Banks typically spend a lot of time looking at what other banks are doing—sometimes to benchmark, sometimes to borrow, and sometimes just to make sure we aren’t missing something obvious. But the best lessons don’t always come from our own industry. Sometimes, we need to look outside banking to see what happens when companies make the right (or wrong) moves.

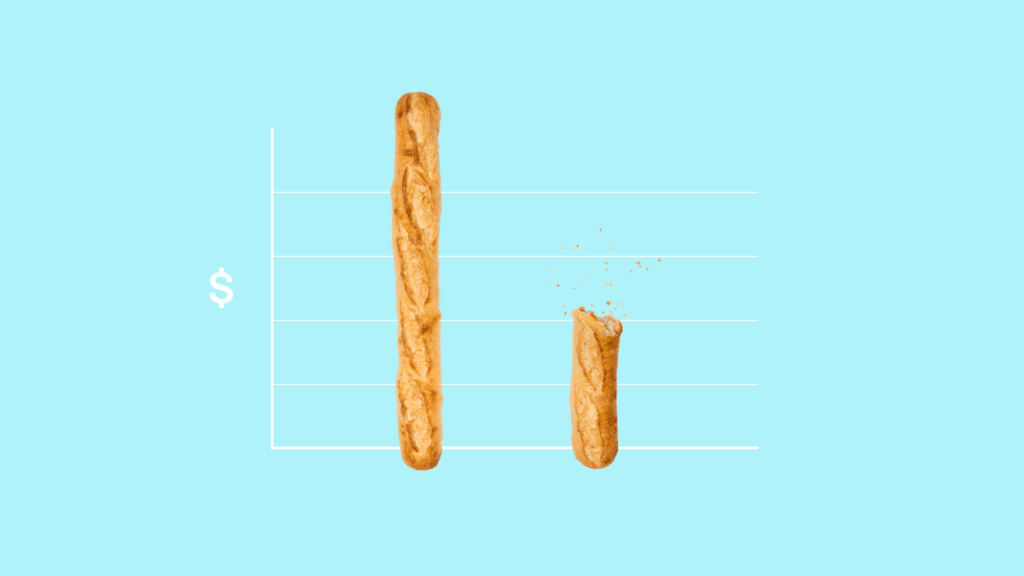

Today, we’re talking about bread. No, not money, but a lesson that might make your bank more profitable.

Let’s look at the difference between Panera Bread and Atlanta Bread Company. Because the way these two companies handled their name and brand—one rising to national dominance and the other fading into obscurity—has everything to do with the way banks approach their own names.

And it’s why having a geographically-based name might be the very thing holding you back.

The Power of a Name

Let’s start at the beginning.

Founded in 1987, St. Louis Bread Company was a local bakery in—you guessed it—St. Louis. In 1993, it was acquired by Au Bon Pain Co., and in 1997, it underwent a full rebrand, emerging with the now-famous name: Panera Bread. The word “Panera” comes from Latin, meaning “breadbasket.” But more importantly, it was unique, abstract, and completely unshackled from geography.

Atlanta Bread Company, founded in 1993, started in Sandy Springs, Georgia. It took the opposite approach. It kept its regional, location-based name and, while it expanded, never gained the same national traction.

Both are bakery-centered fast casual restaurants. Their offerings are so similar, Atlanta Bread Company’s Wikipedia has this disclaimer: Despite the similar name and type of outlets, Atlanta Bread carries no relation to the American bakery-café chain Panera Bread.

Why? I think a major reason is the name “Atlanta Bread” immediately limits its audience. Potential franchisees in Oregon or New York sees that name and thinks, That’s not for me. That’s for Atlanta. And it’s even more Impactful for customers considering the brand—what does Atlanta know about bread anyway? If the name had some built-in benefit—if it were San Francisco Sourdough or New York Bagel Co.—that might be different. But Atlanta? Not exactly a city known for its bread-making legacy.

Today, Panera has over 2,000 locations across all 48 lower states and Canada. Atlanta Bread? It peaked at 170 locations. Now, it’s barely a blip, struggling to keep its last 10 locations open. This is a stark contrast that underscores the power of a name in shaping long-term success, though missteps in operations and franchising certainly played a role

That’s the danger of tying your name to geography. Not only does it limit your market; it doesn’t automatically communicate value.

Consumers don’t just see a location-based name as a descriptor—they interpret it. A geographic name doesn’t always feel welcoming. If I see “First National Bank of Smith County,” how can that be my bank if I’m not in Smith County? What if my business competes with businesses in Smith County? What if Smith County is home to my high school’s biggest rival? You might think these are small considerations, but they’re not. People are wired to seek belonging. A name that signals “for us” to some signals “not for you” to everyone else.

How Many Banks Are Clinging to Geographic Names? (Too Many.)

Banking has a branding problem. Or, more specifically, a naming problem.

Right now, 1,877 banks—41.84% of all banks—have names tied to a specific city, state, or region.

Think about that. Nearly half of all banks are telling customers, in some form, We belong here—and only here.

It’s like putting an invisible fence around your brand. You might not see it, but customers do.

The Problem with Location-Based Bank Names

Here’s the issue with a name tied to geography:

1. It Limits Your Growth

Panera knew that to expand beyond Missouri, it couldn’t be tied to St. Louis. Meanwhile, Atlanta Bread Company kept its location front and center—and it didn’t scale.

If your bank’s name is tied to a specific town or region, you’re telling the world, This is where we belong. This is our boundary. You might as well put up a “Local Only” sign.

2. It’s Forgettable

There’s nothing inherently wrong with a name tied to your community. But when nearly half of banks are doing the same thing, it means no one stands out.

Panera? Distinct.

Atlanta Bread? Generic.

Your bank’s name should be something people remember—not something that blends into a sea of sameness.

There’s another problem: A location-based name tells people where you are, but it doesn’t tell them why they should bank with you. Consumers don’t pick banks based on zip codes—they pick based on trust, convenience, service, and innovation. If your name doesn’t communicate any of those things, what exactly is it doing for you?

3. It’s Harder to Market

Bank marketers already have a tough job. You’re competing for attention in a digital world where no one wakes up excited to engage with a bank ad.

