Nearly Half of All Banks Are Making the Same Big Branding Mistake

Banks typically spend a lot of time looking at what other banks are doing—sometimes to benchmark, sometimes to borrow, and sometimes just to make sure we aren’t missing something obvious. But the best lessons don’t always come from our own industry. Sometimes, we need to look outside banking to see what happens when companies make the right (or wrong) moves.

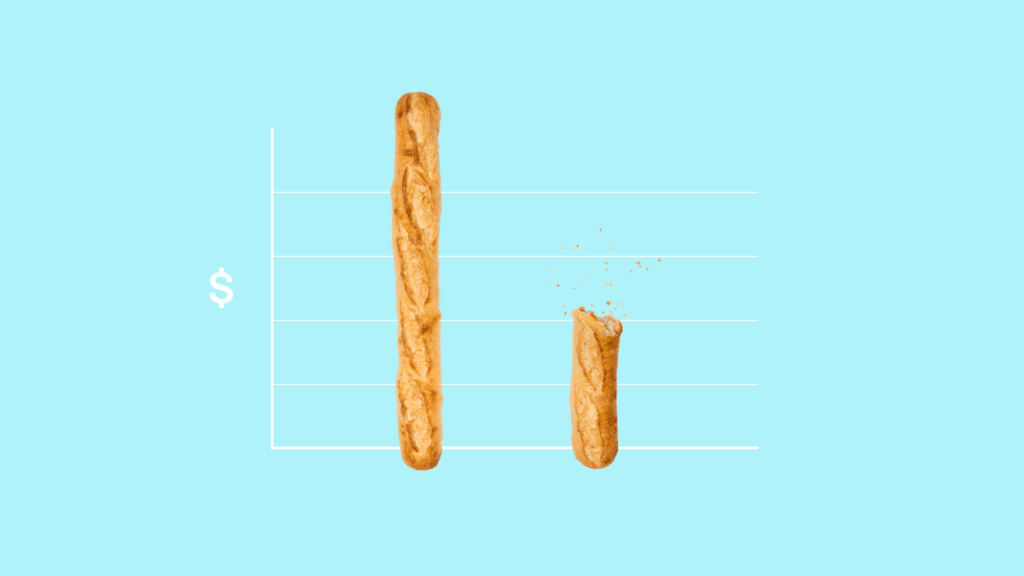

Today, we’re talking about bread. No, not money, but a lesson that might make your bank more profitable.

Let’s look at the difference between Panera Bread and Atlanta Bread Company. Because the way these two companies handled their name and brand—one rising to national dominance and the other fading into obscurity—has everything to do with the way banks approach their own names.

And it’s why having a geographically-based name might be the very thing holding you back.

The Power of a Name

Let’s start at the beginning.

Founded in 1987, St. Louis Bread Company was a local bakery in—you guessed it—St. Louis. In 1993, it was acquired by Au Bon Pain Co., and in 1997, it underwent a full rebrand, emerging with the now-famous name: Panera Bread. The word “Panera” comes from Latin, meaning “breadbasket.” But more importantly, it was unique, abstract, and completely unshackled from geography.

Atlanta Bread Company, founded in 1993, started in Sandy Springs, Georgia. It took the opposite approach. It kept its regional, location-based name and, while it expanded, never gained the same national traction.

Both are bakery-centered fast casual restaurants. Their offerings are so similar, Atlanta Bread Company’s Wikipedia has this disclaimer: Despite the similar name and type of outlets, Atlanta Bread carries no relation to the American bakery-café chain Panera Bread.

Why? I think a major reason is the name “Atlanta Bread” immediately limits its audience. Potential franchisees in Oregon or New York sees that name and thinks, That’s not for me. That’s for Atlanta. And it’s even more Impactful for customers considering the brand—what does Atlanta know about bread anyway? If the name had some built-in benefit—if it were San Francisco Sourdough or New York Bagel Co.—that might be different. But Atlanta? Not exactly a city known for its bread-making legacy.

Today, Panera has over 2,000 locations across all 48 lower states and Canada. Atlanta Bread? It peaked at 170 locations. Now, it’s barely a blip, struggling to keep its last 10 locations open. This is a stark contrast that underscores the power of a name in shaping long-term success, though missteps in operations and franchising certainly played a role

That’s the danger of tying your name to geography. Not only does it limit your market; it doesn’t automatically communicate value.

