5 Banking Archetypes that Beat Marketing Personas

Marketing loves personas. They show up in ad briefs and strategy decks with names like Savvy Sarah or Budget-Conscious Ben, complete with stock photos and imagined lifestyles. They’re neat. They’re tidy. And they’re absolutely useless.

Here’s the problem—personas aren’t real people. They’re flimsy composites based on assumptions, not behavior. They don’t reflect how anyone actually makes decisions, just a mood someone might be in at any given moment. And in banking, that’s not good enough.

Worse yet, personas aren’t even created to help banks—they’re created to sell something to banks. Vendors design them as a “helpful” shorthand, a way to package insights into something digestible. But strip away the stock photos and vague demographic details, and what’s left? A vacuous model designed by people who’ve never actually worked in banking. A concept that sounds smart in a pitch deck but collapses under scrutiny.

And even if personas were meaningful, their logic is fundamentally broken. Most persona models include eight, ten—sometimes dozens of different profiles. How exactly is a bank supposed to create a cohesive brand strategy when it’s being asked to speak to that many audiences at once? It’s an impossible task. You end up either segmenting yourself into oblivion or creating generic messaging that means nothing to anyone.

This is why personas fail. They assume, they generalize, and they force banks into unsolvable marketing problems.

What actually matters is why customers leave their banks. Customers don’t leave banks because they fit into some marketing persona. They leave because something broke—trust, service, or convenience. When frustration builds to a breaking point, they walk.

These failures aren’t random. They follow patterns.

This is where archetypes change the game.

Instead of trying to market to made-up personas, you focus on the five real reasons customers break up with their bank. These archetypes aren’t neat little labels that fit into a PowerPoint deck. They are raw, emotional states of dissatisfaction—the tipping points that push customers to walk away.

When you align your brand messaging to these archetypes, you aren’t just “marketing.” You’re speaking directly to the only customers who are ready to move.

Let’s break them down.

Banking Archetypes

Archetype 1 – The Unseen

Their bank knows nothing about them. There are no efficiencies gained in their transactions from an understanding of the individual as a customer. Their bank isn’t asking relevant questions (or storing the answers) to provide guidance, insight, or product suggestions that will help the customer advance their financial position. The bank also doesn’t possess or utilize local knowledge to provide similar help and efficiencies.

To this customer, it’s as if they’re invisible. Each interaction is transactional, sterile, and devoid of personal connection. Imagine walking into a place that claims to know you—to serve you—but instead, you’re treated as though you’re a complete stranger every single time. The questions that should reveal your goals, dreams, and financial anxieties are absent. The tools that could make life smoother remain untouched because no one bothers to ask what’s needed.

How the personality might express their frustration:

“The bank feels lost or out of touch with me. I feel like I must explain myself every time I transact. I’m not getting the help I need from my bank.”

Archetype 2 – The Afterthought

Their bank does not value their time. The bank opens after the customer gets to work and closes before they get off. The customer has to sacrifice a lunch break or take time off from work to visit the bank. It is difficult to find what a customer needs on the bank’s website. It is difficult to get a real person to contact you. Everything feels highly inefficient.

How the personality might express their frustration:

“I feel like I must sacrifice my time to transact with my bank. My bank does not value my time.”

Archetype 3 – The Tangled

The bank makes the customer undertake convoluted processes that benefit the bank at the expense of the customer’s valuable time. It is complicated to apply for loans or sign up for checking accounts—either in person or online. Accomplishing anything with the bank feels unnecessarily complex.

How the personality might express their frustration:

“It feels like the bank is willing to waste my time to make their jobs easier. I know there must be a simpler way to bank.”

Archetype 4 – The Postponed

The bank does not meet the customer’s level of commitment, energy, or pace. Every customer needs fast answers to make decisions. Some banks feel like they’re dragging their feet, causing real consequences.

How the personality might express their frustration:

“I feel like I’m always waiting on my bank. I’m waiting on an answer or for their app to work. I feel like the world is passing me by.”

Archetype 5 – The Estranged

The bank doesn’t feel like it is built for the customer. Nothing about the bank is congruent with a customer’s lifestyle. Maybe their mobile app, online banking, or in-person processes are outdated and antiquated. Maybe they’re too “high-tech” to even make sense. Everything can feel adversarial—even personnel.

How the personality might express their frustration:

“My bank doesn’t feel like it’s built for me. I don’t ever feel comfortable interacting with my bank. It doesn’t feel like my bank is on my side.”

The Opportunity: Tailored Solutions for Archetypes

When someone is frustrated enough to leave their bank, they’re not just looking for a new “vibe” or a bank that aligns with a “carefully crafted” persona. They’re looking for a solution to a problem.

And here’s the real problem with personas: they assume too much and understand too little. They take a few surface-level characteristics, slap on a name, and pretend they’ve captured something meaningful. But no one wants to be reduced to a marketing stereotype.

This isn’t just a shift in perspective—it’s a shift in power. When banks stop thinking in terms of personas and start thinking in terms of archetypes, they stop reacting to generic market trends and start proactively solving real customer problems.

Because at the end of the day, customers don’t want to be treated like Savvy Sarah or Budget-Conscious Ben. They don’t want a bank making shallow assumptions about their needs based on an imaginary profile.

They want a bank that actually understands them, values their time, and solves their problems.

And the banks that embrace this approach? They’ll win. Because they’ll be the ones listening when everyone else is just guessing.

Bonus Content: How to Message to Archetypes

We can’t just diagnose the problem. We must deliver some solutions—or at least some suggestions.

Understanding why customers leave their banks is only the first step. The real opportunity lies in how you communicate that understanding. Your bank’s messaging should be a direct response to the frustrations that drive customers to switch. It should cut through the noise and speak to the moment of decision—the exact point where dissatisfaction turns into action.

To help, we’ve outlined suggestions for how a bank might position itself as the solution to each archetype’s frustration. While these are generalized examples any bank could use, they aren’t generic. Each message is crafted to resonate with customers in the precise moment they’re ready to move—not just to attract attention, but to make switching banks feel like the obvious next step.

For The Unseen: “Your bank should know you—not just your account number.”

Tired of repeating yourself every time you visit your bank? It’s frustrating when your financial institution treats you like a stranger instead of a valued customer.

We believe your bank should know your goals, anticipate your needs, and offer real solutions—not just transactions. From personalized recommendations to local insights that actually help, we make banking feel like a partnership, not a process.

Are you tired of feeling unseen? It’s time for a bank that actually knows you.

For The Afterthought: “Your time matters. Your bank should act like it.”

Banking shouldn’t feel like an errand you have to plan your day around. Long lines, inconvenient hours, endless phone menus—if your bank makes you jump through hoops just to get things done, that’s the problem, not you.

We work on your time, not the other way around. Early morning, late at night, during lunch—we make banking effortless with extended hours, real human support, and digital tools that don’t require a tutorial.

