent flaws. And they require a new level of analytical and creative rigor not yet fully understood.

That said, we’ve seen a number of banks make substantial use of geolocation to improve customer targeting—and that has yielded a wealth of lessons learned. Here are a few of our biggest takeaways.

1. Advertise where people are sedentary, on their phone, AND often managing their money.

Banks have long looked at major retail areas as the prime real estate for financial decisions. However, a bank’s physical presence at a mall doesn’t necessarily mirror decision-making in a digital advertising medium. People shopping at malls are busy and although they may check their devices, they aren’t making important banking decisions when buying a new pair of shoes or a cinnamon bun.

Don’t waste your digital dollars where people are active or using their phones for more intentional reasons. A better use of your geotargeting investment could be placement around pickup lines at school or large office buildings full of daytime workers. These individuals are stationary and often browsing their phones more casually. This is an opportunity for you to generate meaningful interest.

2. It’s not just about location, it’s about timing, too.

Think about those carpool lines at the elementary school. Don’t spend your money for a full day of advertising. Test time ranges between 7:30 and 8:30 a.m. and 3:00 and 4:00 p.m. Consider the day of the week or the time of year when targeting those employees in the office building. Fridays, plus the 15th and 30th of each month are common paydays—when money is top of mind—and a great time to start a conversation about banking.

3. It’s not just about location and timing, it’s also about creative and messaging.

To properly target by location and timing, your creative and messaging should align with your placement. For example, you could remind those office building employees on payday that they can put a little money from their paychecks into one of your high-yield savings accounts. This is a timely, meaningful message. Anything else would be “just another bank ad” and quickly dismissed.

Keep in mind that your landing pages from these ads should also align with the creative and messaging. Don’t send these interested savers to your homepage. Send them to a page that shows how far a little saving can go. And allow them to take action there on the page to set up a consultation, send themselves a reminder, or open a new savings account on the spot.

4. “Geoconquesting” is a good idea, but not a silver bullet.

People go into banks most often for one of three reasons:

- To open an account

- To close an account

- To transact

All of these events represent an opportunity for you. But when geoconquesting—that is, a form of geotargeting that focuses on your competitors’ locations—you should temper your expectations. By the time a consumer enters a branch, many of the choices that go into opening a new account have already been researched. And your offer may not be strong enough to pull someone away from a decision.

It may sound like a promising opportunity to target a customer who’s in the act of closing an account. Keep in mind, though, these customers have often opened a new account at another bank many months before officially closing their old account. Again, your offer may not impact the decision.

Geoconquesting does offer a strong awareness opportunity, however.

Staying top-of-mind is difficult, and switching banks is rare. Meaningful, brand-boosting advertising will keep your bank fresh in a customer’s mind when they have any issues with a competitor or they decide they want to look elsewhere for another financial solution. To help solidify your brand, weave your bank’s story—and how you serve the greater community—into your more informational ads.

5. Reinforce sponsorships where you can.

Geotargeting local events where you have a presence can significantly enhance your success. If you’re a branded sponsor of the Fifth Annual Local Art Crawl, overlay the area with ads and drive visitors to your booth. Use the event’s topic to your benefit. If you have a presence at a business event, use the ads to highlight some of the other businesses you’ve helped. If it is a local arts fair, try raffling a local art piece at your booth and use the ads to promote it. Traffic will follow.

Don’t let your advertising end when you pack up your booth. Retarget the customers who have clicked on the landing page you use for the event. This can help you deliver relevant advertising to your booth visitors for months to come, moving them from casually interested to new client.