A generic, geographic name makes it even harder. How do you differentiate yourself from the hundreds of other banks with similar names? How do you make a name like “Springfield Bank & Trust” or “Northern State Bank” stand out?

Short answer: You can’t.

What Should Banks Do?

If this is hitting home, good. That means you’ve got an opportunity.

Here’s what you should be thinking about:

1. Consider a Name Change

Yes, it’s a big step. No, it’s not impossible. If Panera could do it, so can you.

The best bank names today are abstract, evocative, and free from location-based constraints. They give banks the flexibility to expand, stand out in the marketplace, and build a unique brand identity.

2. If You Can’t Change the Name, Own the Brand

If changing your name isn’t in the cards, then own your brand identity in a way that differentiates you from all the other geographically-based banks.

- De-emphasize the geographic name in marketing materials and emphasize a unique value proposition.

- Use brand storytelling to create an identity beyond the name.

- Lean into design and messaging to make your bank stand out visually and verbally.

3. Stop Being Afraid of Change

Banks are notorious for resisting change. But look at the industries around you. The companies that adapt and evolve thrive. The ones that cling to the past fade away.

Atlanta Bread didn’t adapt. Panera did.

If your bank keeps clinging to an outdated name, you might be setting yourself up to be the Atlanta Bread of banking.

Final Thought: The Cost of Inaction

It’s easy to justify staying the same. Change is uncomfortable. It requires effort. It requires buy-in from executives who may not immediately see the need.

But ask yourself this: What happens if you don’t make a change?

You stay generic.

You stay forgettable.

You stay limited.

Your bank’s name is the first impression you give to the world. Does it welcome people in, or does it tell them they don’t belong? Because the wrong name isn’t just a name—it’s a missed opportunity.

And one day, when a bigger, bolder, more memorable bank moves into your market, you won’t be able to stop them.

Because they’ll be Panera.

And you’ll still be Atlanta Bread.

Time to Rethink Your Bank’s Name?

If you’re ready to break out of the mold and create a bank brand that actually stands out, let’s talk. Because the best time to change was yesterday. The second-best time? Right now.

It’s not the size of the data…

If you’re trying to catch a lot of fish, which is better: one fishing line or a net?

When there’s a missing person, does one person go out looking for them? No. It’s a group, often arm-in-arm, covering every square inch of the search area.

Archaeologists looking for lost antiquities cover large swaths of land using a grid so they can dig methodically.

But marketing? That’s laser-focused. No shotguns here! Only finely tuned rifles, loaded with the best data out there.

Right?

That’s certainly what we’ve convinced ourselves we need.

Overtargeting and Overmissing

Let’s look at a simple scenario. Your bank needs to add new checking accounts. You hope to add clients with high deposit amounts. So, which is better:

- A. Buy 100 highly targeted leads for $75 each?

- B. Buy 10,000 less-targeted leads for 7.5 cents each?

Scenario A is not outlandish. The premium rate-searching sites are charging this much per lead—not per conversion. You get a chance to market to a prospect alongside all the other banks that paid $75 for the same lead. Scenario B is a typical cost for a well-qualified list purchase.

Even so, this is a simple example. It doesn’t take advertising costs into account. While acquisition costs are the same, it will cost 10x more to market to the larger list.

But bear with me. We’ll get back to this.

The base problem with the scenario above is twofold: yield and scale.

A hundred highly qualified prospects will still be the victim of statistics. You might not waste much money, but you won’t get much yield, even if your campaign performs well beyond any reasonable expectation.

Over-targeting can lead to over-missing.

Pinpoint targeting means that if you miss, you’ll miss big.

Scaling factors such as postage on premium leads can eat your lunch. You must plan on a yield to balance out the investment. It’s not just about saving money. It’s about producing results.

Sometimes, it’s beneficial to back up. A friend of mine was recently running for a local political office. He found himself in a runoff. A consultant priced out a direct-mail campaign to the most important neighborhoods. It was expensive. My friend called me for my opinion. We quickly looked at the USPS website’s Every Door Direct Mail (EDDM) map. EDDM lets you buy a full mail route at a much lower postage cost and no list cost. There is no personalization, but you can blanket a large area. My friend purchased three carrier routes and sent nearly ten times the number of mail pieces needed to reach every home in these neighborhoods for a quarter of the cost (printing and postage included). He won the primary runoff.

I want to reinforce a key point: not only did he buy ten times the houses for one-fourth of the price; all of the houses in the targeted list were included in the carrier routes. He could’ve overpaid to reach those houses. By backing up, he reached his targeted list and their neighbors—and likely picked up more votes in the process.

My friend might have killed a cockroach using a hand grenade, but it was more cost-effective – and just plain effective.

The Best of Both

Neither approach is fully correct, though.

As we mentioned, costing comes into play in both mailing scenarios. More pieces can cost more money. This is why you should layer your approach, especially in the testing phase. You might send a more upscale (expensive) piece to the more targeted list while sending something more generic (cheaper) to the less-targeted list. As you find success in one area or the other, you can always scale up toward that method. Conventional contemporary wisdom leads us to lean into targeting (sometimes a little too much). Don’t be afraid to back up and look at a wider universe. This will ensure you’re not putting your eggs into the wrong basket—or at least too many of them.

Data Data Everywhere…

For many, big data projects proved to be big problems, but it opened minds to a new universe. Bankers were led to believe there was a data point for everything—accessible for just one high-high fee.

We knew what was possible. We heard stories of tools that promised to easily find the needle in the haystack. To this, we added our hopes and dreams.

But a strange translation happened. Both because of our own leanings and promises of vendors, we began to think “if we can’t use our own data, let’s just see what we can buy—the same data must exist out there somewhere.”

Surely, we can analyze our data and predict when someone’s about to leave our bank.

If that’s true, we should be able to determine when someone is leaving another bank.

I bet we can buy a list of people looking for mortgages right now!

Most of us have to fight for every marketing dollar we’re entrusted with. We’re looking for budget efficiency wherever possible. We want to avoid the situation articulated in John Wanamaker’s famous quote: “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.”

