Perspective points out community banking’s value. The lens of time focuses on what’s important.

Change needs perspective to be appreciated, especially the kind of change that makes a real difference. To think about where banking is today, those of us who work in its midst have to consider things from a much different point of view. As it turns out, our world is more different than we’ve probably ever realized.

In his book, “Rise of the Creative Class,” sociologist Richard Florida poses an interesting thought exercise: Imagine someone in America transported from 1900 to the middle of the century, then someone else transported from mid-century to the present day and considered who would notice the greater change.

Florida posits the traveler from 1900 to 1950 would marvel at society’s technological advancements. You could broadcast a live image of a human from one coast to another almost instantly. Automobiles replaced horses. Skyscrapers lifted cities into the clouds. The traveler from 1950 who arrived in 2000 would likely be disappointed in the incremental shifts in technology. Televisions, cars, and buildings advanced mechanically but showed little obvious, fundamental improvement. The changes that would drop the jaws of this traveler are more in the social sphere. On the negative side, television now drips with profane language, and everything is sexually charged. Far more importantly and on the positive, attitudes toward race and gender have progressed tremendously and, while still far from ideal, demonstrate we are headed the right way.

Perspective matters.

As specialists in bank marketing, we thought it would be interesting to send each of those travelers to the bank and see what turned up. We found the enclosed newsreel on YouTube. With this video from the BBC. Take four minutes to travel back in time and rejoin us below…

What you saw captures some of what our first traveler would have seen when he arrived in about 1950 from 1900. Instead of counting coins by a smoldering candle or finely wrought promissory notes, you see the birth of virtualized currency.

Cutting edge for the day, computer-assisted banking and record-keeping were sufficiently noteworthy to merit a short, general interest feature by the BBC.

For the first traveler, the computerization of banking would be mind-blowing. Would his counterpart, someone from 1950 brought to today, be as startled?

Granted, computers have come a long way since then, but, at their heart, the mechanics are the same. There are differences even more striking than those the first traveler saw, though; they just take a little more noticing. So what would the second traveler notice? Certainly, the ability to conduct a full suite of banking services on a computer/television/phone/camera that fits in your pocket would be impressive. But consider the common thread of communication from most banks.

Since the days of the video, banks have run a race against technology as they’ve been saddled with more and more compliance and regulatory oversight.

In the 1970s and 80s, it was all about traveler checks and debit cards. In the 1990s to 2000s, it was online banking and at-home computerized financial tools. In the 2000s and beyond: mobile banking of all sorts.

These advances have driven our external messaging. When the neighboring bank launches a new bell or whistle, we feel the need to add something comparable—and promote it. When the big banks roll out new technology, we stand panting at the doors of our core providers, waiting for them to give us comparable technology.

Through all this, we’ve adopted a mantra: all the technology of a big bank with the service of a community bank. However, we’ve put much more emphasis on the technology than the service—at least in our messaging.

The biggest difference a traveler would notice in the post-modern world is banking no longer requires a banker.

And while “requires” is the operative word, we’ve also forgotten to let our communities know why they need a banker.

Whether chasing efficiency, running out of budget, or overfocusing on the techy aspects, banks stopped connecting customers’ needs to the type of help a real human can provide. And this doesn’t mean the standard banker ad that just shows a lender’s face and does nothing to communicate his or her value to the audience.

We don’t like artificial colors or flavors, so why would we value artificial intelligence over real intelligence? More importantly, why would we insult our customers with artificial interaction when real interaction is available with our bankers?

Big banks have tried to convince their customers they don’t need a human to help them bank. In so doing, they’ve convinced some community banks technology comes before connection. Nothing could be further from the truth.

It’s not the size of the data…

If you’re trying to catch a lot of fish, which is better: one fishing line or a net?

When there’s a missing person, does one person go out looking for them? No. It’s a group, often arm-in-arm, covering every square inch of the search area.

Archaeologists looking for lost antiquities cover large swaths of land using a grid so they can dig methodically.

But marketing? That’s laser-focused. No shotguns here! Only finely tuned rifles, loaded with the best data out there.

Right?

That’s certainly what we’ve convinced ourselves we need.

Overtargeting and Overmissing

Let’s look at a simple scenario. Your bank needs to add new checking accounts. You hope to add clients with high deposit amounts. So, which is better:

- A. Buy 100 highly targeted leads for $75 each?

- B. Buy 10,000 less-targeted leads for 7.5 cents each?

Scenario A is not outlandish. The premium rate-searching sites are charging this much per lead—not per conversion. You get a chance to market to a prospect alongside all the other banks that paid $75 for the same lead. Scenario B is a typical cost for a well-qualified list purchase.

Even so, this is a simple example. It doesn’t take advertising costs into account. While acquisition costs are the same, it will cost 10x more to market to the larger list.

But bear with me. We’ll get back to this.

The base problem with the scenario above is twofold: yield and scale.

A hundred highly qualified prospects will still be the victim of statistics. You might not waste much money, but you won’t get much yield, even if your campaign performs well beyond any reasonable expectation.

Over-targeting can lead to over-missing.

Pinpoint targeting means that if you miss, you’ll miss big.

Scaling factors such as postage on premium leads can eat your lunch. You must plan on a yield to balance out the investment. It’s not just about saving money. It’s about producing results.

Sometimes, it’s beneficial to back up. A friend of mine was recently running for a local political office. He found himself in a runoff. A consultant priced out a direct-mail campaign to the most important neighborhoods. It was expensive. My friend called me for my opinion. We quickly looked at the USPS website’s Every Door Direct Mail (EDDM) map. EDDM lets you buy a full mail route at a much lower postage cost and no list cost. There is no personalization, but you can blanket a large area. My friend purchased three carrier routes and sent nearly ten times the number of mail pieces needed to reach every home in these neighborhoods for a quarter of the cost (printing and postage included). He won the primary runoff.

