These takeaways will make or break your bank’s geotargeting investment.

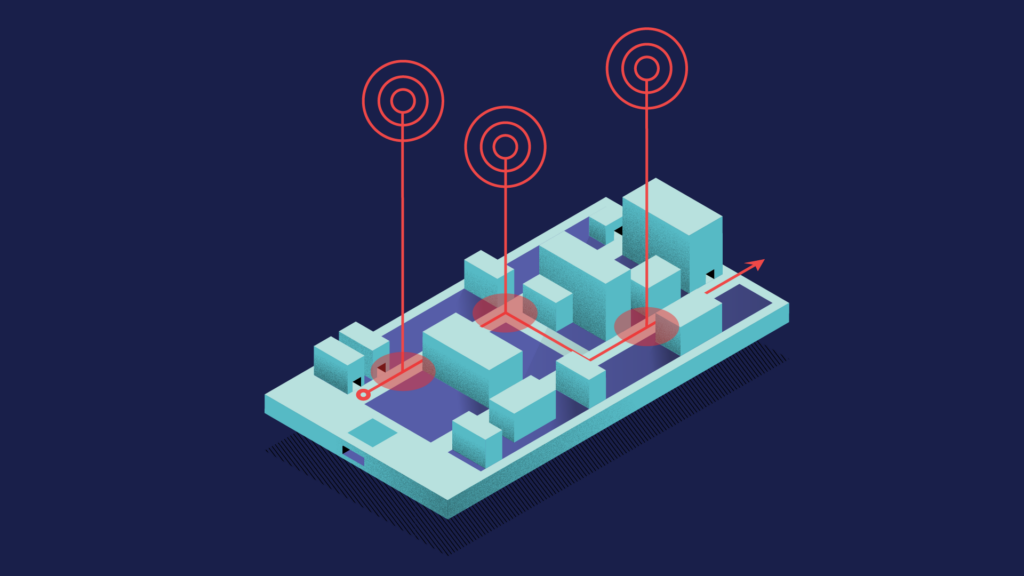

Geotargeting and geofencing are two of the trendiest advertising activities enabled by the mobile revolution. More than that, they’re proving to be the next big thing on the advertising frontier. Understandably so—marketers move their dollars to where people spend most of their time. And today’s U.S. consumers spend at least five hours of their day on their mobile devices.

But both these activities come with inherent flaws. And they require a new level of analytical and creative rigor not yet fully understood.

That said, we’ve seen a number of banks make substantial use of geolocation to improve customer targeting—and that has yielded a wealth of lessons learned. Here are a few of our biggest takeaways.

1. Advertise where people are sedentary, on their phone, AND often managing their money.

Banks have long looked at major retail areas as the prime real estate for financial decisions. However, a bank’s physical presence at a mall doesn’t necessarily mirror decision-making in a digital advertising medium. People shopping at malls are busy and although they may check their devices, they aren’t making important banking decisions when buying a new pair of shoes or a cinnamon bun.

Don’t waste your digital dollars where people are active or using their phones for more intentional reasons. A better use of your geotargeting investment could be placement around pickup lines at school or large office buildings full of daytime workers. These individuals are stationary and often browsing their phones more casually. This is an opportunity for you to generate meaningful interest.

2. It’s not just about location, it’s about timing, too.

Think about those carpool lines at the elementary school. Don’t spend your money for a full day of advertising. Test time ranges between 7:30 and 8:30 a.m. and 3:00 and 4:00 p.m. Consider the day of the week or the time of year when targeting those employees in the office building. Fridays, plus the 15th and 30th of each month are common paydays—when money is top of mind—and a great time to start a conversation about banking.

3. It’s not just about location and timing, it’s also about creative and messaging.

To properly target by location and timing, your creative and messaging should align with your placement. For example, you could remind those office building employees on payday that they can put a little money from their paychecks into one of your high-yield savings accounts. This is a timely, meaningful message. Anything else would be “just another bank ad” and quickly dismissed.

Keep in mind that your landing pages from these ads should also align with the creative and messaging. Don’t send these interested savers to your homepage. Send them to a page that shows how far a little saving can go. And allow them to take action there on the page to set up a consultation, send themselves a reminder, or open a new savings account on the spot.

4. “Geoconquesting” is a good idea, but not a silver bullet.

People go into banks most often for one of three reasons:

- To open an account

- To close an account

- To transact

All of these events represent an opportunity for you. But when geoconquesting—that is, a form of geotargeting that focuses on your competitors’ locations—you should temper your expectations. By the time a consumer enters a branch, many of the choices that go into opening a new account have already been researched. And your offer may not be strong enough to pull someone away from a decision.

It may sound like a promising opportunity to target a customer who’s in the act of closing an account. Keep in mind, though, these customers have often opened a new account at another bank many months before officially closing their old account. Again, your offer may not impact the decision.

Geoconquesting does offer a strong awareness opportunity, however.

Staying top-of-mind is difficult, and switching banks is rare. Meaningful, brand-boosting advertising will keep your bank fresh in a customer’s mind when they have any issues with a competitor or they decide they want to look elsewhere for another financial solution. To help solidify your brand, weave your bank’s story—and how you serve the greater community—into your more informational ads.

5. Reinforce sponsorships where you can.

Geotargeting local events where you have a presence can significantly enhance your success. If you’re a branded sponsor of the Fifth Annual Local Art Crawl, overlay the area with ads and drive visitors to your booth. Use the event’s topic to your benefit. If you have a presence at a business event, use the ads to highlight some of the other businesses you’ve helped. If it is a local arts fair, try raffling a local art piece at your booth and use the ads to promote it. Traffic will follow.