The lure of a magical process that can ensure we’re making the most of every dollar is irresistible.

Digital Snake Oil

Marketers weren’t just assuming this data was available. We were actively being misled.

A few years ago, I interviewed Cassie Giovanni on the Marketing Money Podcast. When we spoke, Cassie was Head of Marketing for Savings Institute Bank & Trust Company in Connecticut. She’d just ended a contract with a service that claimed to provide an artificial intelligence engine powered by machine learning that would deliver ads to very specific potential clients. It promised to dynamically design ads individually targeted to a person’s financial needs. After a look behind the curtain, Cassie determined this system was powered by hopes and dreams, but nothing was actually happening.

You can listen to the podcast here.

This is an egregious example of a bad actor misleading a client. But we fall for these bad actors all the time. We want to avoid waste, and our well-meaning attempts to do so can unwittingly undermine our potential success.

Echoes of Efficiency

Not all data promises were lies, but many marketers were led astray. It boggles the mind to speculate how many marketing dollars were wasted between 2012 and 2019 chasing unicorns.

Why do brand advertising when my cable outlet promises 1:1 data on folks looking to switch bank accounts?

Why build name-i.d. and awareness when we can buy a list of high-net worth individuals looking to buy CDs?

Instead of playing to win, banks played to avoid losing. We were promised easy-to-justify campaigns. It all sounded too good to be true, and it was.

As in all things, it’s best to find a balance—which we’ll cover in the third and final chapter.

The bigger they are…

Eight-ish years ago, you couldn’t attend a banking conference without being bombarded with talks about big data. It’s a natural fit. Banks store an incredible amount of data—transactional and personal. But to use these huge data stores, one needs appropriate hardware and software to process all the bits and bytes.

The term had been around for years, but technological advancements in 2012 brought data processing to the forefront. Ever-more powerful computers made it possible to turn mountains of information into actionable data—allowing us to learn more and more about our bank’s clients, build “lookalike” audiences, determine trends and more.

Big Data. Bigger Barriers.

Much like other specialties, machinery does not equal expertise. You can go buy a race car, but unless you’re a great driver, you won’t win any races. Third-party vendors dangled carrots for years, promising results. Certainly, some banks were able to wrap their arms around their data and use it to nurture relationships, but most big-data projects died under their own weight. Finding the right mix of knowledge, ability, and effort to yield results was insurmountable for most.

The lure of big data is understandable. There are incredibly compelling reasons to tap your own data pool. You can determine everyone who holds a DDA at your bank who also holds a mortgage with another bank. You could cross-reference that data with the individual’s home purchase price and back into their interest rate. From there, you could gate the information to automate a campaign to send emails, direct mail, texts, and more to those who might benefit from a refi at your bank.

But the barriers are huge. Who’s going to create the data streams? Who’s going to map and cross-reference them? Who creates the campaign strategy and creative? Who measures the results?

This is why most projects were shelved. They were just too much to undertake.

Start Small and Grow

Once you ask yourself “can we?;” I recommend asking, “should we?” Too many marketers (especially vendors) approach data projects as all-or-nothing endeavors. We can use all the data, so why don’t we?

Because the project will be too big. I promise.

But it seems like we can’t help ourselves. We implement a CRM and we just have to add the scheduling module for our bankers. We set up email and we try to connect every data point and set up every automation possibility.

Here’s our rule of thumb: do it manually until it shows enough success that you must automate it. Begin with the most profitable endeavors and start incrementally. If you don’t have an onboarding program, start with a welcome email. Don’t stymie yourself trying to build a survey and automated flow. Digital processes are living and breathing. You can always go back and add to the process later. It’s much better to welcome a client today than to send them a 42-part email campaign 10 years from now.

Find easy wins. Contact those who have a mortgage with your bank, but no checking account (and vice versa). Renasant Bank had tremendous response with a simple campaign to those who had regular checking accounts, but no savings. You can read about it here. Once you do these campaigns once, they’re much easier to automate in the future.

Start with baby steps and I’ll see you out along the road.

When someone buys a brand-new car, what do they say?

“Well, mine was getting up in miles. The trade-in value was dropping, and I really wanted something with better gas mileage.”

This is the rationale.

“I wanted something with more safety features.”

“I needed more reliability.”

“Have you seen the trade-in deals lately? They almost paid me to get a new car.”

These are the logical facts we share so we don’t look like an insane person for committing funds to a quickly-depreciating asset.

So what was the reason?

If we’re honest with ourselves, here’s how we’d really answer: “I saw an ad on Facebook during my pre-bed-time doomscrolling. The ad made me feel better than all the disquiet I’ve been feeling, so I clicked through. Building out a car online, to my exact specs, made me feel even better. If a virtual shopping experience feels this good, I imagine a test drive will make me feel ecstatic!”

Once, I asked an “expert” used-car salesman why all used-car ads relied on insane gimmicks with a pitchman yelling at the camera. Almost all consumers say they hate this style of advertising, yet it keeps going, and people keep buying cars.

His response: “You have to realize that for about 72 hours around the purchase of a car, the buyer could be considered legally insane. They’re making completely emotional decisions. These ads play into this emotion. And they work.”

Emotional buying isn’t limited to cars or even large purchases.

Do you really think you buy M&Ms because they “melt in your mouth, not in your hand?” No. You’re probably not even hungry when you buy them. They’re not healthy. They won’t sustain you very long. There are few logical reasons to buy junk food. You could buy a whole bag of salad for the price of a small amount of M&Ms. We don’t buy junk food for any rational reason. We buy M&Ms because they make us feel better, even in a small way.

People make decisions based on emotion, and they backfill with logic.

My mentor, Duane Birch, repeated this axiom to me almost every day we worked together. He never told me who told him first—or if he picked it up in his multi-decade national brand experience. From Yugo to Yoo-Hoo, consumers proved to lean toward what they want before they make certain it’s what they need. This Harvard professor agrees.

Ok. ok. But what about banking?

As a general rule of thumb, bank advertising relies on rationale—the secondary side of decision making. This is based on features, logic, and math. Banks (generally) don’t seem to realize people make decisions on excitement—impulse—how the brand makes them feel (if the brand is good).