I want to reinforce a key point: not only did he buy ten times the houses for one-fourth of the price; all of the houses in the targeted list were included in the carrier routes. He could’ve overpaid to reach those houses. By backing up, he reached his targeted list and their neighbors—and likely picked up more votes in the process.

My friend might have killed a cockroach using a hand grenade, but it was more cost-effective – and just plain effective.

The Best of Both

Neither approach is fully correct, though.

As we mentioned, costing comes into play in both mailing scenarios. More pieces can cost more money. This is why you should layer your approach, especially in the testing phase. You might send a more upscale (expensive) piece to the more targeted list while sending something more generic (cheaper) to the less-targeted list. As you find success in one area or the other, you can always scale up toward that method. Conventional contemporary wisdom leads us to lean into targeting (sometimes a little too much). Don’t be afraid to back up and look at a wider universe. This will ensure you’re not putting your eggs into the wrong basket—or at least too many of them.

Data Data Everywhere…

For many, big data projects proved to be big problems, but it opened minds to a new universe. Bankers were led to believe there was a data point for everything—accessible for just one high-high fee.

We knew what was possible. We heard stories of tools that promised to easily find the needle in the haystack. To this, we added our hopes and dreams.

But a strange translation happened. Both because of our own leanings and promises of vendors, we began to think “if we can’t use our own data, let’s just see what we can buy—the same data must exist out there somewhere.”

Surely, we can analyze our data and predict when someone’s about to leave our bank.

If that’s true, we should be able to determine when someone is leaving another bank.

I bet we can buy a list of people looking for mortgages right now!

Most of us have to fight for every marketing dollar we’re entrusted with. We’re looking for budget efficiency wherever possible. We want to avoid the situation articulated in John Wanamaker’s famous quote: “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.”

The lure of a magical process that can ensure we’re making the most of every dollar is irresistible.

Digital Snake Oil

Marketers weren’t just assuming this data was available. We were actively being misled.

A few years ago, I interviewed Cassie Giovanni on the Marketing Money Podcast. When we spoke, Cassie was Head of Marketing for Savings Institute Bank & Trust Company in Connecticut. She’d just ended a contract with a service that claimed to provide an artificial intelligence engine powered by machine learning that would deliver ads to very specific potential clients. It promised to dynamically design ads individually targeted to a person’s financial needs. After a look behind the curtain, Cassie determined this system was powered by hopes and dreams, but nothing was actually happening.

You can listen to the podcast here.

This is an egregious example of a bad actor misleading a client. But we fall for these bad actors all the time. We want to avoid waste, and our well-meaning attempts to do so can unwittingly undermine our potential success.

Echoes of Efficiency

Not all data promises were lies, but many marketers were led astray. It boggles the mind to speculate how many marketing dollars were wasted between 2012 and 2019 chasing unicorns.

Why do brand advertising when my cable outlet promises 1:1 data on folks looking to switch bank accounts?

Why build name-i.d. and awareness when we can buy a list of high-net worth individuals looking to buy CDs?

Instead of playing to win, banks played to avoid losing. We were promised easy-to-justify campaigns. It all sounded too good to be true, and it was.

As in all things, it’s best to find a balance—which we’ll cover in the third and final chapter.

The bigger they are…

Eight-ish years ago, you couldn’t attend a banking conference without being bombarded with talks about big data. It’s a natural fit. Banks store an incredible amount of data—transactional and personal. But to use these huge data stores, one needs appropriate hardware and software to process all the bits and bytes.

The term had been around for years, but technological advancements in 2012 brought data processing to the forefront. Ever-more powerful computers made it possible to turn mountains of information into actionable data—allowing us to learn more and more about our bank’s clients, build “lookalike” audiences, determine trends and more.

Big Data. Bigger Barriers.

Much like other specialties, machinery does not equal expertise. You can go buy a race car, but unless you’re a great driver, you won’t win any races. Third-party vendors dangled carrots for years, promising results. Certainly, some banks were able to wrap their arms around their data and use it to nurture relationships, but most big-data projects died under their own weight. Finding the right mix of knowledge, ability, and effort to yield results was insurmountable for most.

The lure of big data is understandable. There are incredibly compelling reasons to tap your own data pool. You can determine everyone who holds a DDA at your bank who also holds a mortgage with another bank. You could cross-reference that data with the individual’s home purchase price and back into their interest rate. From there, you could gate the information to automate a campaign to send emails, direct mail, texts, and more to those who might benefit from a refi at your bank.

But the barriers are huge. Who’s going to create the data streams? Who’s going to map and cross-reference them? Who creates the campaign strategy and creative? Who measures the results?

This is why most projects were shelved. They were just too much to undertake.

Start Small and Grow

Once you ask yourself “can we?;” I recommend asking, “should we?” Too many marketers (especially vendors) approach data projects as all-or-nothing endeavors. We can use all the data, so why don’t we?

Because the project will be too big. I promise.

But it seems like we can’t help ourselves. We implement a CRM and we just have to add the scheduling module for our bankers. We set up email and we try to connect every data point and set up every automation possibility.

Here’s our rule of thumb: do it manually until it shows enough success that you must automate it. Begin with the most profitable endeavors and start incrementally. If you don’t have an onboarding program, start with a welcome email. Don’t stymie yourself trying to build a survey and automated flow. Digital processes are living and breathing. You can always go back and add to the process later. It’s much better to welcome a client today than to send them a 42-part email campaign 10 years from now.

Find easy wins. Contact those who have a mortgage with your bank, but no checking account (and vice versa). Renasant Bank had tremendous response with a simple campaign to those who had regular checking accounts, but no savings. You can read about it here. Once you do these campaigns once, they’re much easier to automate in the future.