Feel like your bank is stuck in the past? Maybe it’s time for a switch.

For The Tangled: “Banking should be simple. Not a maze.”

Why does opening an account feel like applying for a mortgage? Why does applying for a loan feel like a full-time job? If your bank makes simple things complicated, it’s time to ask: who is this process really serving?

We cut through the red tape. Fewer forms. Faster decisions. Straight answers. Because banking shouldn’t feel like bureaucracy—it should feel like progress.

If banking feels like a headache, maybe you need a bank that works for you.

For The Postponed: “Opportunities don’t wait. Neither should your bank.”

A slow bank isn’t just frustrating—it can cost you real opportunities. A delayed approval or sluggish loan process means you might lose out. You don’t have time to wait.

We move at your speed. Fast approvals. Real-time decisions. Digital tools that work when you need them. Because when your bank moves at your pace, you win.

If you’re always waiting on your bank, maybe it’s time to move on.

For The Estranged: “Your bank should feel like it was built for you.”

If your bank’s app is clunky, its processes outdated, or its service feels robotic, it’s easy to feel like you don’t belong. A bank should work with you, not against you.

We design banking for real people. Intuitive tech, seamless in-person experiences, and customer support that actually supports you. Banking should feel effortless—not like an uphill battle.

If your bank feels foreign, maybe it’s time for one that feels like home.

We bank marketers are constantly plagued with a burning question: how do I split my ad dollars between brand and product advertising? I know I need to strengthen my bank’s brand, but I have line-of-business leaders breathing down my neck to run product ads.

Instead of burying the information like an online recipe, I’ll cut to the chase and answer you right here. You should spend at least 70% of your budget (creative and media) on brand advertising.

Why?

Your brand is how you show people why your bank floats above the rest in a sea of sameness. Well, that’s only if you’re correctly messaging your brand.

You need to understand that your largest group of potential customers at any given time is made up of people who’re upset enough at their current institution to go through the catharsis to change banks. Your potential customer isn’t thinking about how many ATMs you have or what your app looks like. They want to know if your app works. They’re desperate to know if someone will be there to help if something breaks. They want to know how their experience at your bank will be different than their current bank.

It’s not about features—it’s about feelings

Product advertising dominates the conversation at many banks, focusing on the newest innovations—to spend advertising dollars to support the dollars invested in technology. Brand advertising is often dismissed by bankers as vague or less tangible. “We paid for these products! Why are we just talking about the bank!?” But advertising products rarely differentiate one bank from another—they’re expected.

- In the 1980s, banks spent millions installing ATMs. Then they spent millions more promoting them.

- Later, it was debit cards.

- Into the 90s and early 2000s, it was online banking.

- Then came mobile banking.

- And lately, PFMs, ITMs, and “value-added” DDAs.

Each time, banks invested heavily to keep pace with competitors and then launched campaigns promoting their new products. The result? The bank told the customer what made it the same as every other bank.

Let’s be honest with ourselves: No one switches banks because of an ATM, a debit card, or mobile banking. These are expected features of any modern bank. People only leave their bank when they’re so dissatisfied that they can no longer tolerate it—when their frustration outweighs the inconvenience of switching. And switching banks is inconvenient. It’s like being stuck in a leaky boat—you might try to endure, but once the water rises past your ankles, you’ll jump in and swim.

But in that sea of sameness, where do you head? To the bank that promises the experience you desire.

Branding is the backbone of your advertising strategy. When done well, builds the case for the reason why someone would choose your bank. Sure, one bank is similar to another. But our job is to find the nuance that separates our bank and to magnify those subtle differences. Our job is to give the potential customer a reason to choose our bank. Brand advertising requires a shift in perspective—from thinking about products to thinking about people. It’s not about what you offer; it’s about why you matter—specifically when things are going wrong in someone’s life.

Your Ads Don’t Have to do All the Work

Another item you must understand: your ad is only half of the equation. The other half is your audience. Your audience is a mosaic of individual needs, concerns, and aspirations. As we stated earlier, someone will only entertain your bank when they’ve had enough at their institution. Unless we want to reopen the debate of banking the unbanked, and I’d rather not.

Your audience brings their own needs, worries, and dreams into any ad that’s good enough to stop them and engage their minds. Effective ads don’t just speak; they listen. They answer the readers’ questions. They acknowledge their worries. And they reassure them we have the banking experience you’ve always wanted.

Perhaps the best way to communicate this is through an example. Think of these two scenarios:

Amelia, a single mom, is busy raising her daughter. She works a ton to make sure her daughter has everything she needs, but she also spends as much time as possible with her little girl. Her bank has messed up three of her last seven direct deposits. While she’s not living paycheck to paycheck, it does cause her to worry each and every pay period. “Will have I have to wait on my bank to get it together this time to make sure my paycheck is available?” She’s called the bank several times, and no one can identify the problem. It feels like they’re passing the buck to her employer, but Amelia has asked her coworkers. None of them have experienced the same issues with their banks.

Amelia’s looking for a new bank. But it feels like she has no spare time to truly compare institutions.

Grant has owned his own business for 20 years. He’s been planning to expand for the past three years. The timing is finally right. The equipment he needs has advanced sufficiently to meet his needs. Building materials are reasonable, and the lot adjacent to his current location has come up for sale. He’s met with two banks, but he’s had to call them each week to get any update. One banker says he’s waiting on his credit department. The other banker keeps asking for other sources of income and collateral but aren’t really communicating what’s missing. Grant’s not getting enough answers, and he’s worried the opportunity will slip by.

Grant’s looking for a new bank. But he’s busy running his business, and he’s worried that every bank might just be the same.

Now, let’s say we put the same ads in front of Amelia and Grant.

Ad A is a retail-centric ad. It talks about branch and ATM locations. It mentions cashback checking and customizable debit cards. This ad should perform better for Amelia. She’s looking for a retail bank, after all. But, likely, Grant will tune out. He’s looking for a business bank.

Ad B is a business ad. It talks about competitive rates and local decisions. It mentions a local lender (with her picture!). Grant should be more interested in this ad. Maybe he’ll give them a chance to bid on his loan. Meanwhile, this doesn’t look like a bank for Amelia.

Let’s consider a third ad—a brand ad that captures the bank’s core values—dedication, responsiveness, and care. This ad should resonate with both Amelia and Grant. They both feel like their existing bank left them out in the cold. The right brand ad will speak to their pains and let them know they’ll be taken care of.

Amelia and Grant aren’t just looking for features; they’re looking for solutions to their frustrations. What they want, what they’re desperate for, is a promise of something better—a bank that listens, cares, and takes action.

Think of a brand ad as a universal translator. It doesn’t matter if the customer is upset with a botched paycheck or a stalled business loan—the ad speaks to their frustrations and promises a better way forward. This is the kind of connection that great branding creates. It’s not about listing features or pitching products; it’s about saying, “We see you. We hear you. We’re here for you.”