Don’t let your advertising end when you pack up your booth. Retarget the customers who have clicked on the landing page you use for the event. This can help you deliver relevant advertising to your booth visitors for months to come, moving them from casually interested to new client.

After nearly a decade of financial marketing, we’ve noticed a single question that keeps turning up like a bad penny.

“How do I deal with compliance officers?”

Then again, guess what we hear from compliance officers.

We know that you, they, and everyone else in your organization wants to be compliant. After all, you’re all on the same team. And we know that you’re doing a fantastic job marketing your bank and its products to new and current customers alike. But in the midst of that progress, your compliance officer’s role becomes one, not unlike the parent of two siblings who each want something different for dinner.

Compliance officers need to have a very specific set of skills in order to do their jobs correctly. Each day, they make sure that everyone within your entire organization has been trained to follow its own policies and procedures across all facets of business operations. This is what’s known as institutional compliance. At the same time, they must also ensure that all existing financial regulations (and related ethical codes) are followed to the letter—while constantly uncovering, researching, and implementing new or changing industry regulations, of which the potential to run afoul is significant.

Sometimes, the rules and regulations they must follow are cut-and-dried while, at other times, your compliance officers must make judgment calls that will keep your organization free of issues that may put your bank at risk. And just because something worked before (or you did things a certain way in the past) doesn’t mean that will happen again—because the rules are constantly changing.

If you work with your bank’s compliance officers, we’re sure you’ve been frustrated at times. But so have they. Our goal is to help you—and your fellow employees—build better relationships with your compliance officers, one step at a time. And if you want to tackle all five at once, that’s even better.

1. Allow Your Compliance Officers to Do Their Jobs

Our first tip is the easiest one to actually follow. Simply put, your compliance officer has possibly the most underappreciated role within your bank. His or her main duty is to know the ins and outs of legal and regulatory requirements so that the bank operates with the highest level of integrity. Your compliance officer won’t make decisions based on profit potential or new product awareness, but on staying within the lines.

Although his or her recommendations might not be what you hoped to hear, failure to follow your compliance officer’s advice could be much more costly in the long run.

“Regulators aren’t just more aggressively pursuing institutions who break the law,” said Adrian Morrissey, manager of the compliance division at global, specialist professional recruitment consultancy, Robert Walters. “Higher penalties are being imposed on lawbreakers. Compliance has become a pivotal issue for banks, because failing to do their diligence on customers and transactions leaves a company open to scrutiny and litigation.”

2. Empower Them to Voice Their Expertise

Your compliance officer must be able to speak freely without fear of retribution or ridicule. So, it’s important for you to take time to empower those in compliance, and show them that their questions, opinions, and abilities to anticipate and solve problems have great value.

“Sometimes, it’s hard to feel like part of the team while convincing everyone around you that you’re doing a job that must be done so that your organization can maintain compliance and thrive,” said Brigham Young University-Idaho faculty member and compliance expert, CJ Wolf, in a recently published article at Healthicity.com. “You know what’s at stake, but sometimes it can feel impossible to get everyone on board.”

3. Help Other Employees Want to Comply With Compliance Training

Yes, official legal and compliance reviews should always take place. That’s a no-brainer. But, taking the step to ensure that your other employees have the opportunity to understand the rules and regulations guiding the financial industry will help improve both processes and efficiency.

“If you want 100% compliance (or 100% of your employees to complete the compliance training with a passing score), your training must be usable for all employees,” said Gauri Reyes, principal learning strategist and CEO at Triple Point Advisors. “For example, if using online training for compliance training programs, providing employees with desktop and mobile learning options lets employees choose when and where to learn.”

It’s also important to remember that training must be both ADA-compliant and, in many cases, available in multiple languages. The more your team knows, the less stressful the process will be for your compliance officers.

4. Perform Risk Assessments

Risk assessments not only let your compliance officers know where to focus their time, but they engage other bank employees, too

In Compliance 101: A Guide to Building Effective Compliance Programs, Lori A. Brown, Nikita Williams, and Christopher Miles advance the notion that risk assessments allow organizations to maximize the utility of scarce resources by directing them to the most significant compliance issues they face.

So, be sure to schedule risk assessments that not only focus on the most significant issues, but ones that also include those with boots on the ground.

“When individuals who have day-to-day administrative responsibilities participate in identifying compliance risks and developing mitigation plans, they’re more likely to actively participate in the compliance process,” said the book’s authors.

5. Fix What’s Wrong, and Make Things Right

When banks fall out of compliance, a common practice upon catching a mistake is to fix it, ignore the past, and make sure it doesn’t happen again.

“‘Correcting from now on,’ is a terrible attitude to have, when it comes to overpayments, but I’ve heard this from senior level management leaders,” Wolf said. “The whole purpose of a compliance program is to prevent or detect and correct noncompliance.

“We get it—nobody likes to give back money,” he said. “But in the case of overpayments, it’s not your money. You’re giving back money that’s not actually your money.”

Help all your employees feel a part of the solution—not just the problem. It will take your entire team to make things right, and that collective expertise might be just what your compliance officers need to assist them in getting your organization back on track.

—

Finally—and this one’s a bonus—never, ever rest on your laurels, for that’s when disaster will strike. “We’ve always done it this way,” is never a suitable course of action.

“As a compliance officer, this is the worst excuse I hear, because if your process is non-compliant, and you’ve “always done it this way,” you might be facing some significant payback issues or other ramifications, given the longevity of the problem,” Wolf said. “Don’t wait until it’s too late.”

If all of your employees feel invested, not only in their positions, but in the organization as well, they’re more apt to take ownership. That culture of teamwork starts with you.