Perhaps banks drank the wrong Kool-Aid and believed potential customers couldn’t be excited about banks. Maybe they forgot banks, almost literally, perform magic—transferring funds from your strong brick building to a trendy retailer to complete a purchase—almost at the speed of light.

Either we forgot how magical—how helpful—banking is. Or, at the very least, took it for granted and forgot to tell people.

Banking is emotional.

Most customers who switch banks do so for two reasons: poor service or a mistake (which likely wasn’t handled well). The customer is angry—they feel mistreated or unimportant. They feel emotional. And they want to find another bank that will not do this to them. They want a bank that will not make them feel this way.

First, you must realize you’re not creating ads trying to convince satisfied people to leave their bank. As we covered in a past blog, only 2% of people are either Dissatisfied or Very Dissatisfied with their primary bank. You have a small potential audience who is ready to leave at any time. You must be ready with advertising messages created to speak to those looking to leave their current bank.

Second, you must build your message around a beneficial brand. To do so, you need to deeply understand the difference between benefits and features (and those features trying to be benefits). We cover that here.

Third, you must combine these into a consistent, benefit-based brand message. This is much easier said than done, but if it was easy to do, everyone would be doing it. Your advantage? Out of 5,000 banks, almost no one is doing this well.

How does that make you feel?

A paradox is an unanswerable question. One famous example is: “What happens when an unstoppable force meets an immovable object?” This question dates back to ancient China and is credited with creating the word “contradiction” in the Chinese language. The adjectives do the heavy lifting here. If something is truly unstoppable, an immovable object can’t stop it, and the force can’t move it.

So, what gives? Nothing. Except maybe our minds—which tend to explode over problems like this.

Banking also has a conundrum.

As part of its Unconventional Convention, the American Bankers Association unveiled a research report by Morning Consult that outlined customer sentiment in banking. This study showed a statistically overwhelming positive sentiment for community banks.

89% of those surveyed indicated they were satisfied or very satisfied with their primary bank.

96% said their primary bank’s customer service could be characterized as good, very good, or excellent.

That’s a helluva good job! These are awesome stats, and we celebrate with you. The survey goes on to outline even more positivity, specifically around banks’ response COVID-19.

But as we look forward to a day beyond the pandemic, where we fall back into our norms of loans and deposits, this survey provides a bit more information.

Unstoppable Goals. Immovable Customers.

When you look at the data one way, it shows your customers are likely satisfied (or better). This is good news for you. And bad news for every other bank.

But what happens when you’re the other bank? Most banks are flush with deposits due to PPP funds being held, but those dollars will flow out eventually. The world will return to normal (new or not), and we’ll face our old goals.

We learn from the same survey that only 1% of bank clients are very dissatisfied with their primary bank. Another 1% are simply dissatisfied. Generally speaking, customers have to be on the more extreme side of this scale to leave.

New deposits? New loans? Those come from new customers—and we’re faced with asking someone to leave their primary bank where only two out of every hundred customers are looking to leave their bank at any given time.

This is the paradox. Your bank must continue to grow. But customers aren’t looking to leave.

Loosing the Gordian Knot

Some paradoxes do have answers, but you generally have to cheat—or at least think laterally— to find a solution. Another well-known paradox is the Gordian Knot. If you want the full story, I recommend the Wikipedia entry.

The short version is thus: Alexander the Great was confronted with a prophecy: an oxcart was hitched to a post with the Gordian Knot—one so complex it could not be untied. It was foretold that whoever unraveled this knot and unhitched the cart would be the ruler of all of Asia (then defined as basically the Middle-East).

Although Alexander was great, he first approached the problem as most of us would: when confronted with a knot, one tries to untie it. The problem was the knot was so tangled and intricate that it was truly impossible to untie. We do it all the time. We confront a problem based on preconceived notions. This is the underlying reason why almost all magic shows are entertaining, and most jokes are funny. The payoffs of both subvert our expectations to humorous or astonishing effect.

There’s another saying: “when you’re a hammer, the world is a nail.” We try to find solutions with the criteria at hand.

There are two versions of Alexander’s solution.

The more straightforward version rumors he cut the rope. Another version (for all the purists) says Alexander pulled the lynchpin of the wagon’s yoke, pulled it through the knot (thus unraveling it), rehitched the yoke, and dusted his hands in satisfaction.

It turns out even paradoxes are paradoxes. What is supposed to be unanswerable can be answered. This is even true of unstoppable forces and immovable objects.

Stopping the Unstoppable

You might say, “But Alexander found a loophole and exploited it!” To that, I say, “yes!” Solutions to complex issues can be found more in looking for answers than the problem itself. What didn’t the rules say?

The place to start on our banking quandary is to stop—stop the 1-2% from leaving your bank.

When researching for this article, a startling trend became apparent: folks aren’t thinking about retention. There is a dearth of research on what makes customers leave. There is plenty of data on what they say when they leave, how likely they are to say it, how to re-attract them, the costs associated with customer loss, BUT very little available research on WHY.

The clearest assertation comes from Michael Leboeuf’s book, How to Win Customers and Keep Them for Life (2000). Laboef breaks it down as follows:

- 1% die

- 3% move away

- 68% quit because of an attitude of indifference towards the customer by the staff

- 14 % are dissatisfied with the product.

- 9% leave because of competitive reasons.

Unless you have a warlock on staff, we can skip addressing “death.” If these general business numbers hold true for banking, the first answer is simple: train your people well. I’m sure when you agree in assuming it’s likely that dissatisfaction in community banking leans more toward product and competitive reasons.

“We have all the products of a big bank” is a truth, but many of those megabanks outpace the off-the-shelf options given to us by our limited vendors. While there is little you can do about this, you must be willing to push vendors and upgrade when possible. The world waits for no bank.

“Competitive reasons” for banks can probably be expressed as a word: rates. You won’t win every deal. You don’t have to be told this, and there’s not much you can do here. You can determine exactly what’s going on in your bank by performing your own satisfaction survey. It’s a great way to reconnect with clients, hear their needs, and rekindle communication.

We’re only talking about protecting 1-2% who aren’t satisfied, though. Once we have the trickle plugged, it’s time to move onto the more daunting task.

