The Most Dangerous Marketing Plan Is One That Feels Like a Plan

There’s a special kind of satisfaction that comes from filling in a 12-month marketing calendar.

A neat row of quarterly campaigns. A budget column. Product priorities slotted in by season. Maybe even a color-coded Gantt chart to make it all feel official.

It looks strategic. It feels proactive. Everyone on the executive team nods along.

But this isn’t a strategy. It’s a schedule. And for many banks, that schedule becomes a trap.

When your plan mirrors your internal structure instead of customer behavior, you’re optimizing for convenience, not conversion.

“A campaign a quarter” sounds like smart planning. It creates structure. It checks boxes. But this structure is why so many banks struggle with marketing performance.

It’s why your ads feel like background noise.

Why product campaigns miss the right customers.

Why acquisition feels like a coin toss.

And, worst of all, it’s why your marketing isn’t compounding year over year.

When Marketing Is Built for the Bank, Not the Buyer

The biggest flaw in quarterly campaign planning is that it reflects internal structure more than customer behavior.

You promote checking accounts in January, savings in spring, and CDs in the fall. Not because your audience is asking for them, but because your internal plan says it’s time.

That’s not customer-first marketing. That’s institutional habit.

Most customers don’t time their financial decisions around your campaign calendar. They’re driven by real needs or they’re triggered by frustration, opportunity, or urgency.

They open accounts because their old bank dropped the ball.

They apply for loans because they just found a house.

They refinance because a friend told them your bank was easier to work with.

But a schedule built around quarterly product pushes won’t catch those moments. You’ll be off-cycle, off-message, and off-target.

You must remember: Your audience isn’t a crowd waiting for the same message at the same moment. It’s a parade, constantly moving. People drift in and out of need. The right message only matters when they pass by. If you only advertise when it’s convenient for you, most of them are already gone.

And then you’ll wonder why cost-per-acquisition keeps creeping up while engagement stays flat.

The Invisible Cost of Being Off-Message

Quarterly campaigns give you the illusion of consistency, but they rarely deliver meaningful connection at the most opportune time.

Every time you promote a single product, you narrow the audience. Everyone else gets a message that doesn’t apply to them.

That misalignment doesn’t just miss opportunities; it conditions your audience to tune you out.

If your messaging only ever shows up when your bank needs something—deposits, loans, applications—it starts to sound like noise.

Brand value doesn’t build in bursts. It builds in presence, in relevance, and in tone. If every campaign sounds different, feels different, and disappears after 90 days, there’s no continuity for customers to latch onto.

No wonder performance feels unpredictable. The message changes before it has a chance to stick.

How the Quarterly Model Creates Burnout, Not Breakthroughs

Underneath the structure of “one campaign per quarter” is a constant churn.

Each campaign becomes a project: new concept, new creative, new messaging, new approvals. Just as soon as one campaign launches, the next is overdue.

There’s no time to evaluate what worked. No energy to scale what resonated. And no margin to iterate, optimize, or adapt.

Instead of building a system that gains efficiency over time, you’re building from scratch four times a year. Year after year.

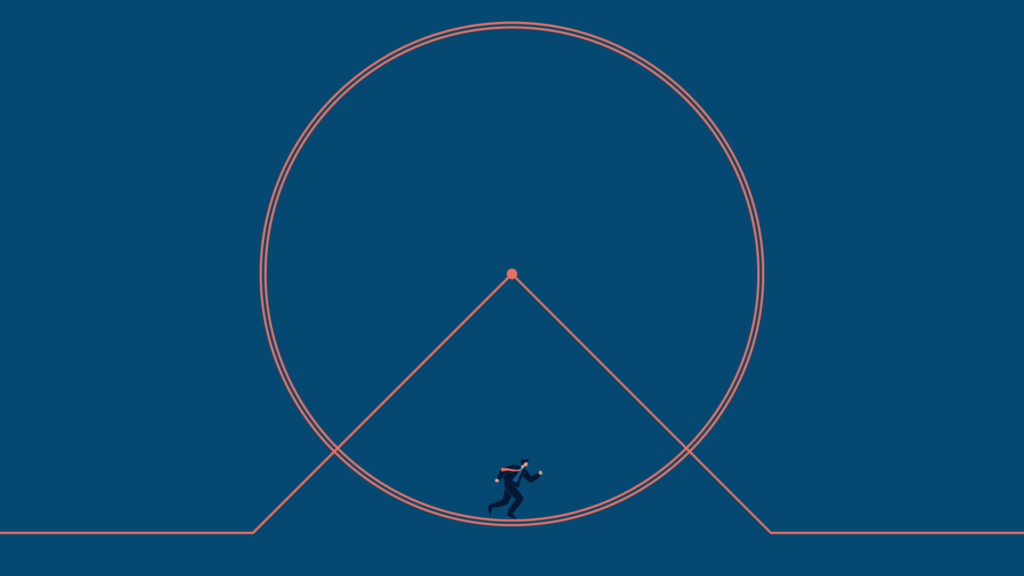

It’s a treadmill disguised as a strategic process.

And it’s no way to build marketing that gets smarter, faster, or more effective.

From Calendar-Driven to Customer-Centered

Most marketing plans are built from the inside out. They’re anchored to quarterly rhythms, budget cycles, and internal priorities. But growth doesn’t come from internal alignment alone. It comes from external relevance.

That’s why the highest-performing bank marketing strategies don’t follow a fixed cadence. They respond to customer behavior.

Not just with product offers, but with helpful content, consistent messaging, and campaigns that show up in the moment, not a quarter too early or too late.

When strategy starts with arbitrary timing, marketing becomes a guessing game. That’s why your calendar should follow the customer journey, not the other way around.

The most effective plans do less, but mean more. They stay on. They stay useful. And they make sure your brand shows up before someone’s ready to switch banks, not just when it’s convenient for you to advertise.

Because if someone’s first exposure to your bank is a spring auto loan promo, you’re probably not their first choice.

The Better Model: Campaigns That Get Better Over Time

If quarterly campaigns are a treadmill, three-year campaigns are a flywheel.

A treadmill keeps you moving, but never forward. Every quarter, you start over: new creative, new copy, new approvals, new stress. The moment you stop running, momentum disappears.

A flywheel is different. It’s heavy at first. It takes work to get it spinning. But, once it’s in motion, every small push makes it spin faster and smoother. It stores energy. It builds power. And over time, it takes less effort to keep it moving.

Instead of reinventing the wheel every 90 days, build one campaign strong enough to last and scale. Layer it. Add channels over time. Test language. Refresh visuals. Update landing pages. Introduce retargeting. Expand reach. Refine audience segments. Rinse. Repeat.

And then do it again with a second long-running campaign.

By year three, you’re not launching campaign #12. You’re running three mature, battle-tested campaigns that each work harder than the last. They’re more efficient, more recognizable, easier to improve, easier to staff, and easier to measure.

When you hit year four, you’re not starting from scratch. You’re choosing: update Campaign One or keep it going and build Campaign Four.

Now you have real marketing momentum. You’ve shifted from activity to architecture.

You’ve built a system that performs, not just a schedule that checks boxes.

Because strategy isn’t about what happens next quarter. It’s about what keeps working long after.