Start with baby steps and I’ll see you out along the road.

Where have all the cowboys gone? In her 1997 hit, Paula Cole laments the decline in down-to-earth, working-class, relatable romantic options.

Today we look at the loss of a cowboy in banking. Fintech startup Simple has been sent off along the old dusty trail by acquirer BBVA. As the sun sets on this tech-based maverick, we find some lessons for your human-centric community bank.

Simple was founded in 2009 and became one of the first fully-digital banking challengers to achieve any real traction, paving the way for the current generation of fintechs and neobanks.

Simple was conceived to simplify banking. In their words (from their site), Simple was the response to these questions:

- Why is banking so complicated?

- Can a bank exist to help people, not confuse them?

- What if banks didn’t charge so many ridiculous fees?

- What if your bank taught you to feel confident with money?

In 2014, BBVA purchased Simple to “accelerates its digital banking expansion,” according to a press release announcing the acquisition. The $117 million acquisition brought 100,000 customers. BBVA allowed Simple to function almost autonomously, until now.

From the bank-peer peanut gallery, there were cheers, and there were jeers. Simple’s original customer base cried foul.

The commentary fell into two categories:

- I told you so! One group will have you believe they predicted this. They say the world never needed a Simple anyway—that any success it enjoyed was a fluke. In their eyes, Simple amounted to nothing more than a trendy, gimmicky, millennially frivolous competitor.

- This is why we can’t have anything nice! Another group attributed Simple’s death to corporate greed crying, “the big guys will always crush the little guys. Customers will never get what they want!” BBVAs sunsetting of Simple was another example of classical corporate neglect of the client’s needs and experience.

I’d suggest the narrative isn’t so simple as big vs. small, the establishment vs. innovation, or the past vs. the future. This is not a conversation strictly between megabanks and fintechs. Nor does this event score points for the “See? No one wanted an online-only bank” crowd.

It might seem strange, but community banks have the most to learn here—why they should listen to their customers and why they must remain stalwart in maintaining independence.

First things first

This announcement is likely tied to another acquisition: PNC’s purchasing of BBVA’s US-based assets. If so, Simple’s shutdown is a byproduct of consolidation and the expected skinnying-up that comes with any acquisition—a cost-cutting measure to ensure profitability.

Even without this acquisition, one has to wonder how Simple looked on BBVA’s balance sheet. As of October 2020, more than 35.6 million of BBVA’s 56+ million active customer base were considered “digital customers.” Compared to Simple’s 100,000 customers, it’s pretty easy to build a speculative business case where Simple simply didn’t make sense.

For those who say, “…But Simple brings a better experience!” Well, that’s not the case. As of this writing, the Apple App store rating for Simple’s app is 4.6 stars while BBVA’s is 4.8 stars with 284.8 thousand reviews (more than 17-times Simple’s).

All of that being said, this is big-bank-scale stuff. No community bank I know would scoff at 100,000 customers. And according to the backlash following the announcement, they’re 100,000 loyal customers—not trend-chasing transients as popularly assumed about the digital sect.

It’s not about tech.

Simple grew from zero to 20,000 users between its founding in 2009 and 2012. Between 2012 and 2014, that number skyrocketed fivefold to 100,000 users.

Why?

Simple was pretty. Simple was focused. Simple was simple.

But most of all, Simple was different.

Being different isn’t enough. If they never told anyone—never got any press—it’s hard to believe they would have enjoyed the same growth.

Simple realized their difference and communicated this difference beautifully, clearly, and with an adequate budget.

Simple positioned themselves as the solution to well-known industry woes. These were tropes that clients and banks alike took as status quo and unchangeable.

This isn’t about creating a great app. It’s not even about scale. It’s about providing something your customers can’t get from megabanks.

Community banks have been doing this for years. They just forget to tell people.

Instead of comparing your community bank to a big bank, you must work to define your own metrics of success and reframe the customer’s perception to help them understand why your success is better for them than big bank success.

That’s what Simple did. Now, those who sought out Simple’s experience will be without a bank.

While you might not be a high-tech whiz-bang bank, you must consider Simple’s story as you consider your bank’s future.

You must consider this key question: If YOUR bank didn’t exist, what would my customers be missing?

Where have all the cowboys gone?

“Where have all the community banks gone?” might not cut as poignant a refrain, but remember, the cowboy didn’t go away due to our culture’s lack of love for the archetype.

The story of Simple turns on this question: Do enough people value what’s good over what’s expedient and widely available?

The answer seems to be Yes.

Simple’s core group of customers—those who chose to leave other banks for Simple’s brand promise—are upset that the banking experience they specifically chose is going away.

“But BBVA’s app is better” isn’t stilling their anger.

“But Simple’s founders made a lot of money” isn’t consoling those people.

Simple succeeded because it clearly defined its purpose and why you should choose their experience. They went all-in on it. Simple made it clear what customers were choosing between. Have you done the same for your bank? Or do you believe that people should choose a community bank because they inherently know it’s better? Hint: they don’t.

Defining your bank’s edge

Couching your bank as “independent,” “service-oriented,” and “people-focused” doesn’t cut it. These are what we call Beneficial Features. They seem packed with meaning and sentiment, yet they don’t actually tell your customers anything on their own.

Go back to Simple. Simple, as a word, is a beneficial feature. Would you prefer a process to be difficult or simple? Would you rather hear a complicated explanation to a problem or a simple one? Those are clearly loaded with beneficial leaning. But would you rather have a gourmet meal with complex flavors or a simple hot dog? Would you rather be known as a dynamic thinker or simple-minded?

