Never Study Your Heroes

Every bank marketer has heard it.

“We want to be the Uber of ___.”

“WeWork changed the game.”

“Let’s build a Snapchat-style app experience.”

Why do banks keep studying companies that play by rules they don’t get to use?

These names get passed around strategy decks like talismans—as if invoking their magic can unlock success. But here’s the truth: these companies are more famous for what they promised than what they produced.

Uber took over a decade to post a profit. WeWork never did. Snap? Still not there. These are companies that created value for users but burned mountains of capital to do it.

When we hear community banks talk about launching online-only brands to gather deposits outside their footprint, we get it. The logic sounds right: break geographic constraints, compete in bigger markets, capture customers who don’t care where your branches are.

But we’ve also been sold (mostly by vendors who stand to profit) that there’s a large, eager audience out there demanding an online-only bank. And while it’s true there are people willing to use one, that doesn’t mean they’re searching for one. Being open to something isn’t the same as seeking it out.

The promised audience might exist. But it’s not large enough to sustain the flood of neobanks that keep launching. Most of the “demand” for online-only banks exists in vendor pitch decks—not in customer behavior.

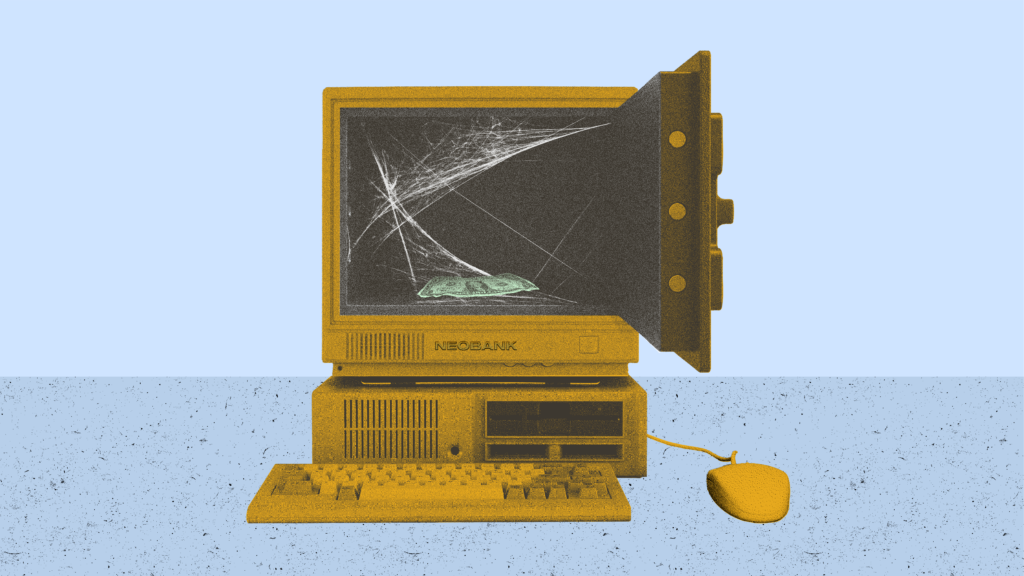

95% of Neobanks Aren’t Profitable

A 2023 study by Simon-Kucher & Partners revealed that fewer than 5% of neobanks are profitable.

Out of roughly 432 neobanks globally, fewer than 22 actually make money.

To put that in perspective:

- Getting into Harvard: ~4%

- Publishing a book: <5% of Americans

- Passing all 4 CPA exams on the first try: <5%

These are rare outcomes. So is building a profitable neobank.

These Questions Matter

We’re not anti-neobank. We’re here to help.

We’ve worked on digital-only spin-offs and national banking concepts. But we ask the hard questions up front—because ambition without clarity is a costly risk.

If you’re going to build a digital-only brand, you’re entering a national arena. These are the rules of that arena. Ignore them, and you lose money fast.

1. Is your message strong enough to stand out?

You’re no longer competing with the bank across town. You’re up against Chime, Ally, Capital One, and Apple. Their ads feature celebrities. Their copy is world-class. Your brand has to be sharp enough to stop the scroll.

2. Do you have the budget to support it?

Launching a national bank means funding a national brand. Chime spent $1.4 billion from 2022 to 2024. Rocket Money (Truebill) spent over $200 million in 2024 alone. If nobody knows your brand exists, even the best offer won’t land.

And now there’s another seductive pitch: build niche sub-brands for specific audiences. “Truck drivers deserve their own bank. You can build it.” But these aren’t real brands. They’re marketing veneers. And you’re funding new initiatives when you’re already underinvesting in your main brand. Slick pitch. Shallow strategy.

3. Is your offer compelling enough to motivate change?

Why would someone move money from their current bank to you? Higher rate? Easier UX? Better rewards? If your value proposition is average, your results won’t just be average, they’ll be expensive.

4. Do you have a plan to onboard well?

An account opened is not an account activated. You need a plan to drive engagement from day one: smart email/SMS sequences, helpful nudges, easy deposit funding, and customer service that actually helps.

5. Will you retain and grow them?

National customer acquisition is expensive. If you’re not cross-selling, not building relationships, not creating product depth—you’re burning money.

6. Have you shopped your competition?

We’ve opened accounts at big banks. And while we don’t admire their ethics, we respect their UX. Their apps are fast. Their flows are frictionless. Customers stay for a reason. Can you match them?

Who Is This For?

Banks build business cases. And they’re pretty straightforward: deposit growth, geographic expansion, digital leverage. But customers don’t. Customers make emotional decisions for practical reasons.

Have you built a case for your ideal customer?

What problem does your online-only brand solve for them? Why would they trust you? What makes the experience worth it?

You can’t fake this part. It has to be real.

Be Real About the Rules

Snap, Uber, and WeWork delivered value to their users:

- Uber gave us convenient, on-demand rides.

- Snap let a generation communicate on their terms.

- WeWork reimagined workspace.

They mattered. But they also ran on rules banks can’t play by.

Community banks have to show results. They answer to regulators, boards, and balance sheets. You don’t get to burn millions on a good story. You can’t raise another round to “figure it out later.”

You’re not chasing a billion-dollar valuation. You’re growing a bank. One that earns trust, builds relationships, and funds itself.

That means every dollar matters. Every customer matters. Every message, journey, and system matters.

If you still want to go national? Good. We want to help you do it right.

Start with truth. Build with focus. Earn what the others try to buy.

That’s how to build something real.

That’s how to build something that lasts.