Your community bank is essential. You likely serve a group of clients that’s overlooked by larger banks. You’re part of a complex and stressful ecosystem. The balance is hard to strike—you must adopt the right resources to serve your clients without losing the human touch that separates you from other banks.

The days when “community bank” was synonymous with “small bank” are long gone. Consolidation and other outside threats loom. You must learn to create healthy growth without losing your bank’s identity.

On the merger and acquisition side, it’s an insanely complicated and trying process (especially your first time around). Simply put, it’s eat or be eaten.

So let’s concentrate on organic growth—marketing your bank to more clients within your footprint while slowly expanding those geographic boundaries. How do you strike a healthy balance of loan growth while controlling funding of deposits to maintain the yield that delivers profits to your institution?

The secret to marketing is simple: tell more people better. Good news—this doesn’t require a huge budget. It does require commitment, some experience, and at least a little expertise.

You can expand over time, but every minute you wait to start, you lose ground. Maybe you’ve started, but you’re stuck. You’re not beating the competition, and you don’t know where to go.

We see many, many ways in which banks are wasting money, time, and human capital. If you feel you’re squandering opportunities, you might be guilty of one (or more) of these 10 cardinal sins:

1. You truly don’t see the value of marketing.

The success of most community banks has been based on shoe leather and handshakes. Personal relationships are directly proportional to asset growth. But what happens when that stalls—when the big bank de-novos into your community, cuts loan rates, and boosts deposit interest? When you’ve pressed the flesh for your whole career (and it’s worked really, really well), it’s hard to see the value in increasing an expense line item.

I understand. You may not be adversarial to marketing. You simply don’t understand it.

Too many banks approach marketing by just checking the box. An admin person gets a “promotion” and a “budget,” then is expected to perform. Perhaps you send them to some training. However, the expense line item bugs you and you’d really like to see some ROI.

The fix:

Commit, but start slow. Understand that, in the beginning, a marketing department doesn’t run a P&L—it’s an expense. Allocate a budget you’re willing to spend. Set goals and determine a path toward accomplishing those goals. If you and your staff genuinely have no idea where to begin, hire some help. Yes, it’s self-serving for an agency to make this recommendation; but it’s just true.

2. You don’t know how to do it.

It’s hard to admit, but ignorance is the number-one reason for failures within bank marketing. It’s tough to get traction if you and your staff don’t know what you’re doing. Moreover, you’ll only make it worse because you will damage the belief in marketing as a valid activity.

If you fall into this category, I won’t beat you up.

The fix:

It’s simple (and a bit self-serving): find outside help. It doesn’t have to be Mabus Agency (but we are the best option). The money spent with a qualified agency can help you experience early wins that return revenue to the bank, fund future activities, and increase confidence in your efforts.

3. You convince yourself you don’t have the budget to compete.

Inaction is second to ignorance in creating failure within financial marketing.

Don’t psych yourself out. Being the underdog might be a better position than you think. In his book, “David and Goliath,” Malcolm Gladwell makes the point about the eponymous story, that David likely had an advantage over his larger opponent. Gladwell posits that David’s youth, stealth, and accuracy from practice with a sling made him the perfect enemy of the larger, slower-moving giant. Because David was not seen as a threat, he was able to get into position and fire while Goliath scoffed. (I highly recommend this book.)

David won because of his size. Not despite it.

Our work with banks proves that “bigger” doesn’t always mean “winner.”

The fix:

Concentrate your limited resources on your most significant opportunity. Everyone has less of a budget than they want or need. You must get used to concentration—and exercise the ability to say no to compelling opportunities that might seem like a decent fit. You must reject activities that spread your resources too thin.

4. You don’t want to poke the bear.

First-time marketers often worry about the consequences of their efforts:

“If I start marketing, will others just spend more money?”

“Will it escalate out of control?”

“Maybe the competition will drop/increase their rate.”

If you’re trying to fly under your competition’s radar, you’re probably flying under your potential clients’ radar, too.

This type of mentality is like punting on first down (we’re not even fans of punting on fourth down). You’re just saying, “If we don’t play the game, we can’t lose.”

Hopefully, it’s apparent that this is not a winning strategy.

The fix:

You don’t have to get in your competitors’ faces to advertise. Tell your story. Again, the trick is doing better today than you did yesterday. You don’t have to compare yourself to the competition, but if you have something that sets you apart, you can (and should) brag on that item. Regardless, you can’t live your marketing life in contrast with another financial institution. You must understand your competitive environment, then execute your own plan.

5. You’re too busy copying them.

They put an ad in the newspaper. Why aren’t we in the newspaper?!

They sponsored a community event. Why weren’t we the sponsor?!

They put their bankers in an ad. Why didn’t we?!

If you’re chasing your competition like this, you’ll never catch up. Bankers just like you, all over the country, face undue stress related to tactics like these. I believe this tendency is derivative of that same competitive letdown you feel when “they beat us for that loan.” It feels like a loss.

Marketing like your competition only depletes valuable energy and leads to homogenized advertising environments that are less effective for all financial institutions.

The fix:

Zig when they zag. When your newspaper rep calls and says, “…but every other bank will be in this publication…,” I want you to grit your teeth and say, “NO.” It will be tough in the beginning, but you must understand that it does you no good to be diluted amongst every other bank. You have to convince your bankers that you’re not missing out by being the only bank missing from a Chamber of Commerce welcome bag containing seven other banks’ promotional items. But it’s not about sitting on the sideline. Your competition is zagging. What are you doing to zig? Own a premium ad position in a key publication (that’s not littered with banks). Commit to a strong billboard message. Show up where you can stand out, and own that platform.

This is a real-world example. A Chamber representative brought this welcome bag to a branch opening. What good does this do any of these banks?

6. You’re buying what THEY’RE selling

I had an epiphany while attending a recent bank marketing event.