Moving the Immovable

The answer to the first paradox is astoundingly (and perhaps frustratingly simple). What happens when an unstoppable force meets an immovable object? The force goes around the object. The framework of the problem urges you to solve the problem directly, but more often than not, it’s simpler to sidestep the issue with lateral thinking.

Banks ensnare themselves in this trap almost every time they sit down to create an ad. Look at the field of banking ads. Yes. They’re all the same. And almost all fail to live up to their potential for one key reason: they’re made to convince someone (anyone) your bank is good.

They’re written, designed, filmed, and published to simply inform about your bank. This happens under the guise of “branding.” We have to inform people about our brand!

Sure.

But now it’s time to upgrade those efforts.

It’s time to consider the 1%.

Before we go any further, let’s back up and look at the numbers. 89% of bank customers are satisfied or very satisfied. Yes, an overwhelming majority, but stop for a second and consider how you’d react if one of every ten customers who interacted with your bank was not satisfied or very satisfied?

One more aside. It’s easy to get too focused on the paradox and say, “Well, if I lose 1% and my competitor loses 1%, we’re just trading customers.” Keep in mind you might have to guard your 1% against ten competitors, but you have the opportunity to grab 1% from each of those ten competitors.

So how do you upgrade your bank ads to win this battle? You create ads for the 1% actually in play—those looking for a new bank. Stop making generic ads stating the obvious to everyone in your town. Think about the person who’s making the drastic decision to leave his/her bank. Would you speak differently to a person you knew was about to make a banking change than one who didn’t give you that information? I hope the answer is “yes.”

While this audience hasn’t raised their collective hands, they’re out there. They’re ready to move. Turn your advertising toward them.

Instead of saying: “We provide really good service!” (like every other bank), say: “Make the move to the banking service you’ve been missing.”

Replace “11 convenient locations” with “Looking for a bank closer to home?” What if they don’t live close to your bank? The message won’t resonate with them. But you know whose bell it will ring? Bingo. Those who live close.

And, yes, target these messages whenever possible. But these are meant as stark examples to confront the innate fear of using a message that might not resonate with everyone in your markets. Would you rather move 100% of your audience 1% or 1% of your audience 100%?

Not convinced? Our methods and philosophies probably don’t resonate with you. It’s ok. You’re part of the immovable 99%. For everyone else, we’ve said enough.

Listen to our bonus discussion with Josh Mabus, Kevin Tate, and Robbie Richardson below.

Community bankers face one of the harshest competitive environments in any industry. At times it can feel we’re adrift on a sea of sameness—in undersized vessels—while gigantic megabanks churn the waters around us.

It’s difficult. We struggle to differentiate ourselves from similarly-sized competitors while contrasting our value against larger banks.

But there’s an alarming trend that I’ve seen emerge from this. Community banks tend to be very insular and cagey against the competition. This is fine—excepting one thing: too many community bankers have never darkened the door of the competition. This leads to making uninformed claims about our own products and service.

We’re the friendliest bank.

Our service is the best.

We’re much more efficient.

But. Do you really know that?

As with anyone thrown on the waves of choppy water, it’s no wonder we cling to what feels safe.

Have you ever opened an account at a competing bank? Have you ever tried their products or services to make an unbiased comparison against yours?

I’m worried that too many of us will say “no.”

Now, this isn’t some kumbaya guide to getting along. Quite the opposite, actually.

You can look at it two ways:

- A vital part of warfare is scouting the enemy.

- How can you ethically compare yourself to the competition if you’ve never experienced what they have to offer?

You can pick either because both are true.

Perhaps you say, “We don’t cast ourselves against the competition. We do our own thing—our best every day.” That is a valid and admirable approach. But, again, it’s insular.

You’re discounting the options from which a potential client must choose. I am not suggesting you advertise “Our bank is better than XYZ Bank.” You don’t have to (and shouldn’t) name the competition. But you can rest assured that clients will consider more than one bank when choosing their primary financial institution. It is your job to understand what your bank does better and make very certain a potential client knows.

I suggest that you can enhance how you serve clients and your community by understanding the offerings present in your bank’s footprint. Otherwise, how do you know what is missing from your bank’s offerings? From your client’s experience? What could you offer that no other bank brings to bear? These could be concrete concepts like products or abstract offerings like service and availability.

Perhaps it’s even simpler.

One day, a bank that serves small businesses will realize that the bank is only open during the entrepreneur’s busiest hours. That bank will shift its hours to 10am – 7pm to be available for that client base and will win business.

We tend to internalize that the grass is always browner on the competitor’s side. This is born from a sort of group egocentrism that “we” (wherever “we” might be) is best. Do you remember early in elementary school when you found out that the United States wasn’t the biggest country? Nor the most populous? There was no reason to have this belief. No one had told us that the US was larger.

We do not need to fall into a similar trap with our banks.

What if you find out the competition is actually super friendly? Or incredibly organized and efficient in processing loans? It probably makes you a bit sick at your stomach to consider that the competition is better in an area or two. Perhaps you find out that you kick THEIR tail.

Regardless, if you haven’t shopped the competition, you don’t know. And that’s dangerous.

I believe in this so much, I took $1,000 of my own money and handed it to Mabus Agency copywriter Riley Manning when he was relatively new to bank marketing. I told him to open 10 bank accounts at 10 banks. It was one of the best training exercises for Riley as he learned about banking. But it was also eye-opening as we engaged with several types of banks. We were constantly surprised about which one was really good (or really bad) in certain aspects of banking.

As you prepare to shop the banks with which you compete, I suggest you watch and listen to Riley as he recounts his adventures—and dig deeper into our special blogs that capture, in detail, what he discovered.

Learn from Riley’s direct experience, but also use our rubric in your approach and valuation of the competition. It’s worth the effort. And your grass will be greener because of it.

Where have all the cowboys gone? In her 1997 hit, Paula Cole laments the decline in down-to-earth, working-class, relatable romantic options.

Today we look at the loss of a cowboy in banking. Fintech startup Simple has been sent off along the old dusty trail by acquirer BBVA. As the sun sets on this tech-based maverick, we find some lessons for your human-centric community bank.