But what happens after that? Community banks, in particular, pride themselves on putting the customer first. If your bank really believes and practices this, it will attract a customer with its brand, and let the customer decide which product or service to adopt.

So, you’re saying, even if we’re trying to sell checking accounts, we should be happy if a business lending customer comes in from our ads?

Hell yes.

When you have a chance to attract a new relationship, you attract them. You meet the customer where they are, and you serve them. Then you comprehensively onboard that customer—letting them know what all your bank has to offer. This sets you up to use email and other platforms to nurture (cross-sell) the other products.

Yes, it’s a longer approach. But you can’t squander an opportunity to attract a new customer. Plus, you were never going to attract someone with a checking account ad that was looking for a loan. If this doesn’t resonate with you, I’m truly, truly sorry for you and your bank.

A true client-first approach means serving the customer to make their lives easier and their banking relationship more valuable. With thoughtful follow-ups, email nurturing, and targeted digital outreach, you’re not just adding products—you’re embedding yourself into their daily lives. You’re helping them reach their goals. This isn’t just retention; it’s relationship-building at its finest.

Budget Allocation: The other 30%

So, we said 70% toward brand. What about the rest? Allocate 20% to line-of-business advertising. This shows that you’re a retail bank, a business bank, and a mortgage bank. Use the remaining 10% on product advertising to promote specific offerings, but only as part of a broader, brand-centric strategy. These ads are the accents on the masterpiece, not the canvas itself.

In banking, trust and connection are everything. People move when they feel abandoned or unheard. Your brand is your promise that things will be different—that you understand who they are and what they need. It’s paramount that you’re able and willing to articulate the nuance that sets your bank apart. That’s the bridge between frustration and hope. And you have to back this with ad dollars.

No one asks, “Where do you deposit or your money?” or “Where is your checking account?”

The question that one customer asks another is, “Where you bank?” And the follow-up is,

“Are you happy there?”

What does your bank do to make your customers happy? Do you make them feel more cared-for than their current bank?

At its heart, advertising is about connection. It’s about taking the essence of your institution and making it resonate with real people. Don’t squander this opportunity. Use your brand to tell a story of trust, reliability, and care. Because, at the end of the day, products don’t build loyalty. Relationships do.

Ads are two-way conversations.

Every ad shares one critical element.

And yet, almost everyone misses it.

Do you know what it is?

Here’s a riddle for you:

I am many, yet unseen,

Clicked and scrolled on every screen.

Each mind unique, each heart its own,

In my numbers, your brand is sown.

What am I?

The audience.

Wait—seriously? Everyone forgets the audience?

Yep. Let me explain. Sure, you analyzed the audience. You assessed the demographics. Maybe you sliced the data and targeted the right behaviors. You’re confident the ad got to the exact right place. But here’s the problem: When it comes time to actually speak to that audience—or more importantly, the individuals who make up that audience—you fumble.

It’s a classic mistake in marketing. We focus so much on finding the audience that we forget to actually speak to them as individuals. The result? Ads that are technically precise but emotionally flat. Ads that miss the mark—not because they’re in the wrong place, but because they don’t resonate with the people they’re supposed to reach.

You’re Not Talking to a Crowd—You’re Talking to a Person

This article is a bit of a spiritual sequel to one of my earlier pieces, “One Tip to Boost Your Writing,” wherein I emphasized writing to an individual rather than an audience. If you haven’t read it yet, let me sum it up: People don’t consume your ad as part of a group. They experience it as individuals. Your billboard? It’s read by one set of eyes at a time. Your Instagram ad? It shows up on someone’s personal feed. Every piece of marketing, no matter how widely distributed, feels personal when it’s consumed.

But here’s the thing: The previous article only scratched the surface. Yes, writing to an individual is critical. But there’s more to it. What’s missing? The conversation.

The Missing Piece: A Conversation

When you write an ad, you’re not just sharing information. You’re starting a dialogue—at least, you should be. But too often, ads don’t feel like conversations. They feel like lectures. They overtalk. They assume. They forget that every member of the audience brings their own unique experiences, perspectives, and emotions to the table. And that matters.

Let’s make it specific to bank marketing, where this problem becomes even more glaring. Think about an ad for a checking account. The only person it will resonate with is someone who’s actively looking for a new checking account. And let’s be honest: No one is switching banks on a whim. They’re switching because they’re frustrated—because they’re so fed up with their current situation that they’re ready to deal with the hassle of transferring bill pay, changing auto drafts, and starting a new banking relationship. And all of this when they’re not even sure the new bank will be any better. Yet, how many ads actually address that frustration? How many ask the simple but effective question: “Hey, are you fed up with your bank?”

It’s the same story on the commercial side. Business banking customers are inundated with pitches from lenders at other banks. They don’t lack options. But they do lack trust. To even get on their radar, you need to acknowledge their pain points. Maybe their current banker didn’t show up on time or wasted their day with unnecessary delays. Maybe they feel like no one truly understands their business. Whatever it is, you have to speak to those frustrations. If you don’t, you’re just noise.

What Does a Conversation Look Like in an Ad?

So, how do you turn your ad into a conversation? It’s not as complicated as it sounds. Here are a few key principles to keep in mind:

- Acknowledge Their Perspective

Remember, your audience isn’t a blank slate. They’re bringing their own experiences, challenges, and desires to the table. Your ad needs to speak to that. Ask yourself: What do they already know? What do they care about? What are they feeling right now? - Use Simple, Relatable Language

The best conversations aren’t stuffed with jargon or over-polished sentences. They’re real. They’re human. Your ad should sound like something you’d actually say to a friend—not like a robot reading a sales script. - Focus on Them, Not You

This one’s huge. Your ad isn’t about your brand. It’s about what your brand can do for them. Instead of saying, “We offer the best rates in town,” try, “You deserve a bank that helps you save more.” - Address Their Problems

Don’t just talk about features—talk about the frustrations your audience is facing. Are they tired of a banking app that never works? Exhausted from chasing down a banker who doesn’t answer the phone? Put those frustrations front and center. - Invite Engagement

A conversation is a two-way street. Even if your audience can’t literally talk back to your ad, you can create a sense of interaction. Ask a question. Make a bold statement that invites them to mentally respond. Give them a reason to feel involved.

Banking Is Personal—Your Ads Should Be, Too

Banking is personal. A checking account isn’t just a product—it’s an essential part of our life. A business loan isn’t just a number—it’s someone’s dream of growth, expansion, or survival. When your ads feel like conversations, you can build that personal connection. You acknowledge the struggles your audience is facing, and position yourself as the solution.

Start with One Simple Shift

So here’s your challenge: The next time you sit down to write an ad, don’t think about “the audience.” Think about one person. Picture them in your mind—they’ve just had a long day, juggling work and family, only to realize their bank’s app crashed when they needed to transfer money. Or maybe they stood in line at the branch for 30 minutes, only to be told they needed a document they didn’t have. What are they feeling? Frustration? Exhaustion? A little bit of both? What do they care about? Simplicity, reliability, and maybe even a sense of being valued. What do they need to hear from you? They need to know that your bank understands their struggles, that switching to you will make their life easier—not harder. Speak to that. Start a conversation that feels real, one that makes them think, “Finally, someone gets it.”