I walked through the tradeshow floor and surveyed the vendors.

Represented were a couple of sales tools (CRMs), personal financial management systems, and lots of digital signage vendors. All of these represented activities that start after a potential client engages with your institution.

Where was all the stuff that attracts a new client? Nonexistent. Absent. There were no digital media representatives. No traditional media. Only a bit of social media.

The problem is that we assume what we’re being shown is what’s important, and it’s what we should be considering.

If you engaged every vendor at the event, you’d still be missing a valuable component: how to attract new clients.

The fix:

Make sure you utilize techniques designed to attract new clients. Yes, it’s important to nurture clients and deepen relationships. However, you first have to make certain new clients are coming in. The great news for you? If your competition hasn’t adopted this philosophy, you might be the only one marketing in your trade area.

7. You admire them too much.

The relationships amongst bankers drive me a bit nuts sometimes. Bankers will compete like bitter enemies over a single loan or client relationship. However, when it comes time to market against the bank down the street, a banker will say, “I’m just not going to do that to him/her.”

It’s like a strange code of honor—one I don’t understand.

This attitude is shrinking, but it’s still around. I’m all for friendly competition, but competition is the keyword. Make certain you’re competitive.

The fix:

Play golf at the annual event with your competitors, but maintain a healthy marketing plan. You don’t have to denigrate your competitors to market, but you have to gain awareness amongst your potential clients.

8. You’re in the industry trap.

Bank-specific vendors do a great job scaring you to death about compliance and security. Then they turn around and charge you based on those fears.

Security and compliance are vitally important, but sometimes, the focus on financial-specific solutions obscures other solutions outside the “built-for-banks” marketplace.

There is a limited pool of bank vendors, so we all wind up using the same tools. Community banks are dependent on outside companies to develop software and solutions. The biggest pain point is when your institution outgrows its current solution, but you’re stuck in a contract.

The fix:

Vet thoroughly. When adopting a new software or solution, we suggest bringing in at least one potential solution from outside the financial world. Even if an outside-the-industry solution doesn’t fit, it might enlighten you to functionality you wouldn’t have known existed.

9. You think bankers are more important than brand.

Want to close the browser? Hang in here with me, because you need to read this more than anyone else. Bankers are infinitely valuable to the banking process. Absolutely. However, when stepping into the world of advertising, putting bankers in an ad is less important than building a brand.

I’ve seen banks spend thousands of dollars building the “brand” of an individual banker. Then that banker (along with his/her portfolio) was lifted out. The new bank didn’t have to pay to build that banker’s following—just a salary it was willing to pay anyway.

Also, bankers seem to think that consumers like to see bankers in ads. A consumer might value a personal relationship with his/her banker. However, a client appreciates a strong institution more than a relationship with a single banker. If you don’t believe that, you probably haven’t worked in one of those strong institutions.

The fix:

When you pay to build your brand, that investment persists beyond bankers who come and go. You build a foundation that communicates strength to a brand-centric culture. You can attract more bankers in the future. In short, you win.

10. That’s just not what community banks do!

Hahahahahahaha.

The fix:

Either shut the doors or sell. Otherwise, we’ll meet when one of your competitors hires us; and you don’t want that.

The data is there, but you can’t get your arms around it.

Oh, data. You are so big. So bright. So beautiful. But like a perfectly curated Instagram post that is filtered to perfection, you often feel unattainable.

As with content, starting to develop a strategic approach to data mining, transformation, and analysis requires support across the organization and commitment to the activity over the long run. Also as with content, there are ways to earn “quick wins” — in this case, connecting a few systems as you expand your data aggregation to include more and more information over time.

Demographic data is often the first step. Ensuring you have an accurate understanding of the basic traits of your customers is baseline. This often comes from your core system, but can also be augmented by other platforms like online/mobile banking and rewards or loyalty platforms. Behavioral data is the hardest to build, but the most powerful by far. This data comes to life by combining email automation systems, website analytics, social media metrics, mobile and online banking behaviors, and transactional data.

The key? Start small. One system connected to another. One focused insight tested.

Discover who has used your mobile app in the past 45 days. Those are your true mobile customers. Determine the top three channels customers use (or doesn’t use) and inform them of alternatives. Uncover a customer’s best email by assigning a scoring system based on engagement with their multiple emails that often live across different systems within your bank.

It’s a long road. A commitment. But the insights you glean will inform your marketing, product decisions, and investments in customer experience for years to come.

Intimidated by all that data? Work with an agency that has experience marrying multiple data streams into one actionable strategy.

Marketing a bank is harder than ever. New techniques and technologies abound. The never-ending cycles of approvals to adopt change are extended as IT and compliance departments balance advancement against risk. On top of that, most banks are actually performing pretty well—which sounds great…until you’re challenged to do better next year.

As banks realize the need to grow in marketing sophistication, many are reaching out to agencies for the first time. I want to help you find one—and it doesn’t even have to be mine.

Now, let’s address the elephant in the room: “But you own an ad agency!” I sure do. But I’ve learned a big lesson over the years in this business: good relationships are worth their weight in gold. I’ve learned a few other things in that time, and I want to share some of them with you.

It’s really not about hiring the best agency, but the best fit. It would be a tragedy to hire an agency with terrible creative talents, but it’s worse (by many orders of magnitude) to hire an agency that’s a bad fit.

This is why you can trust my advice as an agency owner. Even if I spent the rest of this article trying to subliminally convince you that we’re the best bank marketing firm out there (even though we are), I couldn’t determine if we are a fit. And I’m much more concerned with fit. You should be, too. Trust me.

So how do you find the best fit for your bank?