Most community banks overuse similar buzzwords because they come loaded with meaning but fail to connect that meaning with value. Every individual brings their own deeply personal associations to words like “family,” “community,” “success,” and “stability.” You don’t have to explain these concepts to them.

But you do have to explain how your bank embodies those concepts to provide value to the customer.

One reason you might make a clear, focused value proposition is you fear excluding potential clients who might have different definitions of value. Banks often fear lighting the beacon of their value because they fear it will repel others. Simple was willing to commit to its message, even if it meant passing up people who wanted the opposite, who wanted something complex. They knew some folks might not like what they had to offer. But 100,000 people did.

Additionally, defining success also defines failure. Once you make a promise to the customer, you must fulfill it. Banks fear overcommitting to a promise, but I’d caution that while murky water may obscure accountability, it also obscures direction.

These conversations are hard, and it’s tough to get everyone on the same page. In small banks, we all wear multiple hats. Creating a consistent customer experience is difficult. But you must identify what it looks like when your bank wins—when your team wows the customer. And you must determine how to make this a consistent experience and how to communicate this to potential customers. What are you doing better? How can you do that more?

Simple customers didn’t leave because it got bought by a big bank. They left because BBVA eliminated what they wanted.

Your bank offers something your customers want. What is that thing? What would your customers miss if you were gone?

More pointedly, Why do you not want to be bought?

I’ll tell you: because your customers will miss you when you’re gone. It’s up to community banks to make certain community banks continue to exist.

Your bank is unique because your people and your communities are unique. You put the customer first. That counts for a lot. You just have to tell people how.

Features vs Benefits vs Beneficial Features

The battle of features versus benefits is as old as time—or at least as old as the advertising industry itself.

Features are the lifeless attributes of a product, service, or brand.

Benefits are the value a client should find in your product, service, or brand.

While most of us likely understand the difference and preference toward benefit, we rarely explore why benefits are better.

The core differentiator is around extrapolation—drawing conclusions. Benefits innately capture value. Some features might seem valuable (especially if you have a writer’s confirmation bias), but they require readers/listeners/viewers to apply their own experience.

Big is a feature. While “bigger is better” is a well-known phrase, we don’t all process “big” in the same way. For some, “big” can be overwhelming. For others, “big” is invigorating—a concept that brings options and potential to explore.

By simply saying “big,” you can’t expect a universal result. Therein lies the problem.

Benefits bridge the gap and make the intended connection for your audience.

This becomes into greater contrast in community bank marketing, though. Our features don’t necessarily evoke a natural benefit. We rarely have “big” at our disposal as community bankers. Instead, we must extoll the virtues of being small. We have to connect the dots for potential clients to understand why smaller is more accessible, nimble, and responsive.

There are added dangers. We can lean on words we often feel are naturally positive and beneficial.

Words like community, family, and personal permeate banking text. There’s nothing wrong with these words in and of themselves. But we must understand our perspective on these is not universal.

In the debate of features versus benefits, I call these words “beneficial features.”

They’re words loaded with meaning, but that meaning is not ubiquitous or universal.

We all understand the intent behind a word like “family.” It’s a single word that can communicate a tight-knit group who all act in one another’s interest—a loving group of people.

However, this isn’t the reality in all families. Not everyone experienced an idyllic version of family—for some, it is the opposite.

It can be the same with community. It’s not always a safe and positive environment.

These words, whose truth we hold to be self-evident, often don’t communicate with the volume of meaning and positive we want to confer. At their core, they’re just features—even if their leaning is beneficial.

I’m not just being a semantic devil’s advocate. And I am certainly not saying to avoid positive words because they might be negative to a certain group. You just cannot rely solely on the positive intent of these words without connecting the dots for your audience. You must know these words do not communicate enough on their own. They’re still features (no matter how beneficial or positive). With any feature, you must connect the dots to the benefit for your audience.

When we use phrases like, “We’re a true community bank,” we must follow up with explanation and meaning for much of our audience—regardless of their feeling of the word “community.” We use the phrase universally within the industry, but our audience doesn’t inherently gather the benefit. It’s up to us to connect those dots.

If your bank truly provides a family-like atmosphere or is a true community partner, visitors to the branch or your social channels shouldn’t even have to be told “family” and “community.” They should see these concepts in the photos, comments, and experiences. But you must make certain these visitors understand why family and community are benefits.

We must remember that any feature requires some connecting of the dots. Don’t make your audience work to determine your meaning. Make it clear for them. It’s worth the extra words, and it’s worth the extra time.

“We only advertise mortgages in the second quarter.”

“Why?”

“People don’t buy houses in the winter.”

I don’t think all bankers believe this, but I’ve certainly heard it enough to do the research.

Survey says? There’s something to it.

According to U.S. Census Bureau data, spring and early summer consistently boast the highest number of new home sales.

Don’t believe the U.S. Census Bureau? That’s OK, some people don’t. Here’s the National Association of Realtors existing home sales data from 2017.

Even with two graphs, you don’t see the whole picture. Dig a little deeper, and another story emerges—mortgage lenders who limit advertising during an idealized four-month window miss out on the vast majority of home sales.

More Homes Are Sold Outside the Spring Window

In 2017, more new, single-family homes were sold between March 1 and June 30 than during any other four-month period. That’s a large chunk of business but, in reality, March-June sales add up to barely more than one-third of the 608,000 sales made during 2017.

You see, every month last year, people collectively bought at least 43,000 new homes and 315,000 existing homes.

There’s no way around the numbers. In fact, according to my data, people have bought houses every month for the past eight years. The only reason I say eight years is because I didn’t pull older data. I figure eight years makes a strong enough point. The crazy thing is, during each of those months, people bought almost as many houses they did during any other month.

Here’s my point:

People buy homes all year long. Ignoring this fact when developing your marketing strategy can cost you significant revenue.