Simple was founded in 2009 and became one of the first fully-digital banking challengers to achieve any real traction, paving the way for the current generation of fintechs and neobanks.

Simple was conceived to simplify banking. In their words (from their site), Simple was the response to these questions:

- Why is banking so complicated?

- Can a bank exist to help people, not confuse them?

- What if banks didn’t charge so many ridiculous fees?

- What if your bank taught you to feel confident with money?

In 2014, BBVA purchased Simple to “accelerates its digital banking expansion,” according to a press release announcing the acquisition. The $117 million acquisition brought 100,000 customers. BBVA allowed Simple to function almost autonomously, until now.

From the bank-peer peanut gallery, there were cheers, and there were jeers. Simple’s original customer base cried foul.

The commentary fell into two categories:

- I told you so! One group will have you believe they predicted this. They say the world never needed a Simple anyway—that any success it enjoyed was a fluke. In their eyes, Simple amounted to nothing more than a trendy, gimmicky, millennially frivolous competitor.

- This is why we can’t have anything nice! Another group attributed Simple’s death to corporate greed crying, “the big guys will always crush the little guys. Customers will never get what they want!” BBVAs sunsetting of Simple was another example of classical corporate neglect of the client’s needs and experience.

I’d suggest the narrative isn’t so simple as big vs. small, the establishment vs. innovation, or the past vs. the future. This is not a conversation strictly between megabanks and fintechs. Nor does this event score points for the “See? No one wanted an online-only bank” crowd.

It might seem strange, but community banks have the most to learn here—why they should listen to their customers and why they must remain stalwart in maintaining independence.

First things first

This announcement is likely tied to another acquisition: PNC’s purchasing of BBVA’s US-based assets. If so, Simple’s shutdown is a byproduct of consolidation and the expected skinnying-up that comes with any acquisition—a cost-cutting measure to ensure profitability.

Even without this acquisition, one has to wonder how Simple looked on BBVA’s balance sheet. As of October 2020, more than 35.6 million of BBVA’s 56+ million active customer base were considered “digital customers.” Compared to Simple’s 100,000 customers, it’s pretty easy to build a speculative business case where Simple simply didn’t make sense.

For those who say, “…But Simple brings a better experience!” Well, that’s not the case. As of this writing, the Apple App store rating for Simple’s app is 4.6 stars while BBVA’s is 4.8 stars with 284.8 thousand reviews (more than 17-times Simple’s).

All of that being said, this is big-bank-scale stuff. No community bank I know would scoff at 100,000 customers. And according to the backlash following the announcement, they’re 100,000 loyal customers—not trend-chasing transients as popularly assumed about the digital sect.

It’s not about tech.

Simple grew from zero to 20,000 users between its founding in 2009 and 2012. Between 2012 and 2014, that number skyrocketed fivefold to 100,000 users.

Why?

Simple was pretty. Simple was focused. Simple was simple.

But most of all, Simple was different.

Being different isn’t enough. If they never told anyone—never got any press—it’s hard to believe they would have enjoyed the same growth.

Simple realized their difference and communicated this difference beautifully, clearly, and with an adequate budget.

Simple positioned themselves as the solution to well-known industry woes. These were tropes that clients and banks alike took as status quo and unchangeable.

This isn’t about creating a great app. It’s not even about scale. It’s about providing something your customers can’t get from megabanks.

Community banks have been doing this for years. They just forget to tell people.

Instead of comparing your community bank to a big bank, you must work to define your own metrics of success and reframe the customer’s perception to help them understand why your success is better for them than big bank success.

That’s what Simple did. Now, those who sought out Simple’s experience will be without a bank.

While you might not be a high-tech whiz-bang bank, you must consider Simple’s story as you consider your bank’s future.

You must consider this key question: If YOUR bank didn’t exist, what would my customers be missing?

Where have all the cowboys gone?

“Where have all the community banks gone?” might not cut as poignant a refrain, but remember, the cowboy didn’t go away due to our culture’s lack of love for the archetype.

The story of Simple turns on this question: Do enough people value what’s good over what’s expedient and widely available?

The answer seems to be Yes.

Simple’s core group of customers—those who chose to leave other banks for Simple’s brand promise—are upset that the banking experience they specifically chose is going away.

“But BBVA’s app is better” isn’t stilling their anger.

“But Simple’s founders made a lot of money” isn’t consoling those people.

Simple succeeded because it clearly defined its purpose and why you should choose their experience. They went all-in on it. Simple made it clear what customers were choosing between. Have you done the same for your bank? Or do you believe that people should choose a community bank because they inherently know it’s better? Hint: they don’t.

Defining your bank’s edge

Couching your bank as “independent,” “service-oriented,” and “people-focused” doesn’t cut it. These are what we call Beneficial Features. They seem packed with meaning and sentiment, yet they don’t actually tell your customers anything on their own.

Go back to Simple. Simple, as a word, is a beneficial feature. Would you prefer a process to be difficult or simple? Would you rather hear a complicated explanation to a problem or a simple one? Those are clearly loaded with beneficial leaning. But would you rather have a gourmet meal with complex flavors or a simple hot dog? Would you rather be known as a dynamic thinker or simple-minded?

Most community banks overuse similar buzzwords because they come loaded with meaning but fail to connect that meaning with value. Every individual brings their own deeply personal associations to words like “family,” “community,” “success,” and “stability.” You don’t have to explain these concepts to them.

But you do have to explain how your bank embodies those concepts to provide value to the customer.

One reason you might make a clear, focused value proposition is you fear excluding potential clients who might have different definitions of value. Banks often fear lighting the beacon of their value because they fear it will repel others. Simple was willing to commit to its message, even if it meant passing up people who wanted the opposite, who wanted something complex. They knew some folks might not like what they had to offer. But 100,000 people did.

Additionally, defining success also defines failure. Once you make a promise to the customer, you must fulfill it. Banks fear overcommitting to a promise, but I’d caution that while murky water may obscure accountability, it also obscures direction.