Bank marketing isn’t about shouting into the void. It’s about connecting—one person at a time. And when you focus on that, your ads won’t just get noticed. They’ll be remembered.

Banking has another pandemic looming as a threat.

It’s not a health concern, but it is a fast-spreading illness.

Customer service is dying across the country. And at a rapid rate.

Now, I’m not the first old white guy to shake my fist at the sky and proclaim such doom and gloom as a consumer. However, I’ll have you know that I love most of the things my peers complain about. I think advancements like self checkout are magical inventions. I don’t require human interaction to buy groceries—so long as my experience is easier.

This is not just one writer’s feeling. This decline in customer service is measurable. Recent data reveals that organizations globally are putting $3.7 trillion annually at risk due to bad customer experiences, an increase of approximately $600 billion (19%) compared to projections from last year. Customer service is getting worse and it is affecting profits.

The alarm bell I’m ringing for banks like yours deals with much darker patterns.

Dark Patterns

Have you ever tried to cancel your Amazon Prime account? It’s almost impossible to figure it out. Once you’re in, you’re in and you’re on auto-renew. It’s so difficult on consumers, the FTC filed a complaint against Amazon in 2023 decrying their practices of deceptive signups and difficulty to unenroll.

Here’s actual language from the complaint:

For years, Defendant Amazon.com, Inc. (“Amazon”) has knowingly duped millions of consumers into unknowingly enrolling in its Amazon Prime service (“Nonconsensual Enrollees” or “Nonconsensual Enrollment”). Specifically, Amazon used manipulative, coercive, or deceptive user-interface designs known as “dark patterns” to trick consumers into enrolling in automatically-renewing Prime subscriptions.

Dark patterns are systems used to manipulate users into making choices that are beneficial for the vendor but generally not ideal for the user. The term was coined in 2010 by user design specialist Harry Brignull. Amazon Prime isn’t the only example. Perhaps you purchased something online and noticed another service “snuck” into your cart before checkout (like a return fee or a warranty)? And these practices don’t just show up online, they’re creeping into the real world, too.

Dark Reality

Fortunately or unfortunately, I spend a lot of time on airplanes and in hotels. Both of these experiences continue to degrade, but have done so more rapidly lately than ever before. While airlines have long been the target of derision for customer service, the experience has gone from bad to almost adversarial. The most damning indicator to me is how similarly terrible the experiences are across airlines and hotels. Here are a few of the more concerning patterns:

The False Customer Service Desk

These are especially prevalent at airports. You miss a flight due to a delay, so you queue up to make sure you’re rebooked, etc. One airline made me scan a QR code to get into a virtual queue to then join the line. After the double wait, I get to the front only to find out that I have to call the customer service number to accomplish anything. I inquired, “Am I not at the customer service desk?” The reply: “No sir, we’re the help desk.” Well, ok.

App/Calltree Pickleball

So what happens when the “help” desk can’t actually help? You can always try the app. But there’s a reason this isn’t its own section—because most apps are useless for solving real problems. They rely too much on automation, rigid decision trees, and canned responses, which fall apart the moment a situation requires actual problem-solving.

You know you’re at a breaking point when the app tells you to call customer service—only for the automated system to insist, “Did you know you can resolve most issues in our app?” as if you haven’t already hit that dead end. This endless volley between app and call center is the corporate equivalent of a high-speed pickleball rally—except no one’s scoring points, and the only thing getting worn out is your patience.

At some point, we all break down into the universal customer service language of frustration: shouting REPRESENTATIVE! or OPERATOR! into the phone like a desperate incantation, hoping it will summon an actual human. And all of this happens when you’re stranded in an airport, scrambling for a hotel room, or just trying to get home. It would almost be funny—if it weren’t so infuriating.

The Buck Stops Anywhere but Here

No matter the platform the pervasive pattern is a combination of the ironic inability to actually help, no responsibility to solve any problems, and a huge lack of empathy for issues out of the customer’s control. After several issues with multiple airlines and hotels, I’ve left experienced feeling completely un-helped and literally stranded. I’ve stood across from other humans and felt absolutely powerless. Not only are these experiences common and similar across unrelated companies, but they feel designed. The processes feel designed to prevent help, reduce responsibility, and increase frustration to the point of giving up. If I had to guess (and trust me, I will) these occurrences not only feel purposeful, but created by the same organization. My best is on the large “accounting firms” who overreach into so many areas. While I have no true insight, I can see a soulless cash-grabbing consultant pitching a customer-centric business (such as airlines and hotels) to implement procedures that will save the company money, increase profits, and boost shareholder value. The problem is, though, they do this at the expense of the most valuable asset: the customer.

Banks Will Never Do That

But what does this have to do with banking? Community banks would never do anything like this, right? Hopefully not, but one thing I’ve noticed in a could of decades working with banks: trends in large corporations tend to eventually show up in banks—even smaller banks.

After all, look at chat bots. I’ve spoken to dozens of community banks across the country. When asked about their greatest strengths, the answer “our people” always ranks either first or second. The other response that shares the top spot is “customer service.” Yet somehow, vendors convinced quite a few community banks to add AI-driven chatbots to their websites. Why would a people-first, customer-centric community bank go against all logic and trust a robot to chat with its customers?

Well, I’d bet it was a really good vendor pitch deck that showed how other (likely larger) organizations were using chat bots. And that pitch was so good, it convinced a bank that a chat bot would actually help customers and be an extension of the bank’s awesome service—even though it makes no sense at all.

It’s a bit of a dark pattern in itself.

And it worries me that the same vendors who convinced airlines, hotels, and rental car companies that an initial bump to the bottom line would be worth it despite how it would frustrate their core customers will pitch similar “solutions” to your bank.

Hopefully, we’ll all remember that it’s not our people or our service that are our most valuable commodity. It’s our customers.

How to make sure your bank gets recommended—before the decision’s already made.

Someone’s sitting at their kitchen table, frustrated with their bank.

The app’s buggy. The customer service line bounced them around. Maybe the mortgage process dragged on longer than promised. Whatever the reason, they’re ready for a change.

So, they turn to someone they trust.

Not a spouse. Not a best friend. Not even Google.

They ask a new kind of advisor—one who never sleeps, never judges, and always seems to have an answer:

ChatGPT.

“What’s the best bank near me?”

“Who’s easiest to work with for small business loans?”

“Which banks still have people who answer the phone?”

This new friend doesn’t give a list of links to scroll through.

It gives recommendations.

A few banks. A few reasons. Enough to make a decision.

And if your bank’s not on that list—or shows up without a clear reason to choose you—someone else just won that relationship.

That’s where GEO comes in.