Limiting yourself to springtime advertising definitely gives you a shot at snagging some business during the industry’s busiest season, but not advertising during the other seasons will cost you much more. It will cost you more than half of the year’s home sales.

Un-Level the Playing Field

Before we go any further, let’s establish one key point:

The goal of advertising is to make your business stand apart from competitors.

If every mortgage provider in your market saturates a particular four-month advertising window, you’re all competing in an overcrowded marketplace for a limited number of eyes.

But, if most of your competitors have pulled their advertising campaigns by the end of June, you’ll have an empty stage and a captive audience.

When marketing mortgages, or any other parity product, you must pounce anytime the playing field is uneven.

You could be one of many lenders trying to close loans for the 61,000 in the spring, or you could be the only lender closing 43,000 loans in December.

Which scenario sounds more profitable to you?

Grow Brand Identity in Your Marketplace

Imagine getting a call for a favor from an old friend to whom you haven’t talked since the last time you helped him. Then another friend, who bought you lunch last week, asks you to help her, too. Who are you going to help first?

To the latter you may say, “Sure, just tell me when and where,” and to the former, “Nice to hear from you; where have you been all year?”

Coke, Walmart and Apple are top of mind because their advertising is pervasive. It’s why most of us think about them at some point every day—whether we want to or not.

Financial marketing is difficult because regulations won’t let us budge on the “fact,” so we have to find other ways to stand out.

You’d be surprised how often I hear people say, “Oh yeah, I think I’ve heard of that lender. Is it the green one or the blue one?”

Even if your marketplace completely dries up during the winter, I’d still recommend running some degree of “awareness” ads throughout the entire year. The best way to make sure a customer calls you when they’re ready to buy a home, instead of your competition, is to make sure you’re top of mind. You certainly don’t need to be obnoxious (though some studies show that works, too), but you need to be known.

So when other mortgage lenders enter their hibernation caves in July, consider ramping up your awareness efforts. These efforts will certainly translate into business during the fall and winter, but more importantly, it means your business will be top of mind come next March.

Drive Sales All Year Long

Simply put, refusing to advertise outside the spring window is refusing business. Maintaining a consistent marketing and advertising strategy that covers the entire year—rather than just four months—lets you invest consistently in your business and boost cash flow.

In the spring, you might imply your willingness to work faster than the competition. Then, in winter, you can encourage buyers to act while home prices are lower.

Do you want to be a little fish in a big pond, or do you want to be the only fish?

At Mabus Agency, we tell our clients to zig when others zag, but this is a case of zigging while everyone else stands still. If you want to increase loan volume and stand out from the competition, buck the trend and do something different this fall.

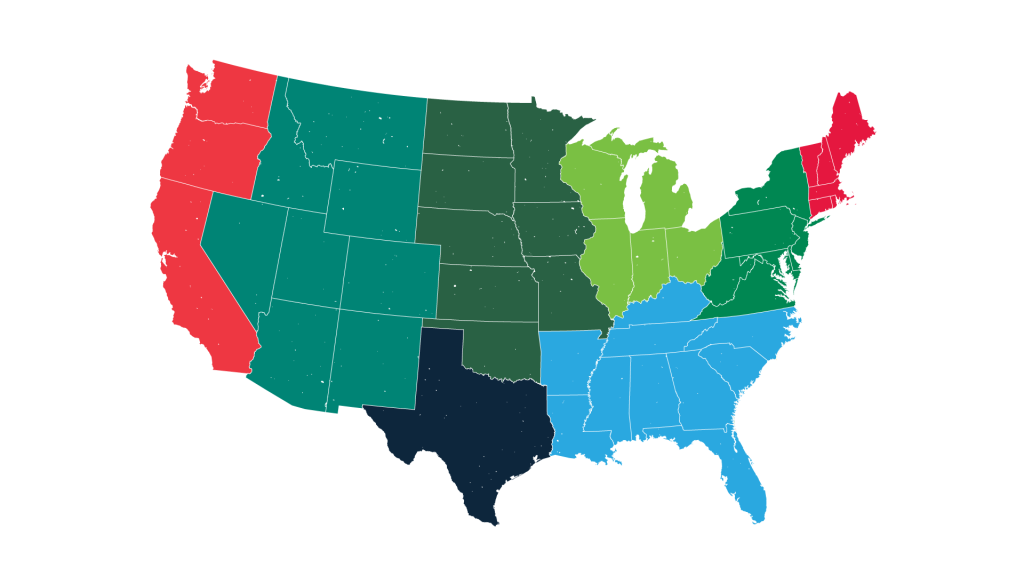

What makes a bank the best? Time magazine’s Money.com published a list of the best banks in each region, and the list is pretty short—eight to be exact.

Renasant Bank—named the best bank in the South—was one, and we were especially excited because it’s our longest-tenured client.

Since Mabus Agency works with Renasant Bank every day, we know what makes it successful, but we were curious. Were Renasant’s habits unique? It turns out these banks all have a few things in common, and we believe these similarities contributed to their place at the top, and could help your bank, too.

Here are the banks that took the prize in each region. Congratulations to each!

- Pacific – Banner Bank

- Mountain West – Washington Federal Bank

- Midwest – First National Bank of Omaha

- Great Lakes – Huntington Bank

- Mid-Atlantic – Northwest Bank

- New England – NBT

- South – Renasant Bank

- Texas – Frost Bank

If you’re looking to improve your offerings, make sure you can check the box next to these industry-leading factors. We can’t guarantee you’ll be the best bank in your region, but we can guarantee you’ll be a better bank. And your clients will appreciate that.