Mabus Agency President Josh Mabus discusses the keys to hiring the right agency with some of the creatives on our staff.

Read or listen to Josh’s full article, “So You’re Thinking About Hiring and Agency,” here.

Subscribe to the Bank Marketing Blogcast and never miss an episode.

I feel the need to voice this concern about the financial industry. Maybe I shouldn’t—I actually think it’s a recipe for success and I certainly don’t want to give the competition too much fuel.

But, I genuinely feel you’ll read this, be inspired, and take no action.

You’ll agree, but you won’t change. You’ll like what I have to say, but not take on the fearless attitude required to cut through varying degrees of bureaucracy, organizational politics, and technological sludge. Forgive my cynicism, but remember, I’ve worked in the banking industry for some time now.

The Current State of Data in Financial Institutions

There are good conversations taking place between financial marketing teams, IT departments, and bank C-suite execs across the country, conversations about the “multi-channel” retail world in which we live, the need to improve the “branch experience,” and preparing companies to “go mobile.” These discussions center around implementing new customer-facing technologies, evolving the role of a branch banker, and exploring back office automation tools that signal the greatest leap in financial experience since the arrival of online banking in the mid-90s.

Yet, good conversations on how to better use data remain elusive. Banks have pursued “better reporting” since computers replaced paper ledgers decades ago, and reporting is better, too. It just hasn’t evolved. We still rely on classic metrics about our customers to determine their value and potential. Reports like “Top 25 clients by deposit dollars” or “Customers who have online banking” continue to define the furthest reaches of accessible customer intelligence at small- and mid-sized banks.

There has been little buy-in for new metrics from those at the top of financial companies, and plenty of pushback on just how much data and customer intelligence can actually inform marketing, selling, and service decisions.

The current modus operandi? In most banks with less than $10 billion in assets, data is delivered as:

- PowerPoint presentations, PDFs, or Excel worksheets from a vendor you hired

- MCIF export files

- IT reports

- An analyst’s combination of three to four spreadsheets

This information often satisfies a single reporting need by answering isolated questions like these:

- How did we do on deposit growth in this market over the past six months?

- What does loan growth look like in Region X?

- How many CDs are 45 days from maturity?

Then, there are the occasional deep-dives, which include questions like these:

- How many active mobile banking users do we have?

- How many of our customers bank elsewhere?

- Who are our most profitable customers? (Cue the cringing.)

- How many products do we sell in the first 90 days of a new relationship?

These are the questions that, frankly, lead to a type of reporting that’s often misguided and simply incorrect thanks to disparate systems, incomplete vendor service, and poor aggregation practices.

Don’t Agree? Try This Experiment.

Determine one report you need, like a three- or six-month trend report. Next, request this report from your IT department or from the technology or product vendor where your data is housed. Then, if possible, request the same data from another source within the bank. Also, have a vendor use the same data to pull down the numbers for you. Try to get the info yourself if possible.

Compare notes. On the standard reports (DDA growth, loan growth, CD maturities), everything might be close. If it’s not, you have much more work ahead of you. On a deep-dive report, I imagine you’re going to see some variation—maybe a lot of variation.

How Can Financial Institutions Improve Their Data Intelligence?

You could write a book on this. Quite a few people have already, but your ability to make improvements boils down to two fundamentals: data integrity and distribution.

How To Repair Data Integrity

Data integrity starts with proper aggregation, and proper aggregation starts with strategic mapping. You may have 25+ potential data feeds (vendor applications, core database, website, marketing tools, CRM, etc.) with 20,000+ measurable items across those feeds. You’re not going to get it all right at first ingestion, nor should you try to wrap your arms around everything on the first day.

Here’s how to get your feet wet:

- Start by (literally) drawing all your systems out on paper or on a whiteboard.

- Identify the top three assets in each system you believe will address your goals (e.g. increased products/household, increased credit card engagement, bill pay adoption).

- Identify the “glue” asset, or assets, between key systems. Customer numbers, Social Security or ITIN numbers, card numbers, IP addresses, and email addresses are common glues.

- Identify the data or file language produced from each system (C, Java, image, text, SQL, etc.).

- Determine if data is convertible to a standard. If not, write clear rules for how the non-standard data will be connected back to the record.

- Ingest a few elements at a time and test the “full view” of the customer record.

- Show a full warehouse record for one customer and then check it against the individual data sources to measure quality.

That’s seven steps. Sounds pretty easy, right? You’ll encounter a lot of incompatibility and system limitations along the way, but the best advice for data integrity is to record everything—every rule, every qualifier, assumption, and missing piece. Keep it all clearly defined against the database solution you use.

Distribute Data and Intelligence Wisely

Banking (like many other industries) has long struggled to find the best way to share good information with their frontline employees and decision makers. There are endless reporting solutions with fancy dashboards and automated or customizable reports. Many offer employees a better view of their customers and prospects than they would otherwise have. However, some key underlying activities can make or break your data distribution strategy as well as the resulting adoption of these types of solutions within your company.

Passive vs. Active Distribution

When do you push information and when do you let users discover it? Think about the timing of each report relative to your employees’ schedules. Is a morning email about prospects the best idea because you’ve trained employees to follow up with prospects during the first 15 minutes of the day? Or is it the worst time for a prospect report because your branch employees are busy returning emails and voicemails, all while scurrying around to get their branches open on time? Ask your employees about timing.

Making It Actionable

You hear this often, but data is only as good as it is actionable. But, for some reason, we fail to provide clear actions within the context of the available data. Since five employees could look at the same data set differently, how do you help guide each of their perspectives? Every report should contain at least three to five scenario-based examples of what to do. Scripts and ancillary training materials help as well.