These conversations are hard, and it’s tough to get everyone on the same page. In small banks, we all wear multiple hats. Creating a consistent customer experience is difficult. But you must identify what it looks like when your bank wins—when your team wows the customer. And you must determine how to make this a consistent experience and how to communicate this to potential customers. What are you doing better? How can you do that more?

Simple customers didn’t leave because it got bought by a big bank. They left because BBVA eliminated what they wanted.

Your bank offers something your customers want. What is that thing? What would your customers miss if you were gone?

More pointedly, Why do you not want to be bought?

I’ll tell you: because your customers will miss you when you’re gone. It’s up to community banks to make certain community banks continue to exist.

Your bank is unique because your people and your communities are unique. You put the customer first. That counts for a lot. You just have to tell people how.

Features vs Benefits vs Beneficial Features

The battle of features versus benefits is as old as time—or at least as old as the advertising industry itself.

Features are the lifeless attributes of a product, service, or brand.

Benefits are the value a client should find in your product, service, or brand.

While most of us likely understand the difference and preference toward benefit, we rarely explore why benefits are better.

The core differentiator is around extrapolation—drawing conclusions. Benefits innately capture value. Some features might seem valuable (especially if you have a writer’s confirmation bias), but they require readers/listeners/viewers to apply their own experience.

Big is a feature. While “bigger is better” is a well-known phrase, we don’t all process “big” in the same way. For some, “big” can be overwhelming. For others, “big” is invigorating—a concept that brings options and potential to explore.

By simply saying “big,” you can’t expect a universal result. Therein lies the problem.

Benefits bridge the gap and make the intended connection for your audience.

This becomes into greater contrast in community bank marketing, though. Our features don’t necessarily evoke a natural benefit. We rarely have “big” at our disposal as community bankers. Instead, we must extoll the virtues of being small. We have to connect the dots for potential clients to understand why smaller is more accessible, nimble, and responsive.

There are added dangers. We can lean on words we often feel are naturally positive and beneficial.

Words like community, family, and personal permeate banking text. There’s nothing wrong with these words in and of themselves. But we must understand our perspective on these is not universal.

In the debate of features versus benefits, I call these words “beneficial features.”

They’re words loaded with meaning, but that meaning is not ubiquitous or universal.

We all understand the intent behind a word like “family.” It’s a single word that can communicate a tight-knit group who all act in one another’s interest—a loving group of people.

However, this isn’t the reality in all families. Not everyone experienced an idyllic version of family—for some, it is the opposite.

It can be the same with community. It’s not always a safe and positive environment.

These words, whose truth we hold to be self-evident, often don’t communicate with the volume of meaning and positive we want to confer. At their core, they’re just features—even if their leaning is beneficial.

I’m not just being a semantic devil’s advocate. And I am certainly not saying to avoid positive words because they might be negative to a certain group. You just cannot rely solely on the positive intent of these words without connecting the dots for your audience. You must know these words do not communicate enough on their own. They’re still features (no matter how beneficial or positive). With any feature, you must connect the dots to the benefit for your audience.

When we use phrases like, “We’re a true community bank,” we must follow up with explanation and meaning for much of our audience—regardless of their feeling of the word “community.” We use the phrase universally within the industry, but our audience doesn’t inherently gather the benefit. It’s up to us to connect those dots.

If your bank truly provides a family-like atmosphere or is a true community partner, visitors to the branch or your social channels shouldn’t even have to be told “family” and “community.” They should see these concepts in the photos, comments, and experiences. But you must make certain these visitors understand why family and community are benefits.

We must remember that any feature requires some connecting of the dots. Don’t make your audience work to determine your meaning. Make it clear for them. It’s worth the extra words, and it’s worth the extra time.

Maximize Wins and Minimize Losses with a Healthy Advertising Mix

Your bank needs deposits. Everyone from the top down knows it. After a spirited ALCO meeting, the bank agrees to roll out a high-yield CD to bring in the bucks. You get a special budget to create a 90-day campaign with new creative. You pull off the miracle of launching the campaign in the nick of time.

Across town, a person is opening her newspaper, and your ad catches her eye. She’s looking for a new bank, after all. But…it’s for a CD. She owns a business and is looking for a place to move her operating account—that holds about $500,000 on average. Even though she’s unhappy with her current bank, she breezes right on past your ad because it doesn’t fit her need. You see, she needs a business bank.

What’s this? Your bank is also a commercial bank?

Of course, it is, but you missed the opportunity because the mandate was to advertise the high-yield CD.

Ugh. It’s a bit of a gut punch, right?

It’s a mistake you might’ve made (and now you’re probably trying to think of how many times). The ad was too focused—when the business owner in question could’ve put a big dent in your deposit-raising goal with her operating account.

I don’t have a problem with CD ads. I don’t have a problem with product-based promotions. Each has its place in your marketing plan.

But this scenario reminds me of something I heard an old man relate once: “You can bet your bottom dollar I’ll be at the airport when my ship comes in.”

It’s maddening to be given a great product, executed a campaign, and know you still might’ve missed the proverbial boat.

The scenario outlined above plays out at banks all across the country—multiple times every day.

A person is looking for a mortgage when you’re running an ad for your new checking account.

A student is looking for a new checking account and receives a digital ad for mortgage.

Your audience is simply bigger, broader, and more diverse than most banks’ ad campaigns. There is no way to match the perfect ad with precise timing to the exact needs of a potential client.

Don’t despair, though. There is a solution.

Turning Tears into Tiers

Before we dig into the “how,” you must distance yourself from two core fallacies that hold back banks:

❌ The only way to attract a person to a bank product is to advertise that bank product.

❌ You don’t have enough resources to do what you need to do.

You have the distinctly difficult task of promoting an incredibly complex product mix to an incredibly complex audience. If you approach the project head-on, you’ll wind up going in circles. I’m sure there are resources that claim to match exact need with a perfect ad*, but there’s a more reliable technique.

You have to divide your advertising into three tiers:

1. Brand

2. Transitional

3. Product

Tier One: Brand Advertising

The core of your advertising campaign must be based on your brand. Many times we commit 40% or more of an entire advertising budget to this portion. There are two facets to brand advertising: the message and the medium.