1. Benefit-Forward Products

Whether it’s Banner Bank’s time-saving bill-pay dashboard, First National Bank of Omaha’s free checking, or Renasant Bank’s ATM fee refunds, most of the banks on this list make their benefits clear. When advertising products, these banks let clients know what’s in it for them up front instead of relying on vague descriptions. Here are a few product descriptions for the best banks:

- “Free means free. And that means no hidden monthly fees…”

- “Get the checking account that gives you cell phone insurance, roadside assistance, ATM fee refunds…”

- “Simplify how your business manages its cash flow with our secure online portal.”

In many cases, banks exhibit FOMO (fear of missing out) and list everything that might bring interest. The banks on this list had the bravery to bring the key benefits to the front.

2. Client-Focused Products

Great benefits come from great accounts. It’s difficult to truly differentiate product offerings from those of other institutions. These banks found nuanced ways to improve products with a focus on client needs.

Most of the banks on this list offer simple, up-front accounts with some combination of no account minimums, service fees, or ATM fees.

But it doesn’t stop with these entry-level products. These banks offer comprehensive upgrade paths that provide impactful interest rates, exceptional technology, and convenient features.

If you want to join the list of best banks, find ways to move from the commoditized field of other banks.

3. Easy-to-Access Digital Banking

Most bank clients live a large portion of their lives online, whether they simply dabble in social media or order all their groceries from Amazon. Banks have taken far too long to adapt to the public’s move toward digital. It’s 2018 and too many banks still have hard-to-find and impossible-to-navigate online banking portals.

Your clients have the entire world at their fingertips. They can order almost anything at almost any time. And they’re comparing their other experiences on the World Wide Web to their experience with your website and online banking.

Each bank on Money.com’s best-in-the-region list provides easy access to its client portals, online account opening tools, and mobile banking services through its website home page.

4. Actual Customer Service

It’s no surprise that many of the award-winning banks have been recognized for superior customer service in recent years. Banner Bank, First National Bank of Omaha, Huntington Bank, Northwest Bank, and Frost Bank were all ranked at or near the top of their region for customer service according to J.D. Power.

Those banks not explicitly rated by J.D. Power make it clear that their associates are ready and willing to address any concerns with easy-to-find contact pages, eager call center staff, and even feedback forms on some sites.

Most banks tout their customer service, but it’s easier said than done. To truly differentiate, you have to live up to those promises of great service.

5. A Brand That’s Different

Banks suffer from a naming problem. Nearly 66 percent of banks use the word state, first, national, trust, or savings in their name. While some have better brands than others, the majority of these banks have a clear identity. Of all the banks on Money.com’s best-in-the-region list, only one uses any of those words. Still, that bank has a clear visual and tonal brand.

Browsing the banks’ marketing materials, it’s clear each bank’s leadership and marketing teams are willing to make a decision one way or the other as opposed to riding the fence and trying to be all things to all people.

A bank that sticks to its identity will attract the clients it’s best suited to serve, and in the end all parties are happier.

Does Your Bank Have What It Takes?

No one’s saying your bank has to be the best in your region, but if you want to grow, you’ve got to be better. There are some clear commonalities between the banks that are doing things right, and pursuing a like-minded approach will pay dividends for your bank and improve the customer experience.

It’s up to you to determine which areas can impact your bank’s culture in a positive way. And you don’t have to do it alone. Find a partner that can help you shore up your weaknesses and keep you moving in the right direction.

Bank brands are the worst.

A few years ago, a group in the U.K. asked consumers what brands they’d like to sit next to at dinner. Facebook, Apple, Nike, and the other usual suspects popped up. But there were no bank brands at the table. More surprisingly, the same survey asked which brands respondents would argue with most at the dinner table. Microsoft grabbed first place—but still, no banks.

Responses to the second question say a lot more about the type of emotions bank brands cultivate within people. Any lingering negative sentiment from the Great Recession has long since dwindled away. Today, banks don’t really stir up anything in today’s consumers.

Couple this emotionless relationship with the rise of the “total experience economy,” where technology and ease of use create today’s best brands, and you’ll find that banks have found a home in the brand gutter. Why do banks insist on sticking to a failing course? Why do banks fall back on the same old process when evaluating who they are, what they want to be, and how to explain that to the larger market?

In banking, we use words like service and friendly and caring and community and cutting edge and innovation and laa de frickin’ da, but in reality, we just spent a few thousand dollars coming up with synonyms for customer service, solutions, and goals. Are we that vanilla, or are we just approaching the “exercise” the wrong way?

The Branding “Exercise”

Over the years, I’ve been part of more than 20 brand exercises to help banks, entertainment companies, large pharmaceutical companies, and law firms define or rethink who they are. I’ve seen it from every perspective: as an agency, client, creative, and company. All suffer from their own inherent disconnects, but still, I’ve grown progressively cynical of the output from this “exercise” and now find the whole charade quite amusing. If you don’t know, a typical (and yes, oversimplified) branding exercise goes something like this:

- Company hires Agency.

- Agency collects basic information about (e.g., has interns Google) Company and possibly sends a survey to Company employees.

- Agency and Company meet in a room and proceed to discuss the company using a few methods:

Method 1: “If You Were A [Object]…” This is a branding original from the earliest days of advertising, where office supplies, cars, and other inanimate objects are used to elicit descriptive words for how staff members think about their company. This usually results in a mix of “We’re old, but changing” or “We have some old parts, but we’re starting to make some upgrades,” and other nebulous allusions.

Method 2: Draw. Literally ask people to draw your ideal customer, or color something based on what color your company would be. Eventually, it becomes “Doodle because you’re no longer paying attention or you no longer care about this branding session.”

Method 3: The Quadrant or Spectrum. This is a personal favorite of mine. Each person makes a mark on a number of scales (think Fun/Serious, Cutting Edge/Established, or Upscale/Accessible) to show where they think the company fits. Then, Agency determines the averages.