Consumers don’t just see a location-based name as a descriptor—they interpret it. A geographic name doesn’t always feel welcoming. If I see “First National Bank of Smith County,” how can that be my bank if I’m not in Smith County? What if my business competes with businesses in Smith County? What if Smith County is home to my high school’s biggest rival? You might think these are small considerations, but they’re not. People are wired to seek belonging. A name that signals “for us” to some signals “not for you” to everyone else.

How Many Banks Are Clinging to Geographic Names? (Too Many.)

Banking has a branding problem. Or, more specifically, a naming problem.

Right now, 1,877 banks—41.84% of all banks—have names tied to a specific city, state, or region.

Think about that. Nearly half of all banks are telling customers, in some form, We belong here—and only here.

It’s like putting an invisible fence around your brand. You might not see it, but customers do.

The Problem with Location-Based Bank Names

Here’s the issue with a name tied to geography:

It Limits Your Growth

Panera knew that to expand beyond Missouri, it couldn’t be tied to St. Louis. Meanwhile, Atlanta Bread Company kept its location front and center—and it didn’t scale.

If your bank’s name is tied to a specific town or region, you’re telling the world, This is where we belong. This is our boundary. You might as well put up a “Local Only” sign.

It’s Forgettable

There’s nothing inherently wrong with a name tied to your community. But when nearly half of banks are doing the same thing, it means no one stands out.

Panera? Distinct.

Atlanta Bread? Generic.

Your bank’s name should be something people remember—not something that blends into a sea of sameness.

There’s another problem: A location-based name tells people where you are, but it doesn’t tell them why they should bank with you. Consumers don’t pick banks based on zip codes—they pick based on trust, convenience, service, and innovation. If your name doesn’t communicate any of those things, what exactly is it doing for you?

It’s Harder to Market

Bank marketers already have a tough job. You’re competing for attention in a digital world where no one wakes up excited to engage with a bank ad.

A generic, geographic name makes it even harder. How do you differentiate yourself from the hundreds of other banks with similar names? How do you make a name like “Springfield Bank & Trust” or “Northern State Bank” stand out?

Short answer: You can’t.

What Should Banks Do?

If this is hitting home, good. That means you’ve got an opportunity.

Here’s what you should be thinking about:

1. Consider a Name Change

Yes, it’s a big step. No, it’s not impossible. If Panera could do it, so can you.

The best bank names today are abstract, evocative, and free from location-based constraints. They give banks the flexibility to expand, stand out in the marketplace, and build a unique brand identity.

2. If You Can’t Change the Name, Own the Brand

If changing your name isn’t in the cards, then own your brand identity in a way that differentiates you from all the other geographically-based banks.

- De-emphasize the geographic name in marketing materials and emphasize a unique value proposition.

- Use brand storytelling to create an identity beyond the name.

- Lean into design and messaging to make your bank stand out visually and verbally.

3. Stop Being Afraid of Change

Banks are notorious for resisting change. But look at the industries around you. The companies that adapt and evolve thrive. The ones that cling to the past fade away.

Atlanta Bread didn’t adapt. Panera did.

If your bank keeps clinging to an outdated name, you might be setting yourself up to be the Atlanta Bread of banking.

Final Thought: The Cost of Inaction

It’s easy to justify staying the same. Change is uncomfortable. It requires effort. It requires buy-in from executives who may not immediately see the need.

But ask yourself this: What happens if you don’t make a change?

You stay generic.

You stay forgettable.

You stay limited.

Your bank’s name is the first impression you give to the world. Does it welcome people in, or does it tell them they don’t belong? Because the wrong name isn’t just a name—it’s a missed opportunity.

And one day, when a bigger, bolder, more memorable bank moves into your market, you won’t be able to stop them.

Because they’ll be Panera.

And you’ll still be Atlanta Bread.

Time to Rethink Your Bank’s Name?

If you’re ready to break out of the mold and create a bank brand that actually stands out, let’s talk. Because the best time to change was yesterday. The second-best time? Right now.