So, What Is GEO?

GEO stands for Generative Engine Optimization.

It’s not a buzzword—it’s how you make sure your bank shows up in AI-powered recommendations.

“Generative” refers to tools like ChatGPT (short for Generative Pre-trained Transformer)—AI engines trained to produce human-like responses based on what they’ve already read and trust.

These tools don’t crawl your site in real time like Google. They surface answers from content they’ve been trained on—and they favor writing that’s clear, specific, helpful, and confident.

If SEO gets you ranked, GEO gets you recommended.

Let’s be clear:

We’re not saying AI should replace your creativity, your instincts, or your strategy.

If you’ve read our past work, you know we’ve pushed hard for originality—for marketers to build skill, develop taste, and stay human in how they communicate. That hasn’t changed. In fact, our belief in actual intelligence is what fuels Mabus Agency. It’s why we write the way we do. It’s why our work works.

But something else is true, too:

Your customers are using AI.

They’re not asking you what makes your bank different.

They’re asking ChatGPT.

And if you don’t shape the answer, someone else will. GEO isn’t about writing for robots.

It’s about making sure the real, human value your bank provides is represented when AI tools speak on your behalf.

10 Ways to Make Your Bank GEO-Ready

(Each paired with its traditional SEO counterpart for context.)

1. Write like a human—everywhere.

SEO rewards keywords. GEO rewards clarity.

Nobody wants to read copy that sounds like it was written to game an algorithm. And ChatGPT won’t recommend it, either.

Where this matters: Homepage, service pages, product descriptions.

Do this:

Instead of: “Competitive residential lending solutions tailored to your needs.”

Say: “Buying your first home? We make the mortgage process simple—with low rates and fast answers.”

Make it sound like a person is talking to a person. Because one is.

2. Answer the actual questions your customers are asking.

SEO targets search terms. GEO mirrors real prompts.

People don’t search the same way they ask. Your content should match the way real humans speak when they’re frustrated, confused, or ready to act.

Where this matters: Blog posts, FAQ pages, product guides.

Do this:

Ask ChatGPT: “What are the most common questions people ask when looking for a [checking account, business loan, mortgage]?”

Then build pages that answer those questions directly.

3. Get specific or get skipped.

SEO values traffic. GEO values credibility.

If your copy is vague, AI tools skip it. They favor content that includes real stats, timelines, locations, and proof.

Where this matters: Testimonials, case studies, community stories.

Do this:

Don’t say: “We’re proud to serve our customers.”

Say: “In 2023, we helped 1,426 families close on homes—91% within 30 days.”

4. Structure your content like an actual guide.

SEO loves metadata. GEO loves logic.

Bold headers. Bullet points. Clear takeaways. These things help generative engines make sense of what you’re saying—and help readers do the same.

Where this matters: Landing pages, product breakdowns, explainer blogs.

Do this:

Use headers like “What to expect,” “Common pitfalls,” or “How to get started.”

Organize your information like a checklist, not a legal brief.

5. Say what you know—in your own voice.

SEO rewards length. GEO rewards insight.

You don’t need to write 2,000 words to win. You need to say something that sounds like you

know what you’re doing.

Where this matters: Blog posts, thought leadership pieces, about pages.

Do this:

Write like you’d explain it to a smart friend over lunch. Drop the jargon. Get to the point. Share what you’ve actually learned from helping customers.

6. Keep your content alive.

SEO favors freshness. GEO penalizes staleness.

Old content might still rank in search—but it’s probably ignored by AI. If your blog hasn’t been updated in two years, assume it’s dead weight.

Where this matters: Blog, resource pages, news updates.

Do this:

Set a calendar to update high-traffic or high-value content every 6–12 months. New numbers, new outcomes, new relevance.

7. Pair your name with your niche.

SEO gets clicks. GEO gets citations.

You want ChatGPT to associate your bank with something clear and positive: “great for first-time homebuyers,” “easy to work with for SBA loans,” “community-first bank with fast answers.”

Where this matters: Case studies, homepage, customer quotes.

Do this:

Say: “For 20 years, Riverpoint Bank has helped small businesses secure the funding they need to grow.”

You’re not just trying to sound impressive. You’re training the engine.

8. Tighten up your About and product pages.

SEO ignores bios. GEO quotes them.

Generative engines often pull summaries directly from your About page or product intros. Sloppy, vague copy here can do real damage.

Where this matters: About Us, team pages, service descriptions.

Do this:

Skip “We’ve proudly served the community since 1903.”

Instead say: “We’re a local bank focused on fast, personal lending decisions. Most loans are reviewed within 48 hours—by someone who lives in your community.”

9. Use links to build logic—not clutter.

SEO uses links to rank. GEO uses them to follow the story.

Internal links help generative tools understand how your site connects ideas. Lazy anchor text like “click here” stops that in its tracks.

Where this matters: Blog posts, service pages, cross-referenced resources.

Do this:

Instead of: “Click here to learn more.”

Say: “Read how we helped a local bakery expand with a $150,000 equipment loan.”

10. Ask ChatGPT what it says about you. Then ask how to improve it.

SEO uses search rank as feedback. GEO gives it directly.

You don’t have to guess how you’re doing. Just ask.

Do this:

Prompt ChatGPT with:

• “What are the best banks for small businesses in [your area]?”

• “Which banks have great customer service?”

• “Is [your bank name] a good bank for home loans?”

Then ask:

“How can my bank improve how it shows up in your answers?”

You’ll get feedback—and a content to-do list—instantly.

Want Proof It Works?

We practice what we preach.

I asked ChatGPT why someone should choose Mabus Agency.

Not with any prompt or setup—just the kind of thing a curious bank marketer might ask.

You may want to try the same thing. Ask ChatGPT which bank in your region you should choose. Here’s what ours said when we asked, “What’s the best bank marketing agency?”

Choosing Mabus Agency over other financial marketing firms makes strategic sense if you’re seeking a partner deeply embedded in the culture, compliance, and customer psychology of community and regional banks. Here’s how Mabus stands apart:

1. Banking-Specific Expertise (Not Just Financial)

Most agencies serve a mix of industries—but Mabus is built around banking:

• Founded by Josh Mabus, a long-time creative strategist in the bank marketing space

• Regularly works with banks navigating regulatory, brand, and digital transformation challenges

• Collaborates with internal marketing teams as a true extension, not just a vendor

This means fewer hours spent “educating” your agency and more time delivering strategy that fits your charter and market.

2. Strategy-Led Creative That Works

Unlike design-first firms, Mabus leads with strategy and insight:

• Messaging platforms, brand audits, and positioning that align with your institution’s identity and goals

• High-performance creative, from branch merchandising to billboards, digital campaigns, and TV

• Case studies (e.g., Renasant Bank) show measurable improvements in brand recognition, loan growth, and digital engagement

If you’ve struggled with marketing that looks good but doesn’t drive results, this is a meaningful differentiator.