- Agency takes research and flip charts back to the office and plugs in popular words from the meeting before using online thesauruses to come up with new words.

- Two to three weeks later, Agency delivers a positioning statement and messaging document chock full of everyone’s favorite buzzwords spread throughout. Something like…

We help people achieve more and become successful by giving them great advice and service, but still earn a reasonable profit because we believe in innovation and, also, you are not a number; you are a relationship and a client, and we love our communities and believe in hometown values, but we’re not the cheapest, but we are the best.

And then the big reveal. A new tagline: Banking on You. And Us. Together. Forever. One You. One Us. One Why.

- Company feels good, and the new “Banking on You” campaign comes out. Everyone feels like they’ve finally created something special.

But they haven’t. They’ve just created a campaign. And three to five years later, a new marketing person or executive will repeat the process with a new agency, because Company has “outgrown” the previous “brand.”

Exercising the Wrong Parts

If you do the same workout every day, you won’t see your body change very much. Muscles get complacent, and the human body adapts to repetition. The same applies to branding. You can’t change your makeup without giving your system a shock from time to time. You have to change the “weights” and the “routine.”

Adjusting the Brand “Weights”

Your bank brand gets weighed down by a number of internal and external drags. There will always be regulation and compliance, but the larger weights tend to be consumer/market fragmentation, heritage or legacy, and misguided research.

Consumer (or market) fragmentation clouds the brand process for many banks. The moment your community bank leaves its original community and grows into a new town, or moves from a rural to more metropolitan location, your “ideals” are challenged. I’ve heard so many “things are different across the river” conversations in banking. Yes, towns are unique, but there are many brands that permeate towns of all sizes, so don’t let fragmentation weigh down your thinking.

Heritage and legacy have long plagued companies. Need a case study? See Sears. Banks are often old, but more than likely, you’re not who you were in 1924. It’s OK to throw it back to the good ol’ days—nostalgia is a powerful and wonderful sentiment—but it can’t define who you are today. Don’t discount an aspirational component to your new brand simply because the “older markets aren’t going to like it.”

Misguided research is the death knell of so many agencies. In the earliest conversations with clients, they’re often getting piecemeal reports from various company sources. Then, the agency uses the information from those reports to develop broad generalizations about the types of customers the bank serves. All of these assumptions are made from just a few weeks’ worth of data. If there are two things I know about banking, they are:

- There’s a ton of great data about the bank’s customers available.

- No one in the bank has the same information.

Don’t get overly ambitious about something you see in the data unless you’ve verified it with three other sources.

Changing the Brand “Routine”

Branding should focus a company; it should help set the foundation for every message, ad, technology decision, and customer experience that falls under it. This rarely happens in most industries, but even less so in banking.

Heritage, notoriety, and service are often go-to bank brand foundations. Legacy can only take bank brands so far today, and service is too watered down after years of empty promises and the rise of online accountability through reviews, ratings, and consumer forums. We live in a world where many top brands are much younger than their established rivals. Although being in the business for 100 years does mean something to consumers, it just doesn’t mean as much as it once did.

When you want to rebrand or refresh your brand, take time before you reach out to a creative firm to talk through exactly what you hope to accomplish. A goal of cleaning up a logo and creating a consistent, multichannel look and feel is very different than “We’ve outgrown who we are and need to change the way we communicate to customers and the larger market.” If the latter is most true for you, you don’t need an agency to immediately come in and run the show. Take the time to bring your employees and customers together to discuss what your organization is, how it’s changed, and what it needs to get better. And if this is truly a brand you want to live for many years to come, let a few creative companies take their best shot at it. Why limit yourself to one group?

Brand or Deliver

Before you start any branding endeavor, make sure you’re seeking the right output. I fluctuate on how important bank branding is on a year-to-year basis—not because it’s not important to understand who you are and what sets you apart; I just don’t think banks accomplish much when reviewing and/or updating their brands.

In a commodity business, where 90 percent of competitors have nearly the same product set and essentially the same message about superior customer service, will branding set you apart? It should, right?

That sounds like an opportunity to me. But, given that banks always seem to fall into the same routine, should they not shift their attention to simply out-executing the competition? Are the best brands today not the best customer experience companies that also filled a timely need in the market? Think Uber, Netflix, Amazon…do you know what any of these companies really standfor? Or do you just value the convenience and experience they provide that far outpaces any similar service?

This brings up the almighty question: Does traditional branding really help banks succeed? Yes, you need consistency in look, message, etc., but beyond brand consistency, should your branding strategy be more of a customer experience strategy? When will a bank come to the table and not only say, “We make banking easy,” but actually devote multiple positions to ensure that every customer touchpoint is perfected? When will banking COOs, CTOs/CIOs, and CMOs work through a CCO (chief customer officer) who has to approve each change based on what it will do to the customer experience?

In other words, when will banks stop branding and start delivering?

When’s the last time an “SEO expert” emailed you, promising to make all of your online marketing dreams come true? You know the one:

Your bank website isn’t optimized, and we drove 8000% growth and boosted sales by a lot for a client, so call us!

Hopefully, you deleted the spam and moved on with your day.

The truth is, there’s no magic bullet for search engine optimization, which helps your website rank higher in search engines. And the promises you’re receiving in those eloquent sales emails don’t tell the whole story

SEO is hard. It’s more than just three to six months of enhancements—it’s a long-term, persistent commitment. It’s an iterative and experimental activity at times. And it can be tough for marketers to see the light at the end of this sometimes arduous tunnel.

But, when done right, SEO delivers some of the strongest results in modern marketing.

What’s the recipe? Let’s walk through the journey that led to a recent win for one of our commercial bank clients.

