No time to read? Listen to an audio version of this blog below. Once you’ve finished, check out the bonus discussion at the bottom of this page.

When a company as big as JP Morgan Chase makes a misstep on Twitter, the clapback is always lit.

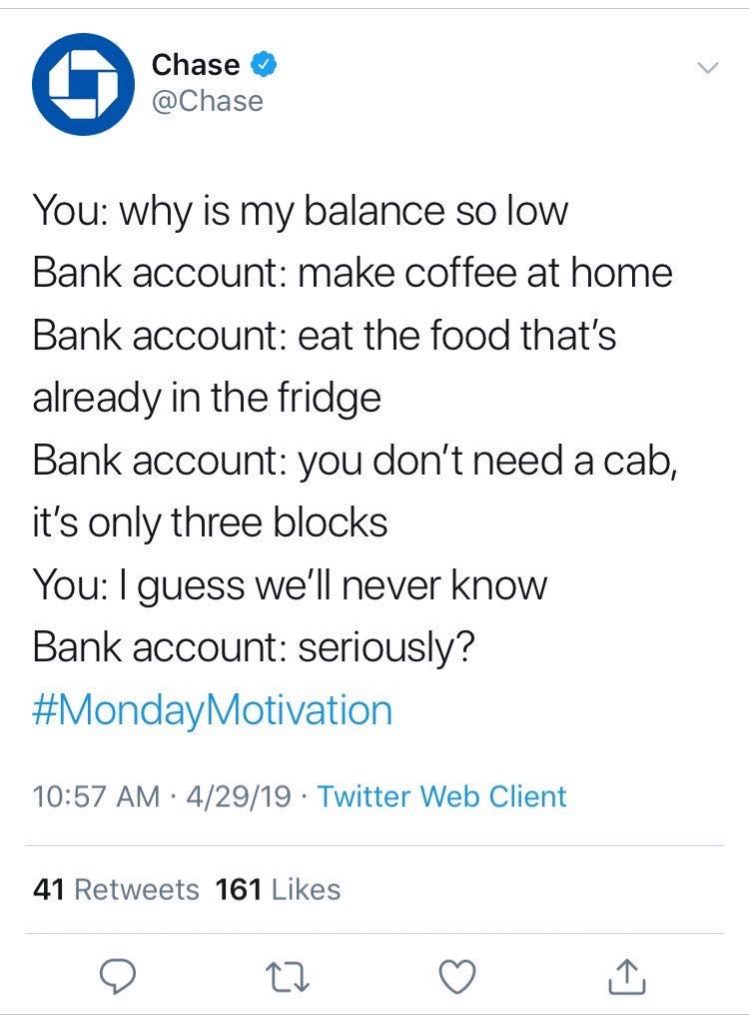

For Chase’s #MondayMotivation post last week, the biggest bank in the country tweeted this:

You might be saying, “So… where’s the bad advice, here?”

It’s true that cutting these kinds of financial corners can make a huge difference for the average consumer. After all, the Bureau of Labor Statistics found that the average American household (including single-person households) spends an average of $3,000 per year eating out. If we assume most positively, Chase merely attempted to meet customers where they are, take part in the culture of now, and offer some concrete money-saving “hacks.”

So how did this become such a blunder?

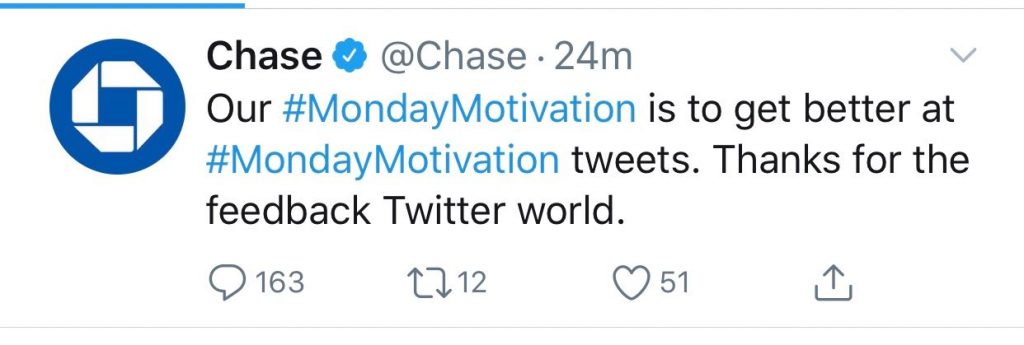

The post was brutally ratioed (meaning it received huge numbers of retweets and comments, and a low number of likes), and it was taken down just a few hours later. Chase followed up with the following almost-apology:

Many tweeters responded that they’d just walked a few blocks to close their Chase account, but the biggest chorus came from Twitter users chiming in to remind the bank of its $13 billion settlement for its role in the 2008 mortgage crisis. Also, lest you’ve forgotten, JP Morgan Chase benefitted from $25 billion in Troubled Asset Relief Program (TARP) funds. Yes, those are billions with a B.