“Branding” as a verb is often misused (unless you’re talking about pressing a hot iron to a cow’s backside). Some purveyors of creativity try to convince an audience that a logo or brand can be so good that it “verbs” an audience in some ways. Make no mistake, though, the Nikes, Cokes, and Amazons of the world would still be stuck at the starting gates if not for an investment in advertising that promoted their brands. Neither would their names echo in the vaunted halls of branding if they didn’t spend BILLIONS backing their position. Sure, they’re great brands, but never forget that they bought the affinity they enjoy.

Brand Messaging

You must commit to advertising that promotes your brand position. If you haven’t arrived at this position, check out this piece or just fast-forward and hire us.

The short version is this: your bank is very similar to 99% of the other 12,000-13,000 financial institutions also marketing to your audience. You must find that 1% and advertise the hell out of it.

Consider this Mabus Agency mantra:

The role of advertising is to facilitate word of mouth in two ways:

1. To get people to talk

2. To tell them what to say

That’s the role of brand messaging. You want to make sure as many people as possible add something like this to their daily conversations: “Hey, have you heard of Strong Bank? Yeah, they’re strong. That’s why I do business with them.”

Brand Media

Once you’ve arrived at your message and committed to sharing it, you have to pick a media mix that fits. While there are no hard and fast rules, we do believe there are media that better lend themselves to certain areas of marketing. For brand, television, billboard, and other broadcast media often carry the biggest brand punch.

No one can choose your bank if they don’t know it exists. You must increase awareness of your brand name, and these agnostic, unfocused media are great tools in your arsenal to spread news of your name. Keep in mind, your brand messaging is only part of the whole. We’ll need to layer in other messaging and tactics.

Tier Two: Transitional Advertising

Being a middle child is tough. One exists as a comparison to older and younger siblings. So is the case with the middle child of our brand-tier approach. You probably can guess that Tier 3 (Product) will be pretty straightforward. Like the youngest sibling, Product is often the baby. And, as we’ve already covered, Brand is the eldest—guiding all our actions.

Transitional Messaging

Transitional is just what the name conveys: the space between the two. But it is definable. Transitional ads outline, with more depth, what type of bank you are.

This could be focused down a line of business:

We’re a commercial bank.

We’re a retail bank.

We’re a mortgage bank.

Perhaps it’s more philosophical:

We’re a community bank.

We’re a bank that crusades for a cause.

We’re a bank that supports our community.

Whatever your bank is, you need to communicate that to your audience early and often.

Transitional ads translate what can be esoteric ideas into more digestible principles for your consumer.

And think of this generally—like the examples above. You can be multiple things in multiple media.

Transitional Media

Again, there are no hard and fast rules, but you can concentrate your Transitional messaging pretty easily. Magazines and specialty publications can be a great forum. If you’re an ag bank, look to your farming publications. Business journals can showcase your position as a business bank. While I’m not a huge fan of radio, there are opportunities (especially in ag territories) to match messaging with medium in powerful ways. Another often overlooked opportunity is events. You can sponsor focused events in agriculture, business, and real estate, or you can level up: make your own. It can be a bit tough to pull off, but there’s no replacement for building relationships. Instead of creating advertising to get someone to walk into your bank, create advertising to draw a farmer or business person to a low-commitment event with a highly valuable speaker. You’ll be thanked for your effort, and likely some of that appreciation will turn into business.

Tier Three: Product Advertising

You probably don’t need a lesson here. We’ve all done plenty of this. It’s the safe route. You’ll never get called on the carpet for promoting product. The only other safe option is putting bankers’ pictures in the paper, but we’re not even going to go there.

Product Messaging

As I said earlier, product advertising has its place. That place is using about 20-30% of your budget to sell a product directly. And when I say “direct,” I mean it.

When you have the properly tiered advertising strategy, you can go in hard on product messaging. You have to be a bit more clever than “Open a damn account now,” but not much. This is where you use your features (such as rate, cashback, etc.), but don’t forget to marry these with your brand benefit.

Product Media

You can advertise product in any almost any media, but you won’t be able to get everything you want in the proper mix. I would guess your biggest fear is how thin your budget is getting by Tier Three. Therefore, you must concentrate where you can.

At the end of the day, your success will likely be quantified in product conversions. To that end, pick media that are extremely conversion-centric. Think digital(ly). Digital display and pay-per-click are areas where you can concentrate strong, straightforward brand messaging. Beyond this, you must have landing pages that match the campaign creative, offer, and messaging. Don’t buy digital ads and drop them on your bank’s homepage. Don’t drop visitors on your standard account signup page. Create unique pages that provide continuity and context from the brand that intrigued the person to click.

Lean Into Your Audience’s Knowledge Understanding

Your audience doesn’t know how a bank works (as we explain here), but they do know what a bank does.

This is especially true of those whose need is the most critical. When a client needs a loan or a new checking account, they know they need a bank. And these are the people you need to attract most.

Think about it. When have you heard someone say, “I need a new checking account”?

It’s more like, “My bank’s app has been wonky for the past six weeks. I need a new bank.”

So which bank will they visit?

One Brand to Rule Them All

You must take a second, close your eyes (if you’re listening to the blogcast), and imagine with me: each of these items must be congruent in messaging, tone, personality, color, photography style—in short, brand. They must look alike. They must sound similar. They must match. Keep in mind, though, I said “congruent.” This means in harmony, but not exact. This is called “Brand-Tier.” Each tier must be ON brand, but you can also use the unique attributes of each medium to great effect.

Hyperfocused, Under-resourced, and Overreacting

All banks have limited resources. There never is enough budget to do everything you want. The result is usually a frantic catch-up game.

We need deposits! Marketing shifts all its focus, time, and money to deposits.

Holy cow! What happened to lending? We need loans! Marketing shifts all its focus, time, and money to loans.

God forbid another bank rolls out a competitive rate. Then you’ll chase them.

To stop, you need a plan, and the Brand-Tier approach is one way to do it.

You don’t have to, and shouldn’t, chase.

Because when you’re chasing, you might not lose, but I can guarantee you won’t win.

Footnote: Remember the lesson, “if it seems too good to be true, it probably is.”)