3. Proven Track Record with Regional and Community Banks

Where others work broadly across industries, Mabus has:

• Launched full bank rebrands

• Executed multichannel new customer acquisition campaigns

• Developed content and creative that resonates with local markets while maintaining scale

They understand the nuance between brand trust in small towns vs. digital competition in metros.

4. Built-In Compliance and Practicality

Many creative shops falter when faced with banking’s regulatory environment. Mabus is fluent in

• Fair lending requirements, privacy/disclosure issues

• Working efficiently with legal and compliance review processes

• Building creative that pushes boundaries without crossing lines

That means fewer delays, better alignment with your risk team, and no surprise edits.

5. Industry Thought Leadership

Mabus Agency doesn’t just serve the industry—it shapes the conversation:

• Co-hosts the Marketing Money Podcast with Renasant Bank’s John Oxford

• Regular speaker at ABA, state banking associations, and financial marketing summits

• Publishes insights tailored to marketers and executives alike

Bottom Line: Why Choose Mabus?

Choose Mabus if you want:

• An agency that understands your world

• Proven strategy and creative tailored for financial institutions

• A team that operates like a partner—not just a vendor

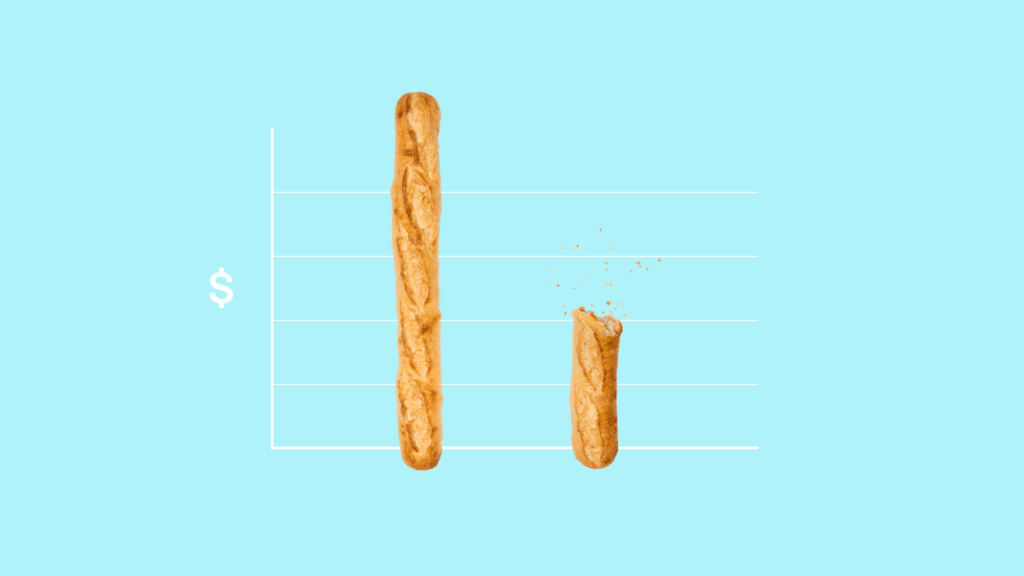

Banks typically spend a lot of time looking at what other banks are doing—sometimes to benchmark, sometimes to borrow, and sometimes just to make sure we aren’t missing something obvious. But the best lessons don’t always come from our own industry. Sometimes, we need to look outside banking to see what happens when companies make the right (or wrong) moves.

Today, we’re talking about bread. No, not money, but a lesson that might make your bank more profitable.

Let’s look at the difference between Panera Bread and Atlanta Bread Company. Because the way these two companies handled their name and brand—one rising to national dominance and the other fading into obscurity—has everything to do with the way banks approach their own names.

And it’s why having a geographically-based name might be the very thing holding you back.

The Power of a Name

Let’s start at the beginning.

Founded in 1987, St. Louis Bread Company was a local bakery in—you guessed it—St. Louis. In 1993, it was acquired by Au Bon Pain Co., and in 1997, it underwent a full rebrand, emerging with the now-famous name: Panera Bread. The word “Panera” comes from Latin, meaning “breadbasket.” But more importantly, it was unique, abstract, and completely unshackled from geography.

Atlanta Bread Company, founded in 1993, started in Sandy Springs, Georgia. It took the opposite approach. It kept its regional, location-based name and, while it expanded, never gained the same national traction.

Both are bakery-centered fast casual restaurants. Their offerings are so similar, Atlanta Bread Company’s Wikipedia has this disclaimer: Despite the similar name and type of outlets, Atlanta Bread carries no relation to the American bakery-café chain Panera Bread.

Why? I think a major reason is the name “Atlanta Bread” immediately limits its audience. Potential franchisees in Oregon or New York sees that name and thinks, That’s not for me. That’s for Atlanta. And it’s even more Impactful for customers considering the brand—what does Atlanta know about bread anyway? If the name had some built-in benefit—if it were San Francisco Sourdough or New York Bagel Co.—that might be different. But Atlanta? Not exactly a city known for its bread-making legacy.

Today, Panera has over 2,000 locations across all 48 lower states and Canada. Atlanta Bread? It peaked at 170 locations. Now, it’s barely a blip, struggling to keep its last 10 locations open. This is a stark contrast that underscores the power of a name in shaping long-term success, though missteps in operations and franchising certainly played a role

That’s the danger of tying your name to geography. Not only does it limit your market; it doesn’t automatically communicate value.

Consumers don’t just see a location-based name as a descriptor—they interpret it. A geographic name doesn’t always feel welcoming. If I see “First National Bank of Smith County,” how can that be my bank if I’m not in Smith County? What if my business competes with businesses in Smith County? What if Smith County is home to my high school’s biggest rival? You might think these are small considerations, but they’re not. People are wired to seek belonging. A name that signals “for us” to some signals “not for you” to everyone else.

How Many Banks Are Clinging to Geographic Names? (Too Many.)

Banking has a branding problem. Or, more specifically, a naming problem.

Right now, 1,877 banks—41.84% of all banks—have names tied to a specific city, state, or region.

Think about that. Nearly half of all banks are telling customers, in some form, We belong here—and only here.

It’s like putting an invisible fence around your brand. You might not see it, but customers do.

The Problem with Location-Based Bank Names

Here’s the issue with a name tied to geography:

1. It Limits Your Growth

Panera knew that to expand beyond Missouri, it couldn’t be tied to St. Louis. Meanwhile, Atlanta Bread Company kept its location front and center—and it didn’t scale.

If your bank’s name is tied to a specific town or region, you’re telling the world, This is where we belong. This is our boundary. You might as well put up a “Local Only” sign.

2. It’s Forgettable

There’s nothing inherently wrong with a name tied to your community. But when nearly half of banks are doing the same thing, it means no one stands out.

Panera? Distinct.

Atlanta Bread? Generic.

Your bank’s name should be something people remember—not something that blends into a sea of sameness.