If you’re a little hazy on the details, this recap from the Washington Post sums it up nicely.

In all fairness, Chase is one of the few banks who fully paid back their part of the $700 billion bailout. Still, it’s hard to swallow “just buckle down” advice from a bank that played a part in one of our nation’s largest financial crises.

Know your medium

Twitter is the last place where people will make positive assumptions.

Out of all the social media platforms, Twitter’s waters might be the most treacherous for a big company to swim in. The platform thrives on outrage (both performative and genuine) and stifles nuance, encouraging a pile-on culture in which the loudest people are “winning.”

Snarky corporate accounts like those of Wendy’s or DiGiorno’s do well because their products are of low consequence. Choosing a takeout pizza or a drive-thru hamburger isn’t exactly a high-stakes decision, and such innocuous companies serving up insults on Twitter offer a nice irony that banks simply can’t partake in. Banking is serious.

Chase’s tweet did nothing to spur a helpful conversation, neither on the platform nor by linking to some other content. The tweet could have just as easily asked its followers to reply with their favorite money-saving “hacks”—anything to spur positive, helpful engagement.

The Transportation Security Administration’s Twitter (@TSA) strikes an excellent balance of information, humor, and interesting content without losing its sense of professionalism—quite an accomplishment, considering that no one enjoys TSA checkpoints and procedures. In addition—and maybe this shows my own nerdiness—the AP Stylebook’s Twitter (@APStylebook) accomplishes this same feat.

Reality check

Hearing a too-big-to-fail bank give a bootstrap lecture to the very taxpayers who funded its own $25 billion bailout is quite…well, rich.

Chase’s tweet wasn’t an attack on poor people. More likely, it was aimed at a demographic of immature spenders who probably could use a little more discipline. However, the tweet snidely implied a false dichotomy in which those with the least power should have to behave more ethically and responsibly than entities with the most power. This is an insulting proposition to clients who clip coupons and work double shifts and still have a hard time making ends meet, because it makes light of their pain.

The thing is, I should want to listen to Chase’s advice. With over $2 trillion in assets, they’re obviously doing something right over there. Chase should be a beacon to people living in financial hardship. The craziest thing about this whole debacle is that Chase *does* boast a rich content library of financial advice. In 2017, Chase launched its sleek, powerful personal finance app, Finn, which is exactly the tool someone who spends too much money on avocado toast could use.

But the tweet promoted exactly none of these assets. By stereotyping a complex demographic, Chase made a stereotype of itself, as a fat-cat bank who just doesn’t get it.

Chase’s tweet gave me the same feeling I get when I read articles about how CEOs manage their jam-packed schedules—if I wanted to know how to manage a busy day, I’d rather talk to a single parent.

Offer value

The biggest problem here is that Chase squandered an opportunity to offer its 365,000 Twitter followers real value.

Instead of saying “Eat what’s already in the fridge,” the account could have linked to recipes that are cheap and easy to make. It could have initiated a month-long campaign that challenged clients to eat out one less time than usual each week, and to put that money in a Chase savings account. Chase could have linked to an article on its website about the difference between “needs” and “wants” when creating a simple budget. The possibilities of what could have been are literally endless.

Many of Chase’s clients (and your clients) live paycheck to paycheck, and they do not see a light at the end of the tunnel. Chase should have made these people feel seen and heard by offering them a little practical help, not a smug, pithy put-down.

Too big to fail, too big to relate

To be clear, I’m not saying that Chase is evil, or that being big is evil—merely that being huge comes with its own set of limitations. Chase’s ubiquity, size, and breadth have made it faceless. Any entity so titanic has difficulty communicating with precision and nuance to its clientele or any demographic within it. It can be difficult to speak to one segment without stepping on the toes of another.

On another level, I think of our proofing processes here at Mabus Agency and wonder how Chase’s tweet made it through so many screenings. I wonder what such a deeply capable institution hoped to score with a surface-level Twitter meme. Perhaps nothing. Perhaps this whole incident was merely a belch issued from an internal system more vast and complex than I can imagine.

For you community banks, though, Chase’s mistake hints at opportunity. You guys are much closer to your clients. Your clients’ needs and preferences are much more uniform and unique than Chase’s.

How can you use that to your advantage to empower your clients with tools and encourage them toward engagement and conversation? Compliance is hard—trust me, I get it—but find a way. When you can’t speak, spotlight customers who have achieved success, and let them speak for you. Enable conversation among your audience, positioning yourself not as the arbiter of knowledge, but as the forum in which clients can help each other.

At Mabus Agency, helping banks help their communities is the passion that drives us. If you’re brainstorming ways to connect with your clients or strategies to better your institution in general, reach out to us through our contact form or give us a call to see how we can help.