The Strategic Start

Like any good marketing initiative, a sound strategy goes a long way to determining success. This means having a solid understanding of the level of competition for any search queries (the exact terms people are searching for) you want to win while making sure you have the content to back up the terms people are searching for, and setting up analytics to measure success and ROI.

Note: specific details of this program were left out to protect the integrity of our client’s competitive marketing program.

In this instance, we focused on niche lending with a key marketing goal of keeping acquisition costs lower than they’d be using traditional methods (e.g. trade events and publication advertising). Our strategic process included:

1. Creating a roadmap for producing content, testing, and optimizing, then making adjustments as needed.

2. Developing targeted content covering key focuses within the niche industry. Topics ranged from broader business best practices to supplier chain specifics for the industry.

3. Competitive analysis of competitor lenders and “share of search” companies.

The SEO Technicals

If you want to achieve your strategic SEO goals, your website has to address some foundational “technicals” to ensure it’s looked upon favorably by Google and other search engines. This work involves making sure your site is optimized for mobile, loads well, has proper structure and tags, and includes no broken links or structural issues that would cause a search engine to “demote” your site.

It’s nerdy, but important, groundwork for your future success.

When we began, our client’s website was dated, poorly built for the new mobile world, and had a number of structural issues. So, we helped them redesign their site, with all of the modern cues for search engines. This immediately helped our client rank better for their core brand and services. Google recognized them and these foundational elements set up our client for their next endeavor: search-oriented content marketing.

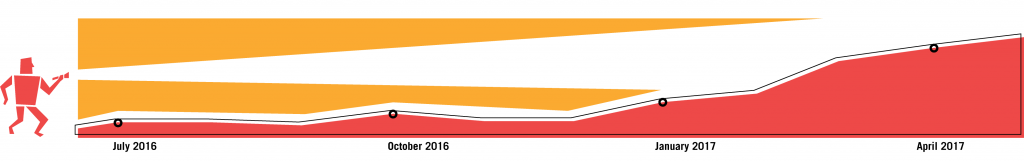

Organic search alone doubled within a month of the changes and increased 6X within four months.

The Tests, Misses, and Hits

Once you’ve mastered the fundamentals, the real fun begins. Great content marketing is goal-oriented. Some of your content should be fun, some should be educational, and some highly visual and conversational for social media. All of these categories of content can impact search, but more often, you need an “organic search content program” to go along with the other information you’re producing. This category of your content program is focused on performance above all else. If an article begins to win for a term in search, it warrants further optimization and additional content development to capture even more terms. If a content piece on your website doesn’t perform well, it needs to be revised, re-purposed, or archived. Again, this area of content is all about the performance. And great performance requires practice, effort, and learning through some failures along the way.

Our client’s organic content program combined research with well-structured writing to deliver the best possible chance for the organization to rank for important search terms. The process (at least to the level of detail we’ll share) looks like this:

1. A content calendar is built from the strategic work for each quarter of the year.

2. At the end of each month, content is scored on its effectiveness (search ranking MoM change, the effect on related content, etc.).

3. Every quarter, content is picked for optimization, expansion, and/or archiving. Keep in mind, some content may “win” up to a year or two later thanks to other influencers (e.g. a link from a prominent website, Google ranking for your site’s authority on a subject, etc.).

4. This process of content evaluation is repeated alongside the more technical keyword research. All of these evaluations provide a nice feedback loop back to your content strategy which can (and should) evolve based on the performance of your program.

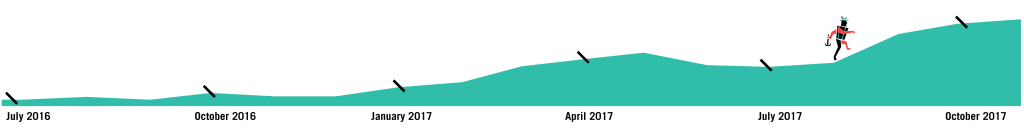

It’s important to note that search engines don’t always behave the way you think they will (or how you’d like them to), but a consistent and thoughtful process will yield results. This isn’t 1998 web SEO—you can’t simply create 50 web pages stuffed with keywords and expect results. Rather, you must first create optimized content across multiple channels then weave it into your overall marketing and audience strategies. Most importantly, it should feel natural. Our client saw 90 days of minimal impact before doubling the traffic they’d already gained from technical improvements.

The Return on SEO

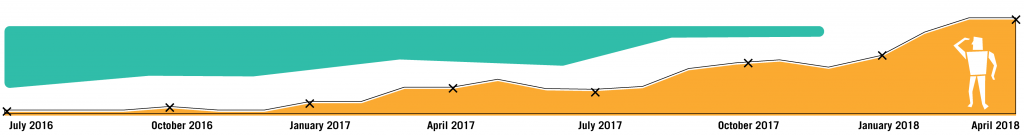

Once you’ve established a process for and consistency within content development, you’ll begin to see the wins increase. Google will assign more authority to you in certain topics—and searchers will follow. This is traffic you’d never see otherwise! And while you made an initial investment, the longevity of your ranking for a particular keyword far outpaces any campaign advertisement.

For our client, ROI was straightforward (and outstanding). The initial investment made in content now provides more 20,000 new website visitors a year, specifically aligned with the niche audience they were targeting. Think about that. When can you market to an unknown group and achieve the same volume of near-perfect intent? With a good qualifier tool and only a half a percent of that traffic converting into a lead, that’s 100 new, high-dollar leads that never would have made it to their organization otherwise. For one year, ROI projects to 300%, but that doesn’t account for the lifecycle of that content—which will continue to produce results for years to come

Interesting in learning more about how SEO works for banks and when you should (and should not) pursue it? Reach out to us.