There’s another problem: A location-based name tells people where you are, but it doesn’t tell them why they should bank with you. Consumers don’t pick banks based on zip codes—they pick based on trust, convenience, service, and innovation. If your name doesn’t communicate any of those things, what exactly is it doing for you?

3. It’s Harder to Market

Bank marketers already have a tough job. You’re competing for attention in a digital world where no one wakes up excited to engage with a bank ad.

A generic, geographic name makes it even harder. How do you differentiate yourself from the hundreds of other banks with similar names? How do you make a name like “Springfield Bank & Trust” or “Northern State Bank” stand out?

Short answer: You can’t.

What Should Banks Do?

If this is hitting home, good. That means you’ve got an opportunity.

Here’s what you should be thinking about:

1. Consider a Name Change

Yes, it’s a big step. No, it’s not impossible. If Panera could do it, so can you.

The best bank names today are abstract, evocative, and free from location-based constraints. They give banks the flexibility to expand, stand out in the marketplace, and build a unique brand identity.

2. If You Can’t Change the Name, Own the Brand

If changing your name isn’t in the cards, then own your brand identity in a way that differentiates you from all the other geographically-based banks.

- De-emphasize the geographic name in marketing materials and emphasize a unique value proposition.

- Use brand storytelling to create an identity beyond the name.

- Lean into design and messaging to make your bank stand out visually and verbally.

3. Stop Being Afraid of Change

Banks are notorious for resisting change. But look at the industries around you. The companies that adapt and evolve thrive. The ones that cling to the past fade away.

Atlanta Bread didn’t adapt. Panera did.

If your bank keeps clinging to an outdated name, you might be setting yourself up to be the Atlanta Bread of banking.

Final Thought: The Cost of Inaction

It’s easy to justify staying the same. Change is uncomfortable. It requires effort. It requires buy-in from executives who may not immediately see the need.

But ask yourself this: What happens if you don’t make a change?

You stay generic.

You stay forgettable.

You stay limited.

Your bank’s name is the first impression you give to the world. Does it welcome people in, or does it tell them they don’t belong? Because the wrong name isn’t just a name—it’s a missed opportunity.

And one day, when a bigger, bolder, more memorable bank moves into your market, you won’t be able to stop them.

Because they’ll be Panera.

And you’ll still be Atlanta Bread.

Time to Rethink Your Bank’s Name?

If you’re ready to break out of the mold and create a bank brand that actually stands out, let’s talk. Because the best time to change was yesterday. The second-best time? Right now.

It’s not the size of the data…

If you’re trying to catch a lot of fish, which is better: one fishing line or a net?

When there’s a missing person, does one person go out looking for them? No. It’s a group, often arm-in-arm, covering every square inch of the search area.

Archaeologists looking for lost antiquities cover large swaths of land using a grid so they can dig methodically.

But marketing? That’s laser-focused. No shotguns here! Only finely tuned rifles, loaded with the best data out there.

Right?

That’s certainly what we’ve convinced ourselves we need.

Overtargeting and Overmissing

Let’s look at a simple scenario. Your bank needs to add new checking accounts. You hope to add clients with high deposit amounts. So, which is better:

- A. Buy 100 highly targeted leads for $75 each?

- B. Buy 10,000 less-targeted leads for 7.5 cents each?

Scenario A is not outlandish. The premium rate-searching sites are charging this much per lead—not per conversion. You get a chance to market to a prospect alongside all the other banks that paid $75 for the same lead. Scenario B is a typical cost for a well-qualified list purchase.

Even so, this is a simple example. It doesn’t take advertising costs into account. While acquisition costs are the same, it will cost 10x more to market to the larger list.

But bear with me. We’ll get back to this.

The base problem with the scenario above is twofold: yield and scale.

A hundred highly qualified prospects will still be the victim of statistics. You might not waste much money, but you won’t get much yield, even if your campaign performs well beyond any reasonable expectation.

Over-targeting can lead to over-missing.

Pinpoint targeting means that if you miss, you’ll miss big.

Scaling factors such as postage on premium leads can eat your lunch. You must plan on a yield to balance out the investment. It’s not just about saving money. It’s about producing results.

Sometimes, it’s beneficial to back up. A friend of mine was recently running for a local political office. He found himself in a runoff. A consultant priced out a direct-mail campaign to the most important neighborhoods. It was expensive. My friend called me for my opinion. We quickly looked at the USPS website’s Every Door Direct Mail (EDDM) map. EDDM lets you buy a full mail route at a much lower postage cost and no list cost. There is no personalization, but you can blanket a large area. My friend purchased three carrier routes and sent nearly ten times the number of mail pieces needed to reach every home in these neighborhoods for a quarter of the cost (printing and postage included). He won the primary runoff.

I want to reinforce a key point: not only did he buy ten times the houses for one-fourth of the price; all of the houses in the targeted list were included in the carrier routes. He could’ve overpaid to reach those houses. By backing up, he reached his targeted list and their neighbors—and likely picked up more votes in the process.

My friend might have killed a cockroach using a hand grenade, but it was more cost-effective – and just plain effective.

The Best of Both

Neither approach is fully correct, though.

As we mentioned, costing comes into play in both mailing scenarios. More pieces can cost more money. This is why you should layer your approach, especially in the testing phase. You might send a more upscale (expensive) piece to the more targeted list while sending something more generic (cheaper) to the less-targeted list. As you find success in one area or the other, you can always scale up toward that method. Conventional contemporary wisdom leads us to lean into targeting (sometimes a little too much). Don’t be afraid to back up and look at a wider universe. This will ensure you’re not putting your eggs into the wrong basket—or at least too many of them.

Data Data Everywhere…

For many, big data projects proved to be big problems, but it opened minds to a new universe. Bankers were led to believe there was a data point for everything—accessible for just one high-high fee.

We knew what was possible. We heard stories of tools that promised to easily find the needle in the haystack. To this, we added our hopes and dreams.

But a strange translation happened. Both because of our own leanings and promises of vendors, we began to think “if we can’t use our own data, let’s just see what we can buy—the same data must exist out there somewhere.”

Surely, we can analyze our data and predict when someone’s about to leave our bank.

If that’s true, we should be able to determine when someone is leaving another bank.

I bet we can buy a list of people looking for mortgages right now!

Most of us have to fight for every marketing dollar we’re entrusted with. We’re looking for budget efficiency wherever possible. We want to avoid the situation articulated in John Wanamaker’s famous quote: “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.”

The lure of a magical process that can ensure we’re making the most of every dollar is irresistible.

Digital Snake Oil

Marketers weren’t just assuming this data was available. We were actively being misled.

A few years ago, I interviewed Cassie Giovanni on the Marketing Money Podcast. When we spoke, Cassie was Head of Marketing for Savings Institute Bank & Trust Company in Connecticut. She’d just ended a contract with a service that claimed to provide an artificial intelligence engine powered by machine learning that would deliver ads to very specific potential clients. It promised to dynamically design ads individually targeted to a person’s financial needs. After a look behind the curtain, Cassie determined this system was powered by hopes and dreams, but nothing was actually happening.