Onboarding and Training

Training applies to every new process and tool at your company. But, within the financial industry, training on customer analysis can feel like the most unnatural educational topic on an agenda.

Make sure you can track employee engagement with your data reporting tools. You’ll have superusers, monthly users, and inactive users. Many of the inactive users need help understanding the value of the report and how to use it, while monthly users might only engage with reports actively pushed their way. Superusers can be your evangelists and assist your Training department. Understand who falls into which group, then target your training accordingly.

We have a saying at Mabus Agency: “If it’s hard to do, it will never get done.”

We call it the rule of wheNEVER. And if I’m honest, I’m not the first person to discover this phenomenon. A lot of people just call it human nature.

We named this phenomenon as a way to remind ourselves to make things as easy as possible for the end user when developing a new marketing strategy or materials.

We preach the importance of updating a website, developing new content, maintaining brand standards, and promoting campaigns across platforms, but if we don’t give the client the right tools, advice, plan and accountability, their marketing will never get done.

The rule of wheNEVER applies to almost anything in life, but we talk about it most often with websites because websites are living, breathing marketing platforms that often sit on the shelf next to our bikes and hiking packs.

It’s easy to think no one notices when you update your company site, but Google notices. What is even scarier, Google notices even more when you don’t.

If I search for a tree service, and there are two tree services in my area, one that has posted three new pieces of information containing the words “tree service” or “stump removal” in the last three months and one that hasn’t updated since it launched a year earlier, Google is going to provide me with the more relevant result.

We build great, easy-to-use websites, but that’s usually the second biggest reason anyone hires us. The number one reason people hire us is their own inability to write code. Knowing that, we have to develop a dashboard that allows the customer to edit the website without having to learn code.

It would be pretty cruel to tell a customer their website’s success depends on their ability to keep it updated and then hand them a big pile of code.

But here’s the thing, even if we do give someone a website they can easily edit and update, a lot of times the content stays the same for months on end. Why is that? Technical advancements don’t mean a whole lot if you don’t have time to learn or use them.

I’m a writer, and my website goes through some pretty embarrassing dry spells. Why should I expect a carpenter or mechanic to write for his website every day? It’s out of the way. It’s not a part of the normal routine. Most of the time, it’s not very fun.

Here are some tricks we’ve found for getting the hard things done, especially when it comes to your website.

Set a deadline.

Projects without deadlines almost never get done. Projects with arbitrary deadlines have a slightly higher completion rate, but once those arbitrary deadlines gain momentum, they are more often expected by your following and a lot easier to hit each month or week.

Set reasonable expectations.

I had some friends set a goal to blog every day. They were writers who used their blog to practice, but were also busy and only posted something once or twice a month before. The idea was ambitious and after a few weeks, they stopped posting altogether.

Here is why. They set a goal, but the expectation was too ambitious. Failure was guaranteed from the start. If you aren’t adding new content to your website right now, don’t start adding content every day. Set a goal of once a month. That’s easy because you only have to add twelve things in a year. If once a month is too easy, go for every other week.

This includes your promotional and social efforts as well. If you’re doing no promotions, figure out what you can take on consistently. Don’t promote a new Twitter handle just to get tired and quit using it.

Just like with everything else in business grow sustainably.

Make it a team effort.

Loop others into your content generation for inspiration and accountability.

It gets even easier when you ask someone else at the company to take two posts and Jerry in finance to take a third. If you have twelve slightly competent content generators in your office, you can each produce one thing a year and have a website that is consistently updating.

Connect with the team members who are already working toward your project goals and piggyback off each other’s ideas.

The secret to making it easy: don’t make it hard.

More often than not, our clients tell us they have nothing to write about. That’s ok, you don’t have to write a giant essay on your profession; you just need to keep adding relevant, searchable words to your website, and hopefully help or entertain someone in the process. If you step back from your blank page and blinking cursor, it’s easy to find relevant content.

Do you have an employee who just passed a certification test? There’s a great post, and it will lead to another post about how important education in your industry is. That post will lead to another about how many talented folks you work with (and a humble brag about all your certifications).

Maybe you had an office Christmas party and just want to share a photo with a good caption. Your content can be 100 words or 1,000 words. It can be a photo or a video. It can be a link to something else you like.

One of the biggest helpers is a big calendar hanging next to your desk. Remind yourself.

Almost everything in life is hard, so when it comes to keeping your website fresh and up to date, make it easy on yourself.

Just know that “When? Tomorrow.” is better than “When? Never.”

I’ve seen a lot of large media companies and corporations whining about ad blockers lately. As a marketer, I’m expected to be the anti-ad blocker — the guy who creates a new scheme to overcome the technological defenses that protect our eyes from the incursion of epilepsy-inducing ads.

The truth is, I have to disable my own ad blocker to read a Wired story just like everyone else.

I use Wired as an example because they got out front of ad blocking earlier this year, publishing the number of their readers who block their ads (20 percent at the time) and explaining how they pay for content. Wired told users they would have to either pay for the content themselves (and offered a very minimal weekly fee for an ad-free experience) or stop restricting ads when viewing Wired content. Now Wired visitors can’t view content until their ad blocker is disabled, which feels like a very reasonable (free) paywall to me.

Ad blockers claim to streamline your web experience. They stop clunky ads from loading and help maintain distraction-free browsing. They restrict inappropriate or harmful ads, and they keep pesky trackers from selling your browsing habits to third parties.

At least that’s the story ad blockers are telling us.

Ad blockers aren’t evil — they’re just telling a better story than the ads they’re blocking, and it’s making advertisers sweat.

Wired ran the first banner ad 22 years ago, and now they’re embracing a model that often means getting rid of their own invention.

