Customer Service is Dying

Banking has another pandemic looming as a threat.

It’s not a health concern, but it is a fast-spreading illness.

Customer service is dying across the country. And at a rapid rate.

Now, I’m not the first old white guy to shake my fist at the sky and proclaim such doom and gloom as a consumer. However, I’ll have you know that I love most of the things my peers complain about. I think advancements like self checkout are magical inventions. I don’t require human interaction to buy groceries—so long as my experience is easier.

This is not just one writer’s feeling. This decline in customer service is measurable. Recent data reveals that organizations globally are putting $3.7 trillion annually at risk due to bad customer experiences, an increase of approximately $600 billion (19%) compared to projections from last year. Customer service is getting worse and it is affecting profits.

The alarm bell I’m ringing for banks like yours deals with much darker patterns.

Dark Patterns

Have you ever tried to cancel your Amazon Prime account? It’s almost impossible to figure it out. Once you’re in, you’re in and you’re on auto-renew. It’s so difficult on consumers, the FTC filed a complaint against Amazon in 2023 decrying their practices of deceptive signups and difficulty to unenroll.

Here’s actual language from the complaint:

For years, Defendant Amazon.com, Inc. (“Amazon”) has knowingly duped millions of consumers into unknowingly enrolling in its Amazon Prime service (“Nonconsensual Enrollees” or “Nonconsensual Enrollment”). Specifically, Amazon used manipulative, coercive, or deceptive user-interface designs known as “dark patterns” to trick consumers into enrolling in automatically-renewing Prime subscriptions.

Dark patterns are systems used to manipulate users into making choices that are beneficial for the vendor but generally not ideal for the user. The term was coined in 2010 by user design specialist Harry Brignull. Amazon Prime isn’t the only example. Perhaps you purchased something online and noticed another service “snuck” into your cart before checkout (like a return fee or a warranty)? And these practices don’t just show up online, they’re creeping into the real world, too.

Dark Reality

Fortunately or unfortunately, I spend a lot of time on airplanes and in hotels. Both of these experiences continue to degrade, but have done so more rapidly lately than ever before. While airlines have long been the target of derision for customer service, the experience has gone from bad to almost adversarial. The most damning indicator to me is how similarly terrible the experiences are across airlines and hotels. Here are a few of the more concerning patterns:

The False Customer Service Desk

These are especially prevalent at airports. You miss a flight due to a delay, so you queue up to make sure you’re rebooked, etc. One airline made me scan a QR code to get into a virtual queue to then join the line. After the double wait, I get to the front only to find out that I have to call the customer service number to accomplish anything. I inquired, “Am I not at the customer service desk?” The reply: “No sir, we’re the help desk.” Well, ok.

App/Calltree Pickleball

So what happens when the “help” desk can’t actually help? You can always try the app. But there’s a reason this isn’t its own section—because most apps are useless for solving real problems. They rely too much on automation, rigid decision trees, and canned responses, which fall apart the moment a situation requires actual problem-solving.

You know you’re at a breaking point when the app tells you to call customer service—only for the automated system to insist, “Did you know you can resolve most issues in our app?” as if you haven’t already hit that dead end. This endless volley between app and call center is the corporate equivalent of a high-speed pickleball rally—except no one’s scoring points, and the only thing getting worn out is your patience.

At some point, we all break down into the universal customer service language of frustration: shouting REPRESENTATIVE! or OPERATOR! into the phone like a desperate incantation, hoping it will summon an actual human. And all of this happens when you’re stranded in an airport, scrambling for a hotel room, or just trying to get home. It would almost be funny—if it weren’t so infuriating.

The Buck Stops Anywhere but Here

No matter the platform the pervasive pattern is a combination of the ironic inability to actually help, no responsibility to solve any problems, and a huge lack of empathy for issues out of the customer’s control. After several issues with multiple airlines and hotels, I’ve left experienced feeling completely un-helped and literally stranded. I’ve stood across from other humans and felt absolutely powerless. Not only are these experiences common and similar across unrelated companies, but they feel designed. The processes feel designed to prevent help, reduce responsibility, and increase frustration to the point of giving up. If I had to guess (and trust me, I will) these occurrences not only feel purposeful, but created by the same organization. My best is on the large “accounting firms” who overreach into so many areas. While I have no true insight, I can see a soulless cash-grabbing consultant pitching a customer-centric business (such as airlines and hotels) to implement procedures that will save the company money, increase profits, and boost shareholder value. The problem is, though, they do this at the expense of the most valuable asset: the customer.

Banks Will Never Do That

But what does this have to do with banking? Community banks would never do anything like this, right? Hopefully not, but one thing I’ve noticed in a could of decades working with banks: trends in large corporations tend to eventually show up in banks—even smaller banks.

After all, look at chat bots. I’ve spoken to dozens of community banks across the country. When asked about their greatest strengths, the answer “our people” always ranks either first or second. The other response that shares the top spot is “customer service.” Yet somehow, vendors convinced quite a few community banks to add AI-driven chatbots to their websites. Why would a people-first, customer-centric community bank go against all logic and trust a robot to chat with its customers?

Well, I’d bet it was a really good vendor pitch deck that showed how other (likely larger) organizations were using chat bots. And that pitch was so good, it convinced a bank that a chat bot would actually help customers and be an extension of the bank’s awesome service—even though it makes no sense at all.

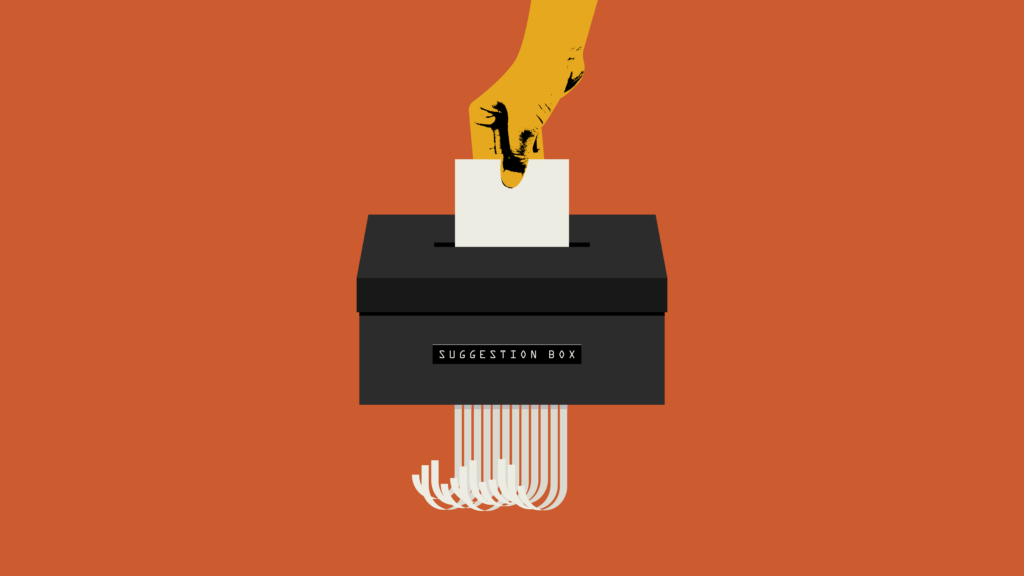

It’s a bit of a dark pattern in itself.

And it worries me that the same vendors who convinced airlines, hotels, and rental car companies that an initial bump to the bottom line would be worth it despite how it would frustrate their core customers will pitch similar “solutions” to your bank.

Hopefully, we’ll all remember that it’s not our people or our service that are our most valuable commodity. It’s our customers.