You can listen to the podcast here.

This is an egregious example of a bad actor misleading a client. But we fall for these bad actors all the time. We want to avoid waste, and our well-meaning attempts to do so can unwittingly undermine our potential success.

Echoes of Efficiency

Not all data promises were lies, but many marketers were led astray. It boggles the mind to speculate how many marketing dollars were wasted between 2012 and 2019 chasing unicorns.

Why do brand advertising when my cable outlet promises 1:1 data on folks looking to switch bank accounts?

Why build name-i.d. and awareness when we can buy a list of high-net worth individuals looking to buy CDs?

Instead of playing to win, banks played to avoid losing. We were promised easy-to-justify campaigns. It all sounded too good to be true, and it was.

As in all things, it’s best to find a balance—which we’ll cover in the third and final chapter.

The bigger they are…

Eight-ish years ago, you couldn’t attend a banking conference without being bombarded with talks about big data. It’s a natural fit. Banks store an incredible amount of data—transactional and personal. But to use these huge data stores, one needs appropriate hardware and software to process all the bits and bytes.

The term had been around for years, but technological advancements in 2012 brought data processing to the forefront. Ever-more powerful computers made it possible to turn mountains of information into actionable data—allowing us to learn more and more about our bank’s clients, build “lookalike” audiences, determine trends and more.

Big Data. Bigger Barriers.

Much like other specialties, machinery does not equal expertise. You can go buy a race car, but unless you’re a great driver, you won’t win any races. Third-party vendors dangled carrots for years, promising results. Certainly, some banks were able to wrap their arms around their data and use it to nurture relationships, but most big-data projects died under their own weight. Finding the right mix of knowledge, ability, and effort to yield results was insurmountable for most.

The lure of big data is understandable. There are incredibly compelling reasons to tap your own data pool. You can determine everyone who holds a DDA at your bank who also holds a mortgage with another bank. You could cross-reference that data with the individual’s home purchase price and back into their interest rate. From there, you could gate the information to automate a campaign to send emails, direct mail, texts, and more to those who might benefit from a refi at your bank.

But the barriers are huge. Who’s going to create the data streams? Who’s going to map and cross-reference them? Who creates the campaign strategy and creative? Who measures the results?

This is why most projects were shelved. They were just too much to undertake.

Start Small and Grow

Once you ask yourself “can we?;” I recommend asking, “should we?” Too many marketers (especially vendors) approach data projects as all-or-nothing endeavors. We can use all the data, so why don’t we?

Because the project will be too big. I promise.

But it seems like we can’t help ourselves. We implement a CRM and we just have to add the scheduling module for our bankers. We set up email and we try to connect every data point and set up every automation possibility.

Here’s our rule of thumb: do it manually until it shows enough success that you must automate it. Begin with the most profitable endeavors and start incrementally. If you don’t have an onboarding program, start with a welcome email. Don’t stymie yourself trying to build a survey and automated flow. Digital processes are living and breathing. You can always go back and add to the process later. It’s much better to welcome a client today than to send them a 42-part email campaign 10 years from now.

Find easy wins. Contact those who have a mortgage with your bank, but no checking account (and vice versa). Renasant Bank had tremendous response with a simple campaign to those who had regular checking accounts, but no savings. You can read about it here. Once you do these campaigns once, they’re much easier to automate in the future.

Start with baby steps and I’ll see you out along the road.

When someone buys a brand-new car, what do they say?

“Well, mine was getting up in miles. The trade-in value was dropping, and I really wanted something with better gas mileage.”

This is the rationale.

“I wanted something with more safety features.”

“I needed more reliability.”

“Have you seen the trade-in deals lately? They almost paid me to get a new car.”

These are the logical facts we share so we don’t look like an insane person for committing funds to a quickly-depreciating asset.

So what was the reason?

If we’re honest with ourselves, here’s how we’d really answer: “I saw an ad on Facebook during my pre-bed-time doomscrolling. The ad made me feel better than all the disquiet I’ve been feeling, so I clicked through. Building out a car online, to my exact specs, made me feel even better. If a virtual shopping experience feels this good, I imagine a test drive will make me feel ecstatic!”

Once, I asked an “expert” used-car salesman why all used-car ads relied on insane gimmicks with a pitchman yelling at the camera. Almost all consumers say they hate this style of advertising, yet it keeps going, and people keep buying cars.

His response: “You have to realize that for about 72 hours around the purchase of a car, the buyer could be considered legally insane. They’re making completely emotional decisions. These ads play into this emotion. And they work.”

Emotional buying isn’t limited to cars or even large purchases.

Do you really think you buy M&Ms because they “melt in your mouth, not in your hand?” No. You’re probably not even hungry when you buy them. They’re not healthy. They won’t sustain you very long. There are few logical reasons to buy junk food. You could buy a whole bag of salad for the price of a small amount of M&Ms. We don’t buy junk food for any rational reason. We buy M&Ms because they make us feel better, even in a small way.

People make decisions based on emotion, and they backfill with logic.

My mentor, Duane Birch, repeated this axiom to me almost every day we worked together. He never told me who told him first—or if he picked it up in his multi-decade national brand experience. From Yugo to Yoo-Hoo, consumers proved to lean toward what they want before they make certain it’s what they need. This Harvard professor agrees.

Ok. ok. But what about banking?

As a general rule of thumb, bank advertising relies on rationale—the secondary side of decision making. This is based on features, logic, and math. Banks (generally) don’t seem to realize people make decisions on excitement—impulse—how the brand makes them feel (if the brand is good).

Perhaps banks drank the wrong Kool-Aid and believed potential customers couldn’t be excited about banks. Maybe they forgot banks, almost literally, perform magic—transferring funds from your strong brick building to a trendy retailer to complete a purchase—almost at the speed of light.

Either we forgot how magical—how helpful—banking is. Or, at the very least, took it for granted and forgot to tell people.

Banking is emotional.

Most customers who switch banks do so for two reasons: poor service or a mistake (which likely wasn’t handled well). The customer is angry—they feel mistreated or unimportant. They feel emotional. And they want to find another bank that will not do this to them. They want a bank that will not make them feel this way.

First, you must realize you’re not creating ads trying to convince satisfied people to leave their bank. As we covered in a past blog, only 2% of people are either Dissatisfied or Very Dissatisfied with their primary bank. You have a small potential audience who is ready to leave at any time. You must be ready with advertising messages created to speak to those looking to leave their current bank.

Second, you must build your message around a beneficial brand. To do so, you need to deeply understand the difference between benefits and features (and those features trying to be benefits). We cover that here.

Third, you must combine these into a consistent, benefit-based brand message. This is much easier said than done, but if it was easy to do, everyone would be doing it. Your advantage? Out of 5,000 banks, almost no one is doing this well.

How does that make you feel?