Many advertisers, scorned by ad blockers, are running to social platforms like Facebook and Snapchat where ads can’t be blocked. This reckless refusal to listen to the consumer will undoubtedly lead to the new platforms adopting blockers of their own. Facebook is already cracking down on how advertisers use Facebook in an effort to preserve the clear story a user’s timeline tells them.

The two types of prominent ad blockers on the market speak clearly to the issues consumers have with online advertising. The first category is the nonprofit blocker that restricts anything the user hasn’t agreed to view and is especially vigilant against trackers (the technology that show you athletic clothing ads after you visit Nike’s website).

The second type of ad blocker is a business that offers a paid service promising to block ads on pages that have heinous ads, poorly placed ads or an overall abundance of ads. Some of these businesses work with advertisers to find a happy medium — a pleasant online advertising experience.

Honestly, with an ad blocker, I still see some great paid content. Adblock Plus gives permission to advertisements that meet certain guidelines, like placement and size. I think of the company like a consumer-supported Federal Communications Commission (FCC) — listening to the outrage of the consumer and developing a solution everyone can agree on.

And what is the reaction to these rare ads that make it through an ad blocking software?

Users don’t react with anger but are instead happy to see a respectful ad.

In fact, the ad blocking users, who are said to be tech savvy, young and attractive to advertisers, are very attentive and responsive when the ads display at a low volume and with some amount of relevance to their lives.

Before we go much further, there’s a question we should ask ourselves: “Why do we accept it as ‘natural’ that someone would want to skip an ad?”

The reasoning partially lies in the fact that we now know we’re being advertised to and that affects our desire for free will. We view ads as an interruption when we used to view them as informative. Gone are the days where we’re excited to learn about a new product.

At the root of this change is the degeneration of ads. We listened to “the message is the medium” too much.

“If I’m on TV, I’m good!”

There were advertisers who didn’t consider the fact they were running poor quality, locally produced ads as a detriment. They were on TV!

“If I’m on TV, I’m good!” became “If I’m on the Internet, I’m good!”

Then it was all about getting attention. Animated ads flashed “lower your interest rate” and “lose weight now!” If you could shoot the alien, you’d get a free sample!

Medium and technique surpassed strategy, and storytelling, and consumers rejected the bad ads — just as they have on TV and every medium before.

Old Spice got ahead of the game in 2010 by making commercials so funny that consumers went straight to their website with the express purpose of watching advertising.

Geico recently produced a series of hilarious pre-roll commercials that tell consumers they scripted an ad so short they had to keep the camera running in order to fill the minimum ad buy. They made their attempts at advertising the butt of the joke. You can’t skip their ads because they’re already over.

On a more serious note, Dodge’s 2013 God Made a Farmer ad struck such a chord that 20 million people were compelled to seek out the ad to watch it again (and again).

Budweiser’s anti-drunk-driving ad hasn’t seen quite as many views yet but tugs a similar heartstring by using a sweet dog to urge young, single adults to drink responsibly.

These are ad campaigns that are sought out.

They are the Holy Grail of advertising.

They also share something in common: sound strategy and strong storytelling.

Ad blockers aren’t going to ruin online advertising, but poor storytelling will. We can’t continue to throw money at bad storytelling and hope consumers will respond positively.

Each time you publish irrelevant, obnoxious or tone deaf content, you are giving up an amount of the customer’s trust — not only for your brand but for the platform in which you publish.

How can you make a customer’s life better? Geico points directly to the fact they are making the shortest commercials they can. Old Spice is trying to make the consumer laugh. Dodge is playing on the sentimentality of the American spirit. Budweiser is offering a public service through love for our pets.

Ad blockers are what we deserve for placing thousands of obnoxious flashing ads for the last two decades. I’m surprised ad blockers weren’t more common 10 years ago when every ad congratulated me on being the 1,000,000th visitor and offered me a cash prize.

We discovered flashing text, animation, spyware and the thousands of other possibilities and acted like children in an unsupervised candy shop.

Now that the consumer has recovered control of their online experience, it’s our job to win back their trust with better storytelling. It’s our job to place appropriate ads in appropriate places and treat online advertising with the same respect we’ve treated print.

If we want consumers to less aggressively oppose advertising and be less suspicious of our motives, we must offer them an actual benefit and stop begging for their time and attention.

We must earn it.

Imagine for a moment you’re on the cake mix aisle at a grocery store. There are probably 100 different cake brands and flavors that will instantly make you a qualified baker. What does each box have in common?

Most boxed cake mixes require a couple of eggs and some milk or oil to bake a successful, tasty cake.

Believe it or not, there was a time when those boxes required nothing but a cup of water to accomplish such a magical culinary feat.

From 1947 until 1953, the sales of boxed cake mixes that included powdered eggs boomed — all the while the companies producing them debated whether the powdered egg was the best route. They were worried powdered eggs led to an inferior end product, but they feared requiring the addition of fresh eggs removed any claim of convenience.

Cake mix sales slowed during the late 1950s. General Mills hired psychologist Ernest Dichter to interview women to determine the sales drop. Dr. Dichter’s study found that ladies felt using a simple cake mix was too easy — there wasn’t enough work involved, leaving them feeling guilty instead of proud of the cake they made.

Cake mix companies decided adding an egg would end their debate over quality while giving the women of the 1950s and 1960s a better interaction with their product. By requiring a little extra work from the purchaser, they were giving the customer permission to call themselves a baker, increasing the quality of their product and making the result something to be proud about, not ashamed of.

Pillsbury advertisements depicted the box, a bowl and some eggs with the headline, “After this, you’re on your own,” which told the customer they were still doing the hard work of baking a cake.

With the original, all-inclusive cake mix, companies were selling a convenient product. As with most convenience-based products, it had a decent run, but it also had a short shelf life.

When the companies took the time to listen to the customers, they began selling a convenient experience. Not only were these new mixes more involved, but they produced a superior product to their powdered-egg predecessors — a difference undoubtedly noticed not only by the baker but by the people eating the cake as well. The new mix achieved all of this while remaining convenient.

Not long after the addition of fresh eggs, cake decoration became the new metric by which cakes were judged. Now, the homemade cake was simply the canvas and homemakers of the 1960s considered the act of cake decorating a rewarding experience.

This gave cake mix companies another opportunity to create pleasant experiences through frosting mixes. Betty Crocker and Pillsbury weren’t frosting companies, but this new line of “homemade frostings” were value-add products for their flagship cake mixes.

If you read my column regularly, you’ve probably noticed I talk about brand experiences often, and I can’t talk about it enough.

We often overlook the experience associated with our own brand and wonder why brands like Yeti or Under Armor or the fancy boutique up the street do so well.

Most brands with overwhelming success are aware of the experience associated with their products and, in turn, continually tailor their experience to better fit their customer base.

Often, like with cake mix, tailored customer experiences can seem counter-intuitive at first.

The online transportation company Uber offers a more recent example of tailored customer experiences. The company began allowing its drivers to rate its passengers, as opposed to the traditional model, where only service providers receive ratings. Many said the practice was insane or discriminatory. With the gift of hindsight, we can see the rating practice has done nothing but ensure the company maintains its quality level of service by having only the best drivers and customers.

By weeding out problematic customers — or at the least letting the customer base know they are being rated — drivers are happier and the customers who appreciate the service are receiving increased access.

What memories come to mind when you read the words, “brand experience?” Maybe you visited a great shop on vacation one summer, and you’re excited to visit each time you’re back in that city. Maybe you waited 45 minutes for some food that didn’t taste fresh, and now you’re skeptical about giving the restaurant a second chance.

What experience does your brand offer customers?

Are you more personable than your competitors? Are you more convenient, but at the cost of using powdered eggs?

Even if you think you don’t have a brand experience, you do — it just may not be what you want it to be. Talk to your customers. Talk to customers you wish you had. Find out what experience you offer. If it’s good, lean into it. If your experience isn’t what you think it should be, look internally and find a way to change it.

Maybe it’s time for your brand to make the jump to fresh eggs.

Do you ever wonder why the tire company known best for its mascot — a big man made of white tires — is also the most trusted name in fine dining and classical-French restaurant reviews.

Maybe you thought the tire company and restaurant review publication just happened to share the name, Michelin. Actually, one created the other. The Michelin Guide as it exists now, 100 years after its inception, is the result of a marketing campaign going so perfectly it became sentient.

For those unfamiliar with the Michelin guide, it’s a series of annual guide books that awards ratings and reviews to restaurants and tourist destinations. The guide is best known for its Michelin Stars, which are given to restaurants and have been known to affect the success of a fine-dining establishment. One star means a restaurant is very good in its category, two means it is well worth a detour and a third star means the food itself is worth a road trip.

That third star spells out the genius of the Michelin Guide. This tire company was promoting great food in France in the early 1900s when cars were very uncommon, but more than anything it was promoting car travel. At the very heart of it, this high-end restaurant guide was promoting the use of tires.

Think about how genius that marketing plan is. A tire promoted the idea of traveling for food so well that people looked to it for food recommendations, and also tried to get them to the restaurants.

Michelin did what many marketers forget to do: they got around their consumers’ defenses.

That’s one of, if not the biggest obstacle in marketing — getting around people’s defenses.

We see hundreds of brand messages every day at the very least (though some estimates say thousands). No matter how sincere the message or how much we think consumers care about our brand, as marketers we are ultimately trying to sell something.

As consumers, we become rather adept at blocking these brand messages out, whether mentally or by using handy new tools like DVR, online ad-blockers and MP3 playlists.

Marketers try to use humor, entertainment and useful information to circumvent our new built-in ad-blockers. But more often than not, they end up further alienating their brand message, or delivering a punch line that has nothing to do with the brand message.

Michelin got around our defenses by producing something of great value and still remaining dead on target with brand strategy. They tell people about great restaurants and places to travel. They are advertising travel — something the general public perceives as good and even fun — in a way that sells tires.

Keep in mind; this is a time before the Internet or Food Network. You might have not known what’s happening in the next city — much less 50 miles or more away. Michelin provided real value to potential customers while keeping their mission in mind: sell more tires.

It’s easy to approach marketing through a standard advertising mix: print ads, television, radio, etc. The problem is that everyone else can do the same thing. It’s worth spending just a little extra brainpower and preparation to circumvent the defenses of the customer, and we can do it in a way that they will gladly welcome. You do this by providing something of value.

Michelin dedicated its brand image to finding the highest quality of food and restaurants in France — and eventually the entire world. Interested foodies responded by traveling far and buying new tires.

Lowe’s has used its social media brand to show people quick and easy tips for completing projects and maintaining their homes instead of spending all their energy on advertising products. Customers respond by purchasing their project supplies at Lowe’s.

I’ve found a lot of marketers believe consumers care about their brand simply because it exists. That’s not true. Operate under the assumption that no one cares or thinks about your brand, and find a way to make it valuable. Making your brand a value-add keeps you top of mind.

Imagine it: your company puts out a magazine that everyone in the industry uses to stay up to date on industry trends. You don’t even have to advertise because your brand is plastered all over the publication. The moment a customer, competitor or industry peer engages your publication, you’ve just gotten past their defenses.

We have to think like the Michelin brothers did more than 100 years ago.

What value-add can we give our customers?

What niche can our brand fill?

What can we make